Strong support range will confirm next more than 5% moves amid more down moves possibilities

Technical Analysis,Research & Weekly Outlook

(Apr 07 to Apr 09,2020)

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (03-Apr-2020):- |

| Just click on chart for its enlarged view |

1- Impulsive Wave-1 beginning from 6825.80 on 29-02-2016 after 1 financial year(2015-16) correction completion

2- Impulsive Wave-1 completion at 8968.70 on 07-09-2016 and corrective Wave-2 beginning

3- Corrective Wave-2 completion at 7893.80 on 26-12-2016 and impulsive Wave-3 beginning

4- Impulsive Wave-3 completion at 11171.50 on 29-01-2018 and corrective Wave-4 beginning

5- Corrective Wave-4 completion at 9951.90 on 23-03-2018 and impulsive Wave-5 beginning

6- Impulsive Wave-5 completion after new life time high formation at 12430.50 on 20-01-2020 and Wave-A of "corrective ABC Waves" beginning

7- Corrective Wave-A continuation with recent bottom formation at 7511.10 on 24-03-2020

8- Indications of Wave-A completion and Wave-B beginning after last 14 Sessions sideways trading between 7512-9602 with rock bottom supports formation between 7512-7970.

Conclusions from EOD chart analysis

(Waves structure)

4 Years rally which started from 6825.80 on 29-02-2016 completed at 12430.50 on 20-01-2020 after 5 waves completion. Now its corrective Wave-A of'ABC" Correction continuation with recent bottom formation at 7511.10 on 24-03-2020.

As last 14 Sessions sideways trading between 7512-9602 with rock bottom supports formation between 7512-7970 therefore indications of Wave-B beginning from 7511.10 on 24-03-2020.

Nifty-EOD Chart Analysis

(Averages)

Nifty-EOD Chart (03-Apr-2020):- |

| Just click on chart for its enlarged view |

1- 5-Day SMA is at 8375

2- 13-Day SMA is at 8360

3- 55-Day SMA is at 10889

4- 200-Day SMA is at 11408

Conclusions from EOD chart analysis

(Averages)

Although 5-Day SMA has moved above 13-Day SMA but last Friday closing was much below both Short Term averages therefore fresh decisive up moves can not be considered because Intermediate and Long Term averages are much above both these Short Term averages.

Nifty-Last 14 Sessions intraday charts analysis

Nifty-Intra Day Chart (Mar 16 to Apr 03,2020):- |

| Just click on chart for its enlarged view |

1- Selling(Resistances) in last 14 sessions between

A- 9254-9403

B- 9430-9584

C- 8846-9038

D- 8772-8883

E- 8760-8873

F- 8663-8733

G- 8465-8660

2- Consolidation(Supports) in last 14 sessions between

A- 8056-8107

B- 7833-8024

C- 7512-7970

3- 14 Sessions actual trading between 7512-9602

Conclusions from 14 Sessions intra day chart analysis

Last 14 sessions sideways trading between 7512-9602 with above mentioned higher levels 7 resistances and lower levels 3 supports therefore Nifty will firstly trade and prepare for next decisive moves within this range,finally sustaining beyond this range will confirm next big moves which should be watched in the coming week/weeks.

Although rock bottom support developed between 7512-7970 but higher levels follow up selling was also seen in previous week therefore expected that nifty will test this support range in next week and finally sustaining beyond this support range will confirm next more than 5% moves.

Nifty-Intra Day Chart Analysis

(03-Apr-2020)

Nifty-Intra Day Chart (03-Apr-2020):- |

| Just click on chart for its enlarged view |

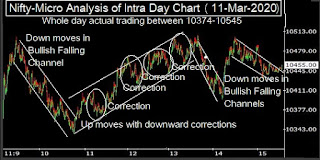

1- Down moves in Bullish Falling Channels

2- Selling between 8100-8160

3- Selling between 8184-8222

4- More than 200 points sharp fall

5- Support between 8056-8107

6- Whole day actual trading between 8056-8222

Conclusions from intra day chart analysis

Although firstly some buying through Down moves in Bullish Falling Channels but after that selling was seen between 8184-8222 and 8056-8107 therefore more than 200 points sharp fall and day's closing was near the lower levels of the day.

As some intraday supports in last hour between 8056-8107 therefore firstly sustaining it beyond should be watched in the beginning of next week and remain cautious also because sharp fall will be seen after sustaining below 8056.

Conclusions

(After Putting All Studies Together)

1- Long term trend is down.

2- Intermediate term trend is down.

3- Short term trend is down but indication of its turning up after last 14 Sessions sideways trading between 7512-9602 with rock bottom supports formation between 7512-7970.

All the Global markets have crashed after Corona pandemic eruption in almost whole world and no indication of its stopping yet and on the other hand its spreading fear has loomed large. Although Corona situation was too much under control in India but situation worsened too much after detection of more than 600 Corona affected cases from Nizamuddin Markaz Jamaat in last 4 days and until whole situation will not come under control completely till then decisive up moves will not be seen and correction continuation possibilities will remain alive.

Last 14 Sessions trading between 7512-9602 and Nifty will firstly trade within this range in next week. As strong supports are lying between 7512-7970 therefore Nifty will firstly trade within and near about this range but will not be able to move up easily because above mentioned 7 resistances are lying above last Friday closing(8083.80).

As too much fear spread after more than 600 Corona affected cases coming from Nizamuddin Markaz Jamaat in last 4 days therefore decisive up moves will not be seen until picture will not be clear and possibilities of more down moves will remain alive as well as finally sustaining beyond strong support range(7512-7970) should be watched in next week because will confirm next more than 5% moves.