Firstly watch next supports & even

Short Term correction will be after

complete selling patterns formations

on intraday & EOD charts

Technical Analysis,Research & Weekly

Outlook(Sep 30 to Oct 04,2024)

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (27-Sep-2024):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C of previous Waves structure "ABC correction" completion at 15183.40 on 17-06-2022 and Impulsive Wave-1 of new Waves structure beginning.

2- Impulsive Wave-1 completion at 18887.60 on 01-12-2022.

3- Corrective Wave-2 completion at 16828.30 on 20-03-2023.

4- Impulsive Wave-(i) of Wave-3 completion at 20222.45 on 15-09-2023 and Wave-A of "ABC" correction beginning.

5- Wave-A of Wave-(ii) of Wave-3 completion at 19333.60 on 04-10-2023.

6- Wave-B of Wave-(ii) of Wave-3 completion at 19849.80 on 17-10-2023.

7- Corrective Wave-C of Wave-(ii) of Wave-3 completion at 18837.80 on 26-10-2023 and impulsive Wave-(iii) of Wave-3 beginning.

8- Impulsive Wave-(iii) of Wave-3 continuation with its recent high and new life time top formations at 26277.30 on 27-09-2024.

Conclusions from EOD chart analysis

(Waves structure)

Corrective Wave-C of "ABC correction" of previous Waves structure completed at 15183.40 on 17-06-2022 and from his level Impulsive Wave-1 of new Waves structure begun. Wave-1 completed at 18887.60 on 01-12-2022 and from this level Wave-2 started which completed at 16828.30 on 20-03-2023 and Impulsive Wave-3 begun from this level which is now in continuation.

Impulsive Wave-(i) of Wave-3 completed at 20222.4 on 15-09-20235 and from this level corrective Wave-A of "ABC" correction of Wave-(ii) of Wave-3 begun which completed at 19333.60 on 04-10-2023 and Wave-B started from this level. Wave-B completed at 19849.80 on 17-10-2023 and Wave-C started from this levels which completed at 18837.80 on 26-10-2023 and impulsive Wave-(iii) of Wave-3 begun from this level.

Now impulsive Wave-(iii) of Wave-3 is in continuation forcefully with its recent high and new life time top formations at 26277.30 on 27-09-2024 and no signal of its completion yet on EOD charts.

Nifty-Weekly Chart Analysis

(Stochastic & MACD)

Nifty-Weekly Chart (27-Sep-2024):-

Technical Patterns and Formations in Weekly charts

1- Stochastic- %K(5) line has intersected %D(3) line upward and its both lines are rising in Over bought zone.

2- Stochastic:- %K(5)- 94.46 & %D(3)- 88.69.

3- In MACD- Both lines are kissing in positive zone.

4- MACD(26,12)- 1120.54 & EXP(9)- 1145.20 & Divergence- -24.66

Conclusions from Weekly chart analysis

(Stochastic & MACD)

Technical positions of Intermediate Term indicators are as follows:-

1- As in Stochastic its %K(5) line has intersected %D(3) line upward and its both lines are rising in Over bought zone therefore it will be understood that at present this indicator is suggesting on going upward moves continuation possibility and not showing clear signals of Intermediate Term correction beginning but remain cautious and watchful because its both lines are in Over bought zone for the last 3 weeks.

2- As in MACD indicator its both MACD line and Average lines are kissing in positive zone therefore it will be understood that at present this indicator is cautioning only and not confirming on going Upward Trend completion. Let any side clear intersection happen then that side next Intermediate Term Trend formations will get confirmations and resultant that side decisive bigger moves beginning will be seen.

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (27-Sep-2024):-

Technical Patterns and Formations in EOD charts

1- Stochastic- Its both lines %K(5) and %D(3) are kissing in Over bought zone.

2- Stochastic:- %K(5)- 89.51 & %D(3)- 92.60.

3- In MACD- MACD line has intersected Average line upward and its both lines are rising in positive zone.

4- MACD(26,12)- 412.43 & EXP(9)- 260.50 & Divergence- 151.93

Conclusions from EOD chart analysis

(Stochastic & MACD)

Technical positions of Short Term indicators are as follows:-

1- As in Stochastic its both lines %K(5) and %D(3) are kissing in Over bought zone therefore it will be understood that at present this indicator is not showing signals of any side next Short Terms decisive moves beginning. Let firstly downward intersection happen and its both lines to move below Over bought zone then Short term correction beginning will be considered.

2- As in MACD indicator its both MACD line and Average lines are kissing in positive zone therefore it will be understood that at present this indicator is not confirming any side moves beginning. Let any side clear intersection happen then that side Short Term decisive moves will be seen after that side Short Term Trend formations.

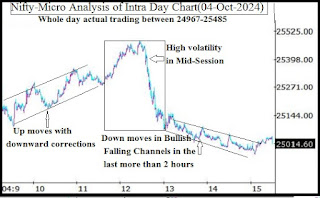

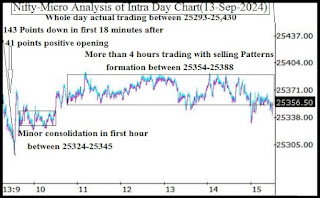

Nifty-Intra Day Chart Analysis

(27-Sep-2024)

Nifty-Intra Day Chart (27-Sep-2024):-

Technical Patterns formation in today intraday charts

1- Up moves after positive opening

2- Selling between 26258-26277

3- Down moves

4- Selling between 26234-26248

5- Down moves

6- Selling between 26191-26231

7- Whole day actual trading between 26152-26277

Conclusions from intra day chart analysis

Although firstly some up moves after positive opening but higher levels selling developed therefore downward move were seen after that. As follow up selling in Mid-Session and more selling in last hours also therefore firstly downward moves are expected below last Friday lowest in the beginning on next week.

Conclusions

(After putting all studies together)

1- Long Term Trend is up.

2- Intermediate Term trend is up.

3- Short Term Trend is up.

Corrective Wave-C of "ABC correction" of previous Waves structure completed at 15183.40 on 17-06-2022 and from his level Impulsive Wave-1 of new Waves structure begun. Wave-1 completed at 18887.60 on 01-12-2022 and from this level Wave-2 started which completed at 16828.30 on 20-03-2023 and Impulsive Wave-3 begun from this level which is now in continuation with its recent high and new life time top formations last Friday at 26277.30 and no indication of its completion yet on EOD and intraday charts.

Although Weekly indicator MACD is not showing clear signals of any side next Intermediate Term Trend formations but Weekly Stochastic is showing signals on going upward moves continuation possibility therefore at it will be understood that at present Intermediate Term Upward Trend is in continuation and let clear Bearish signals develop on Weekly indicators then Intermediate Term Trend reversal will be considered.

As Daily indicator MACD is suggesting on going upward trend continuation possibility in Short Term therefore finally on going Upward moves may remain continued after Short Term correction completion which may be seen also because Daily indicator Stochastic is showing signals Short Term correction beginning possibility.

Intraday charts of last Friday are showing signals of firstly downward moves possibility in the beginning of next week which may be also therefore following next supports below last Friday lowest should be watched one by one for the confirmations of expected Short Term correction continuation/completion:-

1- 26084-26106

2- 26061-26073

3- 26013-26047

4- 25854-25948

Although firstly watch above next supports but it also should be kept in mind that until complete selling patterns will not form on intraday and EOD charts till then even Short Term correction will not be seen.