As busy therefore Stock Market Outlook of today(04-08-2017) and next Monday(17-07-2017) will not be updated but suggesting to watch those 2 supports which were updated in yesterday outlook for deeper correction confirmations amid on going correction continuation expectations.

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Trading "calls" from our "Software" with more than "90% accuracy"

Very Short Term correction expectations towards next supports

Market Outlook(03-08-2017)

As whole day today market was on RBI Credit policy expectations and its announcements led last hour volatility also therefore analysis of today intraday Nifty chart is not being updated because technical positions reverses during such high sentimental led volatility.

Although last 2 sessions closing was near the higher levels of the day after strong recovery from lower levels but we were cautious because both previous sessions trading was with Mixed Patterns formations and we updated levels for next trend confirmations. As today intraday trading was also completely affected from RBI Credit policy expectations therefore firstly sustaining beyond today trading range(10055-10237) should be watched for next trend confirmations and with Very Short Term correction expectations towards following next supports:-

1- 10023-10039

2- 9980-9998

Levels will confirm post RBI Credit policy decisive big moves

Intra Day Chart Analysis & Market Outlook

(02-08-2017)

Nifty-Intra Day Chart (01-Aug-2017):-

|

| Just click on chart for its enlarged view |

1- Most time trading with Mixed Patterns formations between 10066-10100

2- Sharp up moves in last half hour

3- Whole day actual trading between 10066-10128

Conclusions from intra day chart analysis

Although closing near the higher levels of the day after last half hour sharp up moves but most time trading with Mixed Patterns formations between 10066-10100 therefore firstly sustaining beyond these levels should be watched tomorrow for next decisive big moves which will be seen after RBI Credit policy and before that Nifty will prepare for those decisive big moves between today trading range(10066-10128)

Post RBI Credit policy big moves confirmations from levels

Intra Day Chart Analysis & Market Outlook

(01-08-2017)

Nifty-Intra Day Chart (31-Jul-2017):-

|

| Just click on chart for its enlarged view |

1- Consolidation between 10023-10039

2- Selling patterns formation between 10047-10062

3- Up moves in last hour

4- Whole day actual trading between 10017-10085

Conclusions from intra day chart analysis

Although closing near the higher levels of the day after first 3 hours consolidation but selling patterns formation also developed during Mid session therefore complete fresh consolidation is firstly required for decisive up moves because resistances are also lying between 10067-10114.

Tomorrow will be preparation day for post RBI Credit policy(on 2nd Aug) big moves and that will be done within crucial levels(9945-10114) and firstly valid break out of these levels should be watched for post RBI Credit policy big moves confirmations.

Finally Rally after follow up consolidations within Crucial levels

Intra Day Chart Analysis & Market Outlook

(31-07-2017)

Nifty-Intra Day Chart (28-Jul-2017):-

|

| Just click on chart for its enlarged view |

1- Selling between 9980-9998

1- Support between 9945-9971

3- Up moves in last hour

3- Whole day actual trading between 9945-10026

Conclusions from intra day chart analysis

Following lines were told in "Finally Rally continuation after more down moves":-

1- some more down moves will be seen below today lowest(10005.50) and towards next supports.

2- strong supports are lying between 9952-9978

3- Nifty will remain sideways and prepare for next decisive big moves between 9952-10114

More down moves towards next supports(9952-9978) was told and Nifty slipped just below next supports(9952-9978) as well as recovered after intraday lowest formation at 9944.50.

Although last Friday closing was near the highest levels of the day after last hour up moves and lower levels supports formations also but selling was also seen between 9980-9998 therefore follow up consolidation is firstly required for decisive up moves.

Last 4 sessions trading between 9945-10114 with lower levels good consolidation and higher levels equally good selling therefore Nifty will firstly trade and prepare for next decisive moves within these crucial levels(9945-10114) and expected that finally rally will be seen above 10114 after follow up consolidation within mentioned crucial levels.

Finally Rally continuation after more down moves

Intra Day Chart Analysis & Market

Outlook(28-07-2017)

Nifty-Intra Day Chart (27-Jul-2017):-

|

| Just click on chart for its enlarged view |

1- Selling between 10081-10114

2- Selling between 10067-10083

3- Sharp fall in last Hour

4- Whole day actual trading between 10006-10114

Conclusions from intra day chart analysis

Although strong up moves after gap up opening but clear selling patterns formations between 10067-10114 therefore these levels be first and strong resistance and some more down moves will be seen below today lowest(10005.50) and towards next supports.

As good selling today and strong supports are lying between 9952-9978 therefore Nifty will remain sideways and prepare for next decisive big moves between 9952-10114 and finally valid break out of these crucial levels will confirm next Trend.

Certainly fresh consolidation is firsty required for decisive up moves above today righest and also expected that finally rally will remain continued after fresh consolidation between 9952-10114 because any deeper correction van not be considered from only one day intraday selling and until complete follow up selling patterns will not develop on EOD charts till then any deeper correction will not be seen.

Finally rally continuation above 10000 after fresh consolidation

Intra Day Chart Analysis & Market

Outlook(26-07-2017)

Nifty-Intra Day Chart (25-Jul-2017):- |

| Just click on chart for its enlarged view |

1- Selling between 9868-9875

2- Consolidation between 9949-9961

3- Selling between 9873-9880

4- Whole day actual trading between 9949-10011

Conclusions from intra day chart analysis

Although some selling in the first and last hours of the day but lower levels good consolidation also therefore expected that finally rally will remain continued above 10000 after fresh consolidation in the coming sessions.

Just Watch levels for next Trend confirmations

Intra Day Chart Analysis & Market

Outlook(24-07-2017)

Nifty-Intra Day Chart (21-Jul-2017):-Outlook(24-07-2017)

|

| Just click on chart for its enlarged view |

1- Selling between 9906-9918

2- Lower levels consolidation between 9838-9868

3- Last hour Up moves in Bearish Rising Channel

4- Whole day actual trading between 9838-9918

Conclusions from intra day chart analysis

Following lines were told on 20-07-2017 in "Levels will confirm Short Term Correction beginning":-

down moves below today lowest(9863.45)can not be ruled out

Nifty slipped below 9863.45 after fresh selling between 9906-9918 and formed intraday lowest at 9838. Although first 2 hours selling and last hour Up moves in Bearish Rising Channel but lower levels also consolidation between 9838-9868 therefore last Friday trading will be understood Mixed Patterns formations between 9838-9918.

As higher levels selling last Friday and next resistances upto 9928 are also above last Friday highest therefore follow up consolidation is firstly required for next decisive up moves above 9928. Expected that Nifty will firstly trade and prepare for next trend between 9838-9928 and its valid break out of should be firstly watched in the coming sessions for its confirmations.

Levels will confirm Short Term Correction beginning

Intra Day Chart Analysis & Market Outlook

(21-07-2017)

Nifty-Intra Day Chart (20-Jul-2017):- |

| Just click on chart for its enlarged view |

1- Selling between 9895-9910

2- Mixed Patterns between 9864-9888

3- Whole day actual trading between 9864-9922

Conclusions from intra day chart analysis

Following lines were told yesterday in "Firstly watch levels for next trend":-

1- view will not be Bullish despite today closing near the higher levels of the day.

2- Next and strong resistances are between 9912-9928

3- Last 5 sessions trading between 9792-9928 with lower levels supports and higher levels selling and firstly sustaining beyond these levels should be watched for next trend.

As fresh selling between 9895-9910 today therefore down moves below today lowest(9863.45)can not be ruled out in the coming sessions but sustaining it below is must for Short Term Correction beginning confirmation because last 3 hours trading just above it with Mixed Patterns also between 9864-9888 today.

Firstly watch levels for next trend

Intra Day Chart Analysis & Market Outlook

(20-07-2017)

Nifty-Intra Day Chart (19-Jul-2017):-

|

| Just click on chart for its enlarged view |

1- Selling patterns formation between 9874-9888

2- Up moves in Bearish Rising Channel

3- Whole day actual trading between 9852-9905

Conclusions from intra day chart analysis

As most Asian markets were trading strong therefore positive opening and after that most time up moves but in Bearish Rising Channel therefore view will not be Bullish despite today closing near the higher levels of the day.

Next and strong resistances are between 9912-9928 and until complete condolition will not develop till then fresh rally will not be seen. Last 5 sessions trading between 9792-9928 with lower levels supports and higher levels selling and firstly sustaining beyond these levels should be watched for next trend.

Very Short Term correction continuation Expectations

Intra Day Chart Analysis & Market Outlook

(19-07-2017)

Nifty-Intra Day Chart (18-Jul-2017):-

|

| Just click on chart for its enlarged view |

1- Selling between 9870-9885

2- Selling between 9861-9871

3- Down moves in Bullish Falling Channel

4- Last hour minor Support between 9793-9835

5- Whole day actual trading between 9793-9885

Conclusions from intra day chart analysis

As some selling yesterday and weaker Asian markets today morning therefore gap down opening and follow up selling also therefore some more down moves can not be ruled out in the coming sessions. Some consolidation today through Down moves in Bullish Falling Channel and last hour minor Support between 9793-9835 therefore some up moves can not be ruled out within today trading range but today started Very Short Term correction continuation is expected in the coming sessions.

Break out of Levels will confirm next Trend

Intra Day Chart Analysis & Market Outlook

(18-07-2017)

Nifty-Intra Day Chart (17-Jul-2017):-

|

| Just click on chart for its enlarged view |

1- Selling between 9914-9920

2- Up moves in Bearish Rising Channel

3- Intraday corrections

4- Whole day actual trading between 9895-9928

Conclusions from intra day chart analysis

Although today closing at life time highest levels after whole day positive zone trading but some selling was also seen therefore fresh consolidation is firstly required for decisive up moves above today highest. As some consolidation was also today therefore expected that Nifty will firstly trade and prepare for next decisive moves within and near about today trading range and its valid break out will confirm next trend which should be firstly watched tomorrow.

Rally continuation towards 10000

Intra Day Chart Analysis & Market Outlook

(17-07-2017)

Nifty-Intra Day Chart (14-Jul-2017):- |

| Just click on chart for its enlarged view |

1- Down moves in Bullish Falling Channel

1- Consolidation between 9846-9880

3- Whole day actual trading between 9846-9892

Conclusions from intra day chart analysis

Although whole day negative zone trading but whole day good intraday consolidation patterns formations therefore expected that on going rally will remain continued above life time highest(9913.30) and towards 10000.

(As become free therefore Outlook of 17-07-2017 has been updated)

Rally continuation above life time highest

Intra Day Chart Analysis & Market Outlook

(13-07-2017)

Nifty-Intra Day Chart (12-Jul-2017):-

|

| Just click on chart for its enlarged view |

1- Down moves in Bullish Falling Channel

2- Consolidation between 9788-9807

3- Whole day actual trading between 9788-9824

Conclusions from intra day chart analysis

Although good selling and closing near the lower levels of the day on 11-07-2017 but we following line in "Finally rally continuation after fresh consolidation"

finally rally will remain continued after fresh consolidation within next 2/3 sessions.

As sufficiently good consolidation on 12-07-2017 therefore expected that on going rally will continued above life time highest(9830.10) in the coming sessions.

Finally rally continuation after fresh consolidation

Intra Day Chart Analysis & Market Outlook

(12-07-2017)

Nifty-Intra Day Chart (11-Jul-2017):-

|

| Just click on chart for its enlarged view |

1- Up moves in Bearish Rising Channel

2- Selling between 9815-9830

3- sharp down in last hour

4- Whole day actual trading between 9779-9830

Conclusions from intra day chart analysis

Although Green closing after whole day positive zone trading but sufficiently good intraday selling was seen therefore only very Short Term correction will be considered and until complete follow up selling will not develop in the coming sessions till then decisive down moves will not be seen.

As rally is very much on and such today like corrections are a part of Bull markets therefore expected that finally rally will remain continued after fresh consolidation within next 2/3 sessions.

Rally continuation with continuous new life time high formations

Market Outlook(11-07-2017)

As first 3 hours trading was disturbed due technical problems in NSE software today and after that only up moves were seen without any specific technical pattern formations therefore Intra Day Chart Analysis is not being updated.

It was a big development today that last 30 sessions trading range(9550-9700) was broken out and today closing was also at life time high. As forceful break out today therefore high possibility of rally continuation with continuous new life time high formations.

Firstly Watch Levels for next big trend confirmations

Intra Day Chart Analysis & Market Outlook

(10-07-2017)

Nifty-Intra Day Chart (07-Jul-2017):-

|

| Just click on chart for its enlarged view |

1- Selling between 9655-9665

2- Consolidation between 9652-9662

3- Up moves in Bearish Rising Channels

4- Intraday corrections in last hour

5- Whole day actual trading between 9643-9684

Conclusions from intra day chart analysis

As both consolidation and intraday selling patterns formations therefore last Friday trading will be understood with Mixed patterns formations and valid break out of last Friday range should be firstly watched for next decisive moves beginning confirmations. Previous 30 sessions trading between 9550-9700 with higher levels selling and lower levels consolidation within this range therefore Nifty will have to prepare for next big moves within this range and finally sustaining beyond this range will confirm next big trend which should be firstly watched in next week.

Crucial level will confirm deeper correction

Intra Day Chart Analysis & Market Outlook

(30-06-2017)

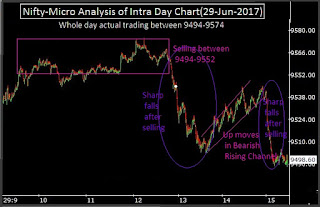

Nifty-Intra Day Chart (29-Jun-2017):-

|

| Just click on chart for its enlarged view |

1- Selling between 9494-9552

2- Up moves in Bearish Rising Channel

3- Sharp falls after selling

4- Whole day actual trading between 9494-9574

Conclusions from intra day chart analysis

As all the Asian markets were trading strong after 144 points positive closing of Dow Jones yesterday therefore up moves after strong opening but not sustaining at higher levels and closing at the lower levels of the day after fresh selling because selling was seen between 9474-9552 in last 2 sessions and today closing is also within this range.

Previous 20 sessions trading between 9561-9698 and and Nifty moved into this range today but could not sustain within it as well as closed below it after follow up selling within this range therefore correction continuation expectations are alive and once valid break down below crucial levels(9473.45) will mean deeper correction which should be firstly watched in the coming sessions.

Subscribe to:

Comments (Atom)