Bullish rally continuation and Short Term correction only after fresh selling patterns formations

Technical Analysis,Research & Weekly Outlook

(Aug 16 to Aug 20,2021)

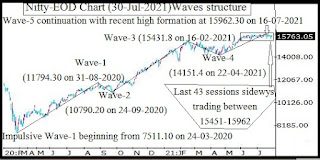

Nifty-EOD Chart Analysis

(MACD & Stochastic)

Nifty-EOD Chart (13-Aug-2021):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 continuation with recent high and new life time top formation at 16543.60 on 13-08-2021

2- Stochastic- %K(5) is at 83.94 & %D(3) is at 73.43

3- Stochastic- %K(5) line has intersected %D(3) line upward and both lines are rising within and towards Over bought zone.

4- In MACD- MACD line has intersected Average line upward and both lines are rising in positive zone.

Conclusions from EOD chart analysis

(Stochastic & MACD)

As in Stochastic indicator %K(5) line has intersected %D(3) line upward and both lines are rising within and towards Over bought zone therefore some more up moves are firstly expected in the beginning of next week. Let some selling develop on intraday and EOD charts and both lines of Stochastic to move into overbought zone as well as %K(5) line to intersect %D(3) downward then Short term correction will be considered.

As in MACD indicator MACD line has intersected Average line upward and both lines are rising in positive zone therefore emergence of some more up moves expectations in next week.

Nifty-Intra Day Chart Analysis

(13-Aug-2021)

Nifty-Intra Day Chart (13-Aug-2021):-

Technical Patterns formation in today intraday charts

1- Whole day up moves with downward corrections

2- Whole day actual trading between 16377-16543

Conclusions from intra day chart analysis

As whole day up moves with downward corrections after positive opening and selling patterns were not seen therefore on going rally continuation is expected in the beginning of next week.

Although sentiment has turned heated but selling patterns were not seen last Friday therefore let intraday selling patterns develop then Short Term correction will be considered.

Conclusions

(After Putting All Studies Together)

All the trends are up and Bullish rally continuation as well as no selling patterns formations on EOD and intraday charts therefore on going rally continuation is expected in the beginning of next week because indicators are also suggesting some more immediate up moves.

As in Stochastic both lines are rising within and towards Over bought zone therefore some more up moves are firstly expected in the beginning of next week but this indicator may turn Overbought after some more up moves then Short Term correction will be seen but only after complete fresh selling patterns formations minimum on intraday charts.