Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Trading "calls" from our "Software" with more than "90% accuracy"

FII & DII trading activity in Capital Market Segment on 03-Feb-2012

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(03-Feb-2012)

1- All the Indices closed in Green except Metals.

2- Strong rally above 5300.

3- White Candle formations.

Ratios

Nifty Put Call Ratio: 1.10

Nifty P/E Ratio(03-Feb-2012): 18.97

Advances & Declines

BSE Advances : 1713

BSE Declines : 1184

NSE Advances : 879

NSE Declines : 560

Nifty Open Interest Changed Today

Nifty- 5200 CE(Feb)- -435600(-11.44%)

Nifty- 5200 PE(Feb)- +1388950(+29.24%)

Nifty- 5300 CE(Feb)- -631500(-10.93%)

Nifty- 5300 PE(Feb)- +924250(+40.01%)

Nifty- 5400 CE(Feb)- -113050(-2.13%)

Nifty- 5400 PE(Feb)- +341300(+39.50%)

Closing

Nifty- closed at 5,325.85(+55.95 Points & +1.06%)

Sensex- closed at 17,604.96(+173.11 Points & +0.99% )

CNX Midcap - closed at 7,324.15(+98.25 Points & +1.36%)

BSE Smallcap- closed at 6,686.55(+77.58 Points & +1.17%)

Nifty Spot-Levels & Trading Strategy for 06-02-2012

R3 5433

R2 5383

R1 5354

Avg 5304

S1 5275

S2 5225

S3 5196

Nifty Spot-Trading Strategy

H6 5405 Trgt 2

H5 5386 Trgt 1

H4 5368 Long breakout

H3 5346 Go Short

H2 5339

H1 5332

L1 5317

L2 5310

L3 5303 Long

L4 5281 Short Breakout

L5 5263 Trgt 1

L6 5244 Trgt 2

Nifty(Feb Fut)-Levels & Trading Strategy for 06-02-2012

R3 5473

R2 5415

R1 5380

Avg 5322

S1 5287

S2 5229

S3 5194

Nifty(Feb Fut)-Trading Strategy

H6 5439 Trgt 2

H5 5417 Trgt 1

H4 5396 Long breakout

H3 5370 Go Short

H2 5362

H1 5353

L1 5336

L2 5327

L3 5319 Long

L4 5293 Short Breakout

L5 5272 Trgt 1

L6 5250 Trgt 2

Bank Nifty(Feb Fut)-Levels & Trading Strategy for 06-02-2012

R3 10544

R2 10364

R1 10259

Avg 10079

S1 9974

S2 9794

S3 9689

Bank Nifty(Feb Fut)-Trading Strategy

H6 10446 Trgt 2

H5 10378 Trgt 1

H4 10310 Long breakout

H3 10232 Go Short

H2 10206

H1 10180

L1 10127

L2 10101

L3 10075 Long

L4 9997 Short Breakout

L5 9929 Trgt 1

L6 9861 Trgt 2

Nifty Spot-Weekly Levels & Trading Strategy(Feb 06 to Feb 10,2012)

R3 5597

R2 5443

R1 5384

Avg 5230

S1 5171

S2 5017

S3 4958

Nifty Spot-Weekly Trading Strategy

H6 5548 Trgt 2

H5 5495 Trgt 1

H4 5442 Long breakout

H3 5383 Go Short

H2 5364

H1 5344

L1 5305

L2 5285

L3 5266 Long

L4 5207 Short Breakout

L5 5154 Trgt 1

L6 5101 Trgt 2

Bank Nifty Spot-Weekly Levels & Trading Strategy(Feb 06 to Feb 10,2012)

R3 11006

R2 10582

R1 10357

Avg 9933

S1 9708

S2 9284

S3 9059

Bank Nifty Spot-Weekly Trading Strategy

H6 10824 Trgt 2

H5 10657 Trgt 1

H4 10489 Long breakout

H3 10311 Go Short

H2 10251

H1 10192

L1 10073

L2 10014

L3 9954 Long

L4 9776 Short Breakout

L5 9608 Trgt 1

L6 9441 Trgt 2

Pre-Closing Outlook(03-02-2012)

All trends upward confirmations at the weekend and blasting Bullish rally is on. Although minor down moves and very short term corrections may be seen any day after intraday selling but until complete selling patterns will not emerge till then short term correction will not be seen.

Mid-session Outlook(03-02-2012)

Minor intraday down moves and trading between 5256-5279 seen today after Intraday selling between 5272-5289 yesterday. Minor intraday support also seen at lower levels today.

Range of 5256-5289 should be watched for next moves confitmations because mixed technical positions between this range today and yesterday.

Range of 5256-5289 should be watched for next moves confitmations because mixed technical positions between this range today and yesterday.

NIFTY-Feb F&O-1st Shorting of 02-02-2012-Covering

NIFTY Feb F & O(Shorted on 02-02-2012)-Cover immediately-CMP-5286

NIFTY-Feb F&O-1st Shorting of 02-02-2012-Message

NIFTY-Feb F&O-1st Shorting of 02-02-2012-Market will be volatile therefore hold and cover after my covering message

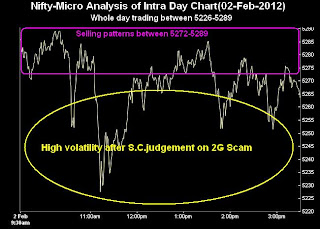

Nifty-Micro Analysis of Intra Day Chart For 03-02-2012

Nifty-Intra Day Chart(02-Feb-2012):-

1- Selling patterns between 5272-5289.

2- High volatility after S.C.judgement on 2G Scam.

3- Doji candle formation

4- Whole day trading between 5226-5289

Intraday supports at lower leves after high volatility due to negative news of S.C.judgement on 2G Scam but clear intraday selling patterns at higher levels also therefore minor intraday correction is due and that will be seen today.

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in today intraday charts

1- Selling patterns between 5272-5289.

2- High volatility after S.C.judgement on 2G Scam.

3- Doji candle formation

4- Whole day trading between 5226-5289

Conclusions from intra day chart analysis

Intraday supports at lower leves after high volatility due to negative news of S.C.judgement on 2G Scam but clear intraday selling patterns at higher levels also therefore minor intraday correction is due and that will be seen today.

FII & DII trading activity in Capital Market Segment on 02-Feb-2012

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(021-Feb-2012)

1- All the Indices closed in Green.

2- Doji candle formation in both NIFTY and SENSEX.

3- S.C.judgement on 2G Scam based highly volatile market today.

Ratios

Nifty Put Call Ratio: 1.16

Nifty P/E Ratio(021-Feb-2012): 18.77

Advances & Declines

BSE Advances : 1575

BSE Declines : 1305

NSE Advances : 802

NSE Declines : 652

Nifty Open Interest Changed Today

Nifty- 5100 CE(Feb)- -284550(-12.01%)

Nifty- 5100 PE(Feb)- +1139800(+20.59%)

Nifty- 5200 CE(Feb)- -153800(-3.81%)

Nifty- 5200 PE(Feb)- +1362450(+37.71%)

Nifty- 5300 CE(Feb)- -24700(-0.42%)

Nifty- 5300 PE(Feb)- +782400(+48.77%)

Closing

Nifty- closed at 5,269.90(+34.20 Points & +0.65%)

Sensex- closed at 17,431.85(+131.27 Points & +0.76% )

CNX Midcap - closed at 7,225.90(+37.50 Points & +0.52%)

BSE Smallcap- closed at 6,608.97(+35.39 Points & +0.54%)

Nifty Spot-Levels & Trading Strategy for 03-02-2012

R3 5361

R2 5325

R1 5297

Avg 5261

S1 5233

S2 5197

S3 5169

Nifty Spot-Trading Strategy

H6 5333 Trgt 2

H5 5318 Trgt 1

H4 5304 Long breakout

H3 5286 Go Short

H2 5280

H1 5274

L1 5263

L2 5257

L3 5251 Long

L4 5233 Short Breakout

L5 5219 Trgt 1

L6 5204 Trgt 2

Nifty(Feb Fut)-Levels & Trading Strategy for 03-02-2012

R3 5371

R2 5335

R1 5304

Avg 5268

S1 5237

S2 5201

S3 5170

Nifty(Feb Fut)-Trading Strategy

H6 5341 Trgt 2

H5 5326 Trgt 1

H4 5310 Long breakout

H3 5292 Go Short

H2 5286

H1 5280

L1 5267

L2 5261

L3 5255 Long

L4 5237 Short Breakout

L5 5221 Trgt 1

L6 5206 Trgt 2

Bank Nifty(Feb Fut)-Levels & Trading Strategy for 03-02-2012

R3 10468

R2 10279

R1 10123

Avg 9934

S1 9778

S2 9589

S3 9433

Bank Nifty(Feb Fut)-Trading Strategy

H6 10319 Trgt 2

H5 10238 Trgt 1

H4 10156 Long breakout

H3 10061 Go Short

H2 10030

H1 9998

L1 9935

L2 9903

L3 9872 Long

L4 9777 Short Breakout

L5 9695 Trgt 1

L6 9614 Trgt 2

NIFTY-F&O-1st Selling of 02-02-2012-Trade

NIFTY(Feb Fut-Sell-Intraday/Positional)SL-5296-TGT-5216-CMP-5272

NIFTY(Jan Put Option-Buy-Intraday/Positional)SL-5296-TGT-5216-S.P.FOR Put-5200,53000(Feb Fut-Rates for all Options)-CMP-5272

NIFTY(Jan Put Option-Buy-Intraday/Positional)SL-5296-TGT-5216-S.P.FOR Put-5200,53000(Feb Fut-Rates for all Options)-CMP-5272

Pre-Closing Outlook(02-02-2012)

Firstly positive global news based gap up opening and after that S.C.judgement on 2G Scam based highly volatile market today with following 2 main features:-

1- Although tested 5229 but most of the time sustained above it

2- Most of the time trading between 5250-5290 with intraday mixed patterns and clear intraday selling patterns between 5272-5290.

Although lower levels support amid high volatility but sustaining above 5290 is also must for next immediate up moves. More consolidation is required for sustaining above 5290 and range of 5250-5290 will be firstly watched for next moves confirmations.

1- Although tested 5229 but most of the time sustained above it

2- Most of the time trading between 5250-5290 with intraday mixed patterns and clear intraday selling patterns between 5272-5290.

Although lower levels support amid high volatility but sustaining above 5290 is also must for next immediate up moves. More consolidation is required for sustaining above 5290 and range of 5250-5290 will be firstly watched for next moves confirmations.

Subscribe to:

Comments (Atom)