Correction continuation & strong

supports breaking down will

confirm deeper correction

Technical Analysis,Research & Weekly

Outlook(Aug 29 to Sep 02,2022)

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (26-Aug-2022):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C completion and Impulsive Wave-1 beginning from 7511.10 on 24-03-2020

2- Impulsive Wave-1 completion at 11794.30 on 31-08-2020

3- Corrective Wave-2 completion at 10790.20 on 24-09-2020

4- Impulsive Wave-3 completion at 15431.8 on 16-02-2021

5- Corrective Wave-4 completion at 14151.4 on 22-04-2021

6- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC" correction beginning with Double Zig-Zag pattern formation

7- Wave-A completion at 16410.20 on 20-12-2021

8- Wave-B completion at 18351.00 on 18-01-2022

9- Wave-C bottom formation at 15671.5 on 08-03-2022

10- Wave-X completion at 18114.70 on 04-04-2022

11- Wave-A completion at 15735.80 on 12-05-2021

12- Wave-B completion at 16793.80 on 03-06-2022

13- Wave-C completion at 15183.4 on 17-06-2022

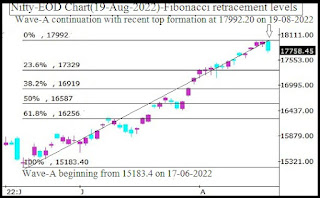

14- Wave-A continuation with recent top formation at 17992.20 on 19-08-2022

15- Wave-A correction continuation recent bottom formation at 17345.2 on 23-08-2022

Conclusions from EOD chart analysis

(Waves structure)

Waves structure which begun from 7511.10 on 24-03-2020 through its impulsive Wave-1 completed through its impulsive Wave-5 at 18604.50 on 19-10-2021 after 11093.4 points gains in almost 21 months and its Wave-A of "ABC" correction begins.

Now more than 10 months old "ABC" correction continuation with maximum 3421.1 points loss and Double Zig-Zag pattern formation. At present Wave-A of on going correction continuation with recent top formation at 17992.20 on 19-08-2022 and no confirmation of its completion yet but now its correction is on with recent bottom formation at 17345.2 on 23-08-2022.

Nifty-Weekly Chart Analysis

(Stochastic & MACD)

Nifty-Weekly Chart (26-Aug-2022):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC" correction beginning with Double Zig-Zag pattern formation

2- Wave-A continuation with recent top formation at 17992.20 on 19-08-2022

3- Wave-A correction continuation recent bottom formation at 17345.2 on 23-08-2022

4- Stochastic- %K(5) line has intersected %D(3) line downward and its both lines are falling within Over bought zone.

5- Stochastic:- %K(5)- 86.02 & %D(3)- 92.39.

6- In MACD- MACD line has intersected Average line upward and its both lines are rising.

7- MACD(26,12)- 150.77 & EXP(9)- -383.96 & Divergence- 534.73

Conclusions from Weekly chart analysis

(Stochastic & MACD)

Although no confirmation of Wave-A completion but its correction has started and in continuation with recent bottom formation at 17345.2 on 23-08-2022. Positions of Weekly indicators are as follows:-

1- In Stochastic indicator %K(5) line has intersected %D(3) line downward and its both lines are falling within Over bought zone therefore showing strong signals of Intermedaite Term correction continuation.

2- In MACD indicator MACD line has intersected Average line upward and its both lines are rising therefore suggesting that Intermediate Term upward trend is still intact.

Nifty-EOD Chart Analysis

(Averages)

Nifty-EOD Chart (26-Aug-2022):-

Technical Patterns and Formations in EOD charts

Averages:-

A- 5-Day SMA is today at 17550

B- 21-Day SMA is today at 17487

C- 55-Day SMA is today at 16549

D- 100-Day SMA is today at 16643

E- 200-Day SMA is today at 16979

Conclusions from EOD chart analysis

(Averages)

Nifty is well above Long and Intermediate Term trend(55,100,200-Day SMA) deciding Averages but hovering near about Short Term trend(5 & 21-Day SMA) and firstly sustaining it(17550 & 17487) beyond should be watched in next week for on going correction continuation or completion.

Nifty-Last 5 Sessions

intraday charts analysis

Nifty-Intra Day Chart (Aug 22 to Aug 26,2022):-

Technical Patterns formation in last 5 Sessions intraday charts

1- Selling(Resistances) in last 5 sessions are as follows:-

A- 17671-17726

B- 17522-17627

2- Consolidation(Supports) in last 5 sessions are as follows:-

A- 17425-17470

3- Last 5 Sessions trading between 17346-17726

Conclusions from 5 Sessions

intra day chart analysis

Last 5 Sessions trading between 17346-17726 with above mentioned supports and resistances. As higher levels resistances are much stronger than lower levels supports and good intraday selling was seen last Friday also therefore firstly down moves are expected towards above mentioned supports. Finally sustaining below 17425 will mean strong signals of deeper correction beginning after last 10 sessions actual trading range breaking down confirmations therefore should be firstly watched in next week for its confirmations.

Conclusions

(After putting all studies together)

1- Long Term Trend is up.

2- Intermediate Term Trend is up.

3- Short Term Trend is down.

At present correction of Wave-A is on and no indication of its completion yet on EOD and intraday charts. As intraday charts of both previous sessions are showing selling patterns formations also therefore on going correction continuation is expected in the beginning of next week and finally sustaining beyond 21-Day SMA(17487) will confirm the life and length of on going correction.

Although Intermedaite Term indicator Weekly MACD is showing upward trend but Weekly Stochastic is confirming decisive down moves beginning therefore firstly on oging correction will remained continued in next week towards following next supports:-

1- 17425-17470

2- 17366-17428

3- 17226-17293(Strong supports)

As supports between 17226-17293 are strong therefore firstly sustaining it beyond should be watched in next week because sustaining below 17226 will open the gate of deeper correction beginning towards following next supports after last 17 sessions trading range breaking down confirmations:-

1- 17061-17121

2- 16948-17018(Gap supports)

3- 16654-16746(Gap supports)

4- 16565-16628

5- 16495-16542