Rally continuation towards 10000

Intra Day Chart Analysis & Market Outlook

(17-07-2017)

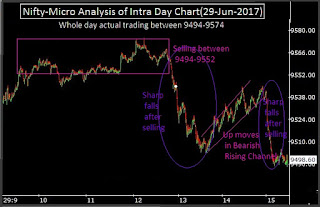

Nifty-Intra Day Chart (14-Jul-2017):- |

| Just click on chart for its enlarged view |

1- Down moves in Bullish Falling Channel

1- Consolidation between 9846-9880

3- Whole day actual trading between 9846-9892

Conclusions from intra day chart analysis

Although whole day negative zone trading but whole day good intraday consolidation patterns formations therefore expected that on going rally will remain continued above life time highest(9913.30) and towards 10000.

(As become free therefore Outlook of 17-07-2017 has been updated)