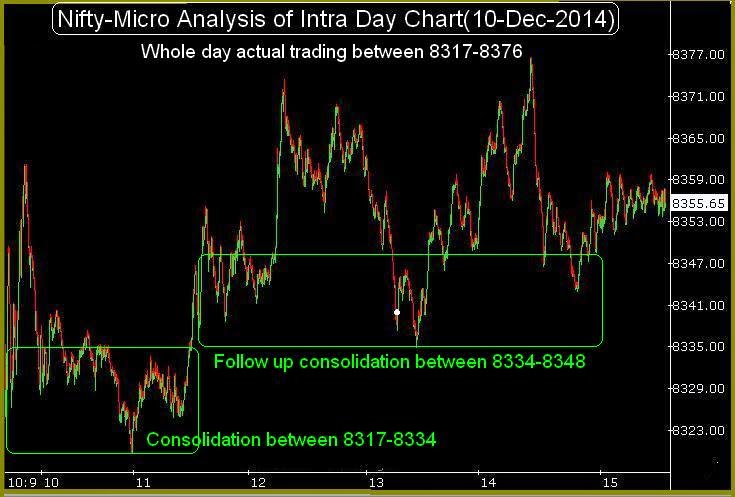

Nifty-Intra Day Chart (10-Dec-2014):-

Technical Patterns and Formations in today intraday charts

1- Consolidation between 8317-8334

2- Follow up consolidation between 8334-8348

3- Whole day actual trading between 8317-8376

Firstly lower levels good consolidations but not sustaining at higher levels also therefore some more higher levels consolidations is firstly required for next decisive up moves above today highest.

Correction is on but Whole day Bullish Falling Channel formation yesterday and lower levels good consolidations also today therefore emergence of first signal of on going correction completion. As good selling at higher levels in previous weeks therefore more consolidation is required for fresh rally and new life time highest formations.

As consolidation between 8317-8348 today therefore sustaining beyond this range should be firstly watched tomorrow for:-

1- Correction continuation below 8317

2- First signal of on going correction completion above 8348

|

| Just click on chart for its enlarged view |

1- Consolidation between 8317-8334

2- Follow up consolidation between 8334-8348

3- Whole day actual trading between 8317-8376

Conclusions from intra day chart analysis

Firstly lower levels good consolidations but not sustaining at higher levels also therefore some more higher levels consolidations is firstly required for next decisive up moves above today highest.

Correction is on but Whole day Bullish Falling Channel formation yesterday and lower levels good consolidations also today therefore emergence of first signal of on going correction completion. As good selling at higher levels in previous weeks therefore more consolidation is required for fresh rally and new life time highest formations.

As consolidation between 8317-8348 today therefore sustaining beyond this range should be firstly watched tomorrow for:-

1- Correction continuation below 8317

2- First signal of on going correction completion above 8348