Correction continuation towards and below next supports

Technical Analysis,Research & Weekly Outlook

(Feb 24 to Feb 28,2020)

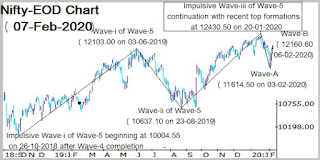

Nifty-EOD Chart Analysis

(5th Wave structure)

Nifty-EOD Chart (20-Feb-2020):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-i of Wave-5 beginning at 10004.55 on 26-10-2018 after Wave-4 completion

2- Wave-i of Wave-5 completion at 12103.00 on 03-06-2019 and corrective Wave-ii beginning

3- Corrective Wave-ii of Wave-5 completion at 10637.10 on 23-08-2019 and impulsive Wave-iii beginning

4- Impulsive Wave-iii of Wave-5 continuation with recent top formations at 12430.50 on 20-01-2020

5- Wave-A completion at 11614.50 on 03-02-2020

6- Wave-B completion at 12246.70 on 14-02-2020

Nifty-Last 24 Sessions intraday charts analysis

Nifty-Intra Day Chart (Jan 21 to Feb 20,2020):-

|

| Just click on chart for its enlarged view |

Technical Patterns formation in last 24 Sessions intraday charts

1- Previous 24 Sessions trading with lower levels supports and higher levels good selling

2- 24 Sessions actual trading between 11615-12272

Nifty-Intra Day Chart Analysis

(20-Feb-2020)

Nifty-Intra Day Chart (20-Feb-2020):-

|

| Just click on chart for its enlarged view |

Technical Patterns formation in today intraday charts

1- Selling between 12118-12152(Immediate Resistances)

2- Sharp fall in last hour

3- Whole day actual trading between 12072-12152

Conclusions from EOD chart analysis

1- Long Term Trend is up after moving above its decider 200 Day SMA(today at 11682.00)

2- Intermediate Term Trend is sideways between 11615-12272 for the last 24 sessions.

3- Short Term Trend is sideways between 11909-12246 for the last 5 sessions.

Conclusions from 24 Sessions intra day chart analysis

Nifty slipped 213 points on 21-01-2019 after new life time high formation at 12430.50 and after that Nifty is trading sideways between 11615-12272 for the last 24 Sessions. Although lower levels some supports but higher levels good selling in last 24 sessions therefore emergence of more down moves possibilities and once sustaining below last 24 sessions lowest will mean huge fall hence remain cautious also.

Conclusions from intra day chart analysis

As more than 4 hours selling between 12118-12152 therefore sharp fall was seeen in last hour. No intraday consolidation patterns formations and good selling last Thursday therefore more down moves are expected in next week.

Conclusions

(After Putting All Studies Together)

Following lines were told on 15-02-2020 in "Strong signals of deeper correction beginning from next week":-

fresh down moves are expected below last Friday lowest(12,091.20) in the beginning of next week

As was told 100% same happened and Nifty slipped 185 points in first 2 sessions of previous week.

As Nifty has closed above Long Term Trend decider 200 Day SMA in last 14 sessions therefore it is still up but Intermediate Term Trend is sideways between 11615-12272 for the last 24 sessions and finally sustaining beyond this range will confirm next big moves which should be firstly watched in the coming week/months.

Next resistances above last Thursday closing and last 24 sessions trading range are as follows:-

1- 12118-12152

2- 12194-12264

Wave-B of Wave-iii of Wave-5 continuation with recent top formation at 12246.70 on 14-02-2020 but slipped sharply same day from there and after that Nifty slipped to 11909 in first 2 sessions of previous week also therefore Short Term Trend will be understood sideways between 11909-12246 and finally sustaining beyond this range will generate first strong signal of next decisive moves. As more than 4 hours selling last Thursday therefore more down moves are expected in next week towards following supports:-

1- 12043-12063

2- 11909-11948

3- 11615-11705

As strong signals of corrective Wave-C formation has been developed in previous weeks therefore correction is expected in next week also. First strong signal of deeper correction beginning will be after sustaining below 11909 and that will mean correction continuation towards and below 11615/11460.70 also which will be seen in the coming weeks/months.