Watch Levels amid maximum target

of on going Wave at 22231.95

Technical Analysis,Research & Weekly Outlook

(Feb 05 to Feb 09,2024)

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (02-Feb-2024):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C of previous Waves structure "ABC correction" completion at 15183.40 on 17-06-2022 and Impulsive Wave-1 of new Waves structure beginning.

2- Impulsive Wave-1 completion at 18096.20 on 15-09-2022.

3- Corrective Wave-2 completion at 16747.70 on 30-09-2022.

4- Impulsive Wave-(i) of Wave-3 completion at 18887.60 on 01-12-2022.

5- Corrective Wave-(ii) of Wave-3 completion at 16828.30 on 20-03-2023.

6- Impulsive Wave-(iii) of Wave-3 completion at 20222.45 on 15-09-2023 and Wave-A of "ABC" correction beginning.

7- Wave-A of Wave-(iv) of Wave-3 completion at 19333.60 on 04-10-2023.

8- Wave-B of Wave-(iv) of Wave-3 completion at 19849.80 on 17-10-2023.

9- Corrective Wave-C of Wave-(iv) of Wave-3 completion at 18837.80 on 26-10-2023 and impulsive Wave-(v) of Wave-3 beginning.

10- Impulsive Wave-(v) of Wave-3 continuation with its recent high and new life time top formations at 22126.80 on 02-02-2024.

Conclusions from EOD chart analysis

(Waves structure)

Impulsive Wave-1 of new Waves structure started from 15183.4 on 17-06-2022 after corrective Wave-C of "ABC correction" of previous Waves structure completion at this level. Now its Impulsive Wave-(v) of Wave-3 is in continuation with its recent high and new life time top formations at 22126.80 on 02-02-2024 as well as no confirmation of its completion yet on EOD charts.

Nifty-EOD Chart Analysis

(Wave-(iii,iv & v) of Wave-3 structure)

Nifty-EOD Chart (02-Feb-2024):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-(ii) of Wave-3 completion at 16828.30 on 20-03-2023 and Impulsive Wave-(iii) of Wave-3 beginning from this level

2- Impulsive Wave-(iii) of Wave-3 completion at 20222.45 on 15-09-2023 and Wave-A of "ABC" correction beginning.

3- Impulsive Wave-(iii) of Wave-3 gained 3394.15 points(20222.45-16828.30)

4- Wave-A of Wave-(iv) of Wave-3 completion at 19333.60 on 04-10-2023.

5- Wave-B of Wave-(iv) of Wave-3 completion at 19849.80 on 17-10-2023.

6- Corrective Wave-C of Wave-(iv) of Wave-3 completion at 18837.80 on 26-10-2023 and impulsive Wave-(v) of Wave-3 beginning.

7- Impulsive Wave-(v) of Wave-3 continuation with its recent high and new life time top formations at 22126.80 on 02-02-2024.

8- Impulsive Wave-(v) of Wave-3 has gained 3289.00 points(22126.80-18837.80) till now.

Conclusions from EOD chart analysis

(iii,iv & v) of Wave-3 structure)

Although no confirmation of Wave-(v) of Wave-3 completion yet on EOD charts but remain cautious because as per Elliott Wave theory maximum target of on going impulsive Wave-(v) of Wave-3) is at 22231.95. Its calculations are as follows:-

Impulsive Wave-i gained=2912.8 points(18096.2-15183.4)

Impulsive Wave-iii gained=3394.15 points(20222.45-16828.3)

Impulsive Wave-v has gained 3289.00 points till 02-02-2024(22126.80-18837.80)

As according to Elliott Wave theory Wave-5 can not gain more points than Wave-3 gained therefore on going impulsive Wave-5 will gain lesser points than 3394.15.

Impulsive Wave-5 started from 18837.80 on 26-10-2023 and it has to gain less than 3394.15 points therefore maximum target of on going impulsive Wave-3 is at 22231.95(18837.80+3394.15)

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (02-Feb-2024):-

Technical Patterns and Formations in EOD charts

1- Stochastic- Both lines are kissing just below Over bought zone.

2- Stochastic:- %K(5)- 74.93 & %D(3)- 76.18.

3- In MACD- MACD line has intersected Average line downward. Its MACD line is rising and Average line is falling in negative zone.

4- MACD(26,12)- -71.23 & EXP(9)- -30.89 & Divergence- -40.34

Conclusions from EOD chart analysis

(Stochastic & MACD)

Position of Short Term indicators are as follows:-

1- As in Stochastic indicator its both lines are kissing just below Over bought zone therefore showing first signal of Short term down moves beginning

2- As in MACD indicator MACD line has intersected Average line downward and its MACD line is rising and Average line is falling in negative zone therefore it will be understood that at present this indicator is not confirming Short Term Trend.

Nifty-Intra Day Chart Analysis

(02-Feb-2024)

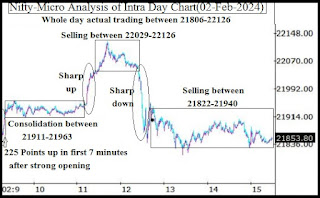

Nifty-Intra Day Chart (02-Feb-2024):-

Technical Patterns formation in today intraday charts

1- 225 Points up in first 7 minutes after strong opening

2- Consolidation between 21911-21963

3- Sharp up

4- Selling between 22029-22126

5- Sharp down

6- Selling between 21822-21940

7- Whole day actual trading between 21806-22126

Conclusions from intra day chart analysis

As growth oriented Interim Budget was presented on 1st Feb 2024 therefore next day firstly 225 Points up moves were seen in first 7 minutes after strong opening and after that almost 2 hours fresh consolidation developed hence new life time highest was formed after sharp up moves.

Although new life time top formations last Friday but higher levels selling was seen in Mid-session therefore sharp down moves developed after that. As follow up selling in almost last 3 hours also therefore it will be understood that good intraday selling developed in last 4 hours last Friday therefore firstly down moves below last Friday lowest(21805.55) is expected in the beginning of next week.

Conclusions

(After putting all studies together)

1- Long Term trend is up.

2- Intermediate Term trend is up.

3- Short Term Trend up.

Although Impulsive Wave-(v) of Wave-3 continuation with its recent high and new life time top formations at 22126.80 on 02-02-2024 as well as no confirmation of its completion yet on EOD charts but remain cautious because:-

1- As per above given Elliott Wave theory calculations maximum target of on going impulsive Wave-3 at is 22231.95.

2- Long "Shooting Star" Bearish Candle formation on 01-02-2024 in which once Nifty retraced 321.25 points from intraday higher levels.

At present indicators are not showing clear signals of any side decisive moves beginning but intraday charts of last Friday are suggesting down moves in the beginning of next week therefore firstly following supports should be watched in the next week:-

1- 21681-21736

2- 21643-21678

3- 21470-21563

4- 21193-21311

Resistances of Nifty are as follows:-

1- 21822-21940

2- 22029-22126

As previous week up moves and new life time top formations was Interim Budget expectations and its announcements led as well as sharp fall from higher levels was seen last Friday also therefore finally sustaining beyond above mentioned supports and resistances should be watched in the coming weeks for post Interim Budget next trend formations amid maximum target of on going impulsive Wave-3 at is 22231.95.

%20of%20Wave-3.jpg)