Technical Analysis,Research & Weekly Outlook

(Mar 05 to Mar 09,2012)

Technical Analysis and Research of EOD,weekly and Monthly charts,Micro Analysis of Nifty Intra Day Chart,Technical Positions,next possibilities have already been explained in following topics with 5 Charts therefore not being repeated. Just click following topic links and go through detailed analysis for trading in next week:-

1- Blasing Rally above 5458

2- Crucial Supports in Assembly Election Results Week

3- For Decisive Break out more Preparation within 5298-5458

4- Correction Fate Decider 5340-5415

Conclusions (After Putting All Studies Together)

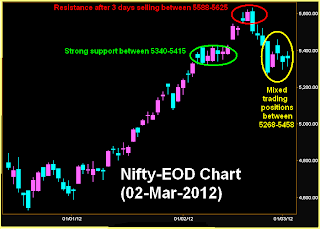

Long term trend is up,Short term trend is down and fate of next long term moves deciding Intermediate term trend was sideways between 5268-5458 in previous week. All the possibilities regarding break out side direction and supports/resistances have already been discussed in above topics.

It is clear from previous week intraday charts analysis that good supporta at lower levels. Although selling at higher levels but intraday patterns of previous week are suggesting consolidation formations therefore breaking out and sustaining above 5458 is high.

Assembly election results will be declared on 06-03-2012 as well as negative results for Congress will certainly badly hamper sentiment therefore coming sessions may be highly volatile also but until Nifty will not sustain below 5268 till then any decisive down move will not be considered.

Expected that Nifty will not sustain below 5120 and Long term trend will not turn down in worst sentiments also but on the other hand very much expected also that Nifty will not sustain below 5268 and finally rally above 5458 will be seen in the coming week/weeks