Levels will confirm next trend according to Coronavirus problem solution timings

Technical Analysis,Research & Weekly Outlook

(Apr 13 to Apr 17,2020)

Nifty-EOD Chart Analysis

(Corrective Waves)

Nifty-EOD Chart 09-Apr-2020:- |

1- Impulsive Wave-5 completion after new life time high formation at 12430.50 on 20-01-2020 and Wave-A of "corrective ABC Waves" beginning

2- Corrective Wave-A completion at 7511.10 on 24-03-2020 and Wave-B beginning

3- Wave-B continuation with recent top formation at 9131.70 on 08-04-2020

4- Last 17 Sessions sideways trading between 7512-9602

Conclusions from EOD chart analysis

(Corrective Waves)

Corrective Wave-B continuation with recent top formation at 9131.70 on 08-04-2020 and no confirmation of its completion yet, As last 17 Sessions sideways trading between 7512-9602 and Wave-B continuation within this range therefore firstly sustaining beyond this range should be watched in the coming week/weeks for the life of Wave-B confirmations.

Nifty

Last 17 Sessions intraday charts analysis

Nifty-Intra Day Chart (Mar 16 to Apr 09,2020):- |

1- Selling(Resistances) in last 17 sessions between

A- 9254-9403

B- 9430-9584

2- Consolidation(Supports) in last 14 sessions

A- 8654-8750

B- 8361-8449

C- 8056-8107

D- 7512-7970

3- Mixed Patterns formation between 8905-9128 on 09-04-2020

4- 17 Sessions actual trading between 7512-9602

Conclusions from 17 Sessions intra day chart analysis

Sideways trading between 7512-9602 for the last 17 sessions with above mentioned higher levels 2 resistances and lower levels 4 supports therefore Nifty will firstly trade and prepare for next decisive moves within this range,finally sustaining beyond this range will confirm next big moves which should be watched in the coming week/weeks.

As Whole day trading with Mixed Patterns formation between 8905-9128 on 09-04-2020 and this range is within above mentioned supports and resistances therefore firstly sustaining beyond this range should be watched in next week for first signal of next decisive moves beginning.

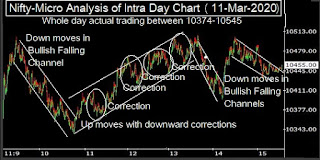

Nifty-Intra Day Chart Analysis

(09-Apr-2020)

Nifty-Intra Day Chart (09-Apr-2020):- |

1- Selling between 8980-9025

2- Support between 8905-8960

3- Up moves in Bearish Rising Channel

4- Down moves in Bullish Falling Channel

5- Support between 9001-9055

6- Sharp up in last hour

7- Whole day actual trading between 8905-9128

Conclusions from intra day chart analysis

Although 04.15% positive closing after gap up strong opening but only consolidation patterns were not seen and selling patterns were also seen on 09-04-2020 therefore expected that Nifty will firstly trade and prepare for next one sided decisive within and near about last Thursday trading range(8905-9128) and finally sustaining it beyond should be watched in the beginning of next week for confirmations.

Conclusions (After Putting All Studies Together)

1- Long term trend is down.

2- Intermediate term trend is down.

3- Short term trend has turned up after more than 1500 points recovery from lower levels in previous week.

Impulsive Wave-B of "corrective ABC Waves" continuation and no indication of its completion yet. As last 17 Sessions sideways trading between 7512-9602 with higher levels seling and lower levels consolidation therefore at present Nifty is not prepared for any side big decisive moves hence Nifty will firstly trade and prepare for it within this range and finally sustaining beyond this range will decide the life of Wave-B.

As Short Term Indicators have turned overbought after last weeks strong up moves therefore Short Term correction may be seen any day in next week but next trend will be decided by sustaining beyond last 17 Sessions trading range(7512-9602) hence it should be watched in the coming week/weeks/months because final moves will be according to Coronavirus problem solution timings only.