Intermediate Term Trend is Down &

Watch Levels after Israel attacked Iran

on 26-10-2024

Technical Analysis,Research & Weekly

Outlook(Oct 28 to Oct 31,2024)

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (25-Oct-2024):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C of previous Waves structure "ABC correction" completion at 15183.40 on 17-06-2022 and Impulsive Wave-1 of new Waves structure beginning.

2- Impulsive Wave-1 completion at 18887.60 on 01-12-2022.

3- Corrective Wave-2 completion at 16828.30 on 20-03-2023.

4- Impulsive Wave-(i) of Wave-3 completion at 20222.45 on 15-09-2023 and Wave-A of "ABC" correction beginning.

5- Wave-A of Wave-(ii) of Wave-3 completion at 19333.60 on 04-10-2023.

6- Wave-B of Wave-(ii) of Wave-3 completion at 19849.80 on 17-10-2023.

7- Corrective Wave-C of Wave-(ii) of Wave-3 completion at 18837.80 on 26-10-2023 and impulsive Wave-(iii) of Wave-3 beginning.

8- Impulsive Wave-(iii) of Wave-3 completion with new life time top formations at 26277.30 on 27-09-2024.

9- Intermediate Term correction continuation with recent bottom formations at 24073.90 on 25-10-2024.

Conclusions from EOD chart analysis

(Waves structure)

Corrective Wave-C of "ABC correction" of previous Waves structure completed at 15183.40 on 17-06-2022 and from this level Impulsive Wave-1 of new Waves structure started which completed at 18887.60 on 01-12-2022 and from this level Wave-2 begun which completed at 16828.30 on 20-03-2023 and Impulsive Wave-3 begun from this level which is now in continuation.

Impulsive Wave-(i) of Wave-3 completed at 20222.4 on 15-09-20235 and from this level corrective Wave-A of "ABC" correction of Wave-(ii) of Wave-3 begun which completed at 19333.60 on 04-10-2023 and Wave-B begun from this level. Wave-B completed at 19849.80 on 17-10-2023 and Wave-C started from this levels which completed at 18837.80 on 26-10-2023 and impulsive Wave-(iii) of Wave-3 started from this level.

Impulsive Wave-(iii) of Wave-3 completed with new life time top formations at 26277.30 on 27-09-2024 and Short Term correction started which is now in continuation with its recent bottom formations at 24073.90 on 25-10-2024 and no confirmation of its completion yet on EOD charts.

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (25-Oct-2024):-

Technical Patterns and Formations in EOD charts

1- Stochastic- Its both %K(5) and %D(3) lines are kissing in Over sold zone

2- Stochastic:- %K(5)- 09.92 & %D(3)- 10.86.

3- In MACD- MACD line has intersected Average line downward and its both lines are falling in negative zone.

4- MACD(26,12)- -508.20 & EXP(9)- -437.85 & Divergence- -70.35

Conclusions from EOD chart analysis

(Stochastic & MACD)

Technical positions of Short Term indicators are as follows:-

1- As in Stochastic its both %K(5) and %D(3) lines are kissing in Over sold zone therefore it will be understood that at present there is no signal of any Upward move beginning. Let its clear Upward intersection happen then Short Term Upward moves will be seen.

2- As in MACD indicator its MACD line has intersected Average line downward and its both lines are falling in negative zone therefore has confirmed that Short Term Trend is down. Although Intermediate Trem Trend is also down but both lines of MACD are narrowing closer therefore if its MACD line intersects Average line upward in the coming week/weeks then Short Term Upward moves will be seen after Short Term Upward Trend formations.

Nifty-EOD Chart Analysis

(Averages)

Nifty-EOD Chart (25-Oct-2024):-

Technical Patterns and Formations in EOD charts

Averages:-

1- 5-Day SMA is today at 24453

2- 21-Day SMA is today at 25050

3- 55-Day SMA is today at 25045

4- 100-Day SMA is today at 24591

5- 200-Day SMA is today at 23380

Conclusions from EOD chart analysis

(Averages)

As Nifty has sustained below Intermediate Term Trend decider 55-Day SMA and also has closed well below 100-Day SMA also last Friday therefore has confirmed that Intermediate Term Trend has turned Downward and Nifty will remain in Downward mode minimum from 3 weeks to 3 Months. In this situation testing possibility of Long Term Trend decider 200-Day SMA can not be ruled out in the coming Months which is now well below. Firstly let it happen then will be decided next Long Term Trend according to finally sustaining beyond its decider 200-Day SMA.

Nifty-EOD Chart Analysis

(Bollinger Band)

Nifty-EOD Chart (25-Oct-2024):-

Technical Patterns and Formations in EOD charts

1- Nifty tested Lower Band on 25-10-2024.

Conclusions from EOD chartanalysis

(Bollinger Band)

As all the 3 lines of Bollinger Band are moving downward therefore it is confirming Downward Trend formations but Nifty has tested its Lower Band also on 25-10-2024 and shown first signal of some upward moves beginning toward its Middle Band. As Nifty may remin in testing mode of Lower Band little more longer period also therefore let Upward moves begins firstly then sustaining beyond Middle Band will be watched for fresh Downward/Upward moves beginning according to Nifty sustaining beyond Middle Band.

Nifty-EOD Chart Analysis

(Fibonacci retracement levels)

Nifty-EOD Chart (25-Oct-2024):-

Technical Patterns and Formations in EOD charts

Fibonacci Retracement levels of

Wave-(iii) of Wave-3(18837.80-26277.30)

13.0%- 25,310 (Corrected)

23.6%- 24,521 (Corrected)

27.0%- 24,268 (Corrected)

38.2%- 23,435 (Crucial Level)

50.0%- 22,557 (Crucial Level)

61.8%- 21,679 (Crucial Level)

70.7%- 21,017

76.4%- 20,593

78.6%- 20,429

88.6%- 19,686

Conclusions from EOD chart analysis

(Fibonacci retracement levels)

As Intermediate Term Trend turning down confirmations therefore Nifty will correct on going Wave-(iii) of Wave-3(18837.80-26277.30) according to above mentioned Fibonacci Retracement levels which should be watched one by one for next Short Term moves beginning.

Nifty has corrected 27.0% and next 38.2% crucial retracement level is at 23,435 which should be firstly watched in the coming week/weeks for the life and length of on going Intermediate Term correction.

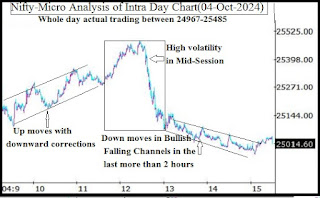

Nifty-Intra Day Chart Analysis

(25-Oct-2024)

Nifty-Intra Day Chart (25-Oct-2024):-

Technical Patterns formation in today intraday charts

1- 322 Points down from intraday higher levels in first 2 hours

2- More than 3 hours consolidation between 24074-24158

3- 149 Points recovery from lower levels in last hour

4- Whole day actual trading between 24074-24440

Conclusions from intra day chart analysis

Although firstly some upward moves in first 15 minutes after positive opening but immediately after that down moves begun which remained continued in the next 2 hours and Nifty lost 322 points from intraday higher levels. As in the next more than 3 hours consolidation developed therefore 149 Points recovery was seen from lower levels in last hour.

As lower levels good intraday consolidation last Friday and Pull Back Rally is also expected in the beginning of next week but sentiment is completely depressed due to Middle East war escalation possibility hence firstly sustaining beyond 24074-24158 should also be watched in the beginning of next week for next Short Term bigger moves beginning confirmations.

Conclusions

(After putting all studies together)

1- Long Term Trend is up.

2- Intermediate Term trend is down.

3- Short Term Trend is down.

Impulsive Wave-(iii) of Wave-3 completed at 26277.30 on 27-09-2024 and from this level Intermediate Term correction begun which is in continuation with its recent bottom formations at 24073.90 on 25-10-2024 and no indication of its completion yet on EOD and intraday charts.

As Short Term indicators Bollinger Band,MACD and Stochastic are suggesting that Short Term upward moves beginning signals may be generated therefore it should also be watched in the coming week for Short Term upward moves beginning with Short Term upward Trend formations. As intraday charts of last Friday are also showing Pull Back Rally beginning possibility if sustains above 24158 then Short Term upward moves will be seen towards following next resistances which should be watched one by one for next decisive moves beginning;-

1- 24537-24604

2- 24627-24684

3- 24787-24886

Averages are confirming that Intermediate Term Trend has turned down and Long Term Trend will be down after sustaining below its decider 200-Day SMA which is today at 23380. As next 38.2% crucial retracement level is at 23,435 and it is little above 200-Day SMA(23380) therefore if Nifty sustains below these 2 levels then deeper correction beginning will be seen after Long Term Trend turning down confirmations.

As Israel has attacked Iran on 26-10-2024 and risk of Middle-East war escalation has also increased therefore possibility of more downward moves can not be ruled out in next week and firstly sustaining beyond following supports should be watched one by one for next for next decisive moves beginning confirmations:-

1- 24074-24158

2- 23977-24094

3- 23671-23734

4- 23563-23612

5- 23502-23537

6- 23358-23476