Sharp fall & deeper correction

on cards

Technical Analysis,Research & Weekly Outlook

(Feb 21 to Feb 25,2022)

Nifty-EOD Chart Analysis

(Averages)

Nifty-EOD Chart (18-Feb-2022):-

Technical Patterns and Formations in EOD charts

1- 5-Day SMA is today at 17219

2- 21-Day SMA is today at 17371

3- 55-Day SMA is today at 17442

4- 100-Day SMA is today at 17617

5- 200-Day SMA is today at 16851

Conclusions from EOD chart analysis

(Averages)

Averages are suggesting that deeper correction is on cards because all the Short Term Averages have moved below Intermediate Term Averages and Nifty closed little above 5-Day SMA(17219) at 17276.30 after intraday lowest(17219.20) formation exactly on it.

Although Long Term Average is still up but at stake because intraday lowest formation on 14-02-2022 was below it at 16809.70.

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (18-Feb-2022):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC' correction beginning.

2- Corrective Wave-A of "ABC" correction completion at 16410.20 on 20-12-2021

3- Wave-B completion at 18351.00 on 18-01-2022 and and Wave-C beginning

4- Wave-C continuation with recent bottom formation at 16809.7 on 14-02-2022

5- Last 20 Sessions sideways trading between 16810-17794

6- Stochastic- %K(5) line has intersected %D(3) line upward and its both lines are rising towards Over bought zone.

7- Stochastic:- %K(5)- 66.62 & %D(3)- 50.67.

8- In MACD- Both lines are kissing.

9- MACD(26,12)- -200.00 & EXP(9)- -238.89 & Divergence- 38.89

Conclusions from EOD chart analysis

(Stochastic & MACD)

Although in Stochastic both lines are rising towards Over bought zone after %K(5) line upward intersection of %D(3) line but such type of upward and downward intersection is being seen after little up and down moves for the last 20 sessions therefore Price action and trading range break out should be firstly watched in next week for next Short Term Trend formation confirmations.

As in MACD both lines are kissing in negative zone therefore not suggesting any side trend formations and let clear trend formation confirmation come from this indicator then will be decided accordingly.

Nifty

(Last 3 Sessions intraday charts analysis)

Nifty-Intra Day Chart (Feb 16 to Feb 18,2022):-

Technical Patterns formation in last 3 Sessions intraday charts

1- Whole day only intraday volatility on 16-02-2022

2- Selling between 17324-17417 on 17-02-2022

3- Selling between 17329-19380 17,380 on 17-02-2022

4- Getting suppports between 17235-17293 in last 3 sessions

5- Last 3 Sessions actual trading between 17220-17490

Conclusions from 3 Sessions intra day chart analysis

Although Nifty got supports at lower levels between 17335-17293 in last 3 sessions but higher levels good selling also in 2 previous sessions therefore expected that firstly down moves will be seen in the beginning of next week towards the lowest of last 3 sessions(17220) and once sustaining below it will mean sharp fall after breaking down confirmation of last 3 sessions trading range.

Conclusions

(After putting all studies together)

1- Short Term Trend is sideways.

2- Intermediate Term Trend is sideways.

3- Long Term Trend is up.

As corrective Wave-A of "ABC' correction started after Impulsive Wave-5 completion and new life time top formation at 18604.50 on 19-10-2021 therefore Nifty has to correct whole rally which strted begun from 7511.10 on 24-03-2020.

Now Wave-C of on going "ABC' correction continuation with recent bottom formation at 16809.7 on 14-02-2022 towards and below the bottom of of Wave-A(16410.20) after Wave-B completion at 18351.00 on 18-01-2022.

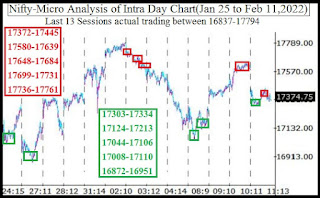

Last 20 Sessions sideways trading between 16810-17794 and finally sustaining beyond this range will form next trend therefore should be firstly watched in the coming week/weeks. Next supports and resistances within this range are as follows;-

1- Resistances in last 20 Sessions trading range are as follows:-

A- 17324-17417

B- 17580-17639

C- 17648-17684

D- 17699-17731

E- 17736-17761

2- Supports in last 20 Sessions trading range are as follows:-

A- 17235-17293

B- 17124-17213

C- 17044-17106

D- 17008-17110

E- 16872-16951

As good intraday selling in last 2 sessions of previous week therefore firstly down moves will be seen towards and below the lowest(17220) of last 3 sessions and once broken down confirmation of last 3 sessions trading range will mean steep fall possibility towards and below the lowest(16810) of last 20 sessions trading range because Short To Long Term averages are also suggesting inherent weakness.

200-Day SMA is today at 16851 and last Friday closing was above it therefore Long Term Trend is still up but at stake because it was tested on 14-02-2022 after intraday lowest formation below it was at 16809.70.

Wave-B begun after corrective Wave-A of "ABC" correction completion at 16410.20 on 20-12-2021 which is now below 200-Day SMA(16851). Now Wave-C continuation towards and below the bottom of Wave-B(16410.20) and once sustaining below 16851 will mean Long Term Trend turning down confirmation as well as sharp fall possibility towards below 16410.20.