Although more than 1% down yesterday and now trading almost flat but today intraday patterns and last 3 sessions intraday charts are showing consolidation patterns therefore means that consolidation process is on and expected that on going correction will complete within or above those next supports which have been updated in previous Outlook yesterday. Also expected that next rally will start above 7082.

Trading "calls" from our "Software" with more than "90% accuracy"

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Technical Analysis and Market Outlook(29-05-2014)

Nifty-Intra Day Chart (29-May-2014):-

Technical Patterns and Formations in today intraday charts

1- Whole day down moves but in Bullish Falling Channel formations also.

2- Whole day actual trading between 7225-7325

Although consolidation in last 2 sessions but huge selling was also seen on 16th May(Election results day) and on 26th May(Modi Govt oath taking day) therefore big fall seen on May Derivative expiry day and market closed more than 1% down today. As huge selling on 16th May therefore following topic was posted on 19-05-2014:-

Long and Intermediate Term Trends are up and Short Term Trend turned down amid last 13 sessions trading between 7082-7563. Next supports within this range are as follows:-

1- Support between 7193-7229

2- Supports between 7082-7102

|

| Just click on chart for its enlarged view |

1- Whole day down moves but in Bullish Falling Channel formations also.

2- Whole day actual trading between 7225-7325

Conclusions from intra day chart analysis

Although consolidation in last 2 sessions but huge selling was also seen on 16th May(Election results day) and on 26th May(Modi Govt oath taking day) therefore big fall seen on May Derivative expiry day and market closed more than 1% down today. As huge selling on 16th May therefore following topic was posted on 19-05-2014:-

1- Support between 7193-7229

2- Supports between 7082-7102

Although Whole day down moves today but with Bullish Falling Channel formations therefore indications of consolidation process emergence also amid on going correction. As consolidation was seen in last 2 sessions also therefore expected that correction will complete within above mentioned both supports ranges.

Post-open Outlook(29-05-2014)

As negative news of CEO-probable B G Srinivas quits Infy therefore heavy weight Infy traded more than 7% down and resultant negative zone trading of Indian markets. As consolidation in last 2 sessions therefore up moves/rally beginning hopes are still alive and finally sustaining beyond 7275-7504 should be firstly watched for next immediate decisive trend first strong indication.

Technical Analysis and Market Outlook(29-05-2014)

Nifty-Intra Day Chart (28-May-2014):-

Technical Patterns and Formations in today intraday charts

1- Consolidation between 7303-7327

2- Whole day actual trading between 7303-7344

Whole day sideways trading within 41 points between 7303-7344 with lower levels supports and consolidation therefore emergence of rally beginning expectations after last Monday started correction completion because consolidation was seen above 7275 yesterday also. As selling with huge volumes between 7430-7504 last Monday also therefore firstly Nifty has to prepare for next decisive moves between 7275-7504. Long and Intermediate Term trends are up and Short Term Trend is sideways between 7275-7504 as well as immediate resistances and supports beyond this range are as follows:-

1- Resistances between 7505-7563

2- Support between 7248-7274

As resistances are just above 7504 and supports are just below 7275 therefore next decisive moves will start after valid break out of 7248-7563 in following manner:-

1- Sustaining above 7563 will mean fresh strong rally after correction completion.

2- Sustaining below 7248 will mean down moves towards following next supports:-

a- Support between 7193-7229

b- Supports between 7082-7102

|

| Just click on chart for its enlarged view |

1- Consolidation between 7303-7327

2- Whole day actual trading between 7303-7344

Conclusions from intra day chart analysis

Whole day sideways trading within 41 points between 7303-7344 with lower levels supports and consolidation therefore emergence of rally beginning expectations after last Monday started correction completion because consolidation was seen above 7275 yesterday also. As selling with huge volumes between 7430-7504 last Monday also therefore firstly Nifty has to prepare for next decisive moves between 7275-7504. Long and Intermediate Term trends are up and Short Term Trend is sideways between 7275-7504 as well as immediate resistances and supports beyond this range are as follows:-

1- Resistances between 7505-7563

2- Support between 7248-7274

As resistances are just above 7504 and supports are just below 7275 therefore next decisive moves will start after valid break out of 7248-7563 in following manner:-

1- Sustaining above 7563 will mean fresh strong rally after correction completion.

2- Sustaining below 7248 will mean down moves towards following next supports:-

a- Support between 7193-7229

b- Supports between 7082-7102

Firstly sideways markets between 7275-7504 and should be firstly watched tomorrow/in the coming sessions and May derivative expiry is expected between/near about 7350-7400 tomorrow.

Pre-closing Outlook(28-05-2014)

Range of 7275-7245 was given yesterday for next immediate trend confirmations and whole day Nifty traded within this range. Although flat market today and negative market yesterday but intraday patterns of both sessions are showing consolidation signals also therefore rally continuation hopes are alive.

Mid-session Outlook(28-05-2014)

Following lines were told yesterday in Technical Analysis and Market Outlook(28-05-2014)

Both consolidation and Bearish patterns seen between 7275-7245 today therefore firstly follow up moves with sustaining beyond today trading range should be watched for next immediate trend confirmations.

Both consolidation and Bearish patterns seen between 7275-7245 today therefore firstly follow up moves with sustaining beyond today trading range should be watched for next immediate trend confirmations.

Range of 7275-7245 was given for next immediate trend confirmations and Nifty traded first 3 hours exactly within this range between 7302.60-7344.75. Although some supports and consolidation seen today but as a whole intraday patterns have not shown clear formations yet therefore same view that sustaining beyond mentioned yesterday trading range should be watched for next immediate trend confirmations and fresh rally beginning hopes are still alive after follow up consolidations above 7248.

Technical Analysis and Market Outlook(28-05-2014)

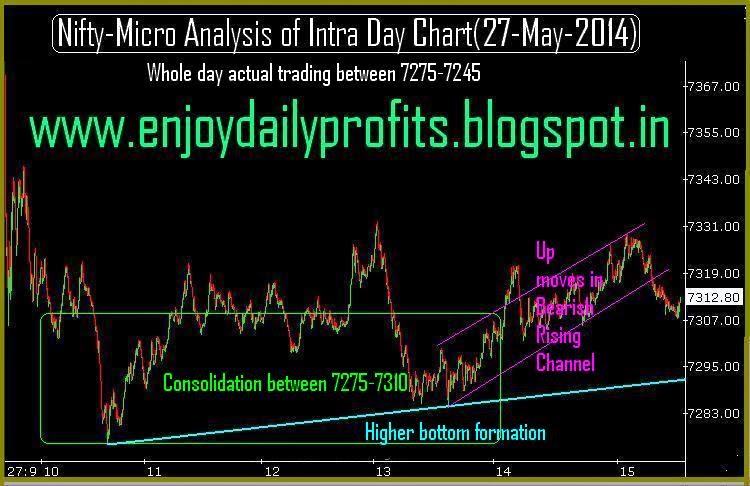

Nifty-Intra Day Chart (27-May-2014):-

Technical Patterns and Formations in today intraday charts

1- Consolidation between 7275-7310

2- Higher bottom formation

3- Up moves in Bearish Rising Channel

4- Whole day actual trading between 7275-7245

Correction continuation after huge selling under most heated sentiment due to Modi's Govt oath taking ceremony on 26-05-2014 and whole day negative zone trading today as well as -0.56% closing today. As lower levels consolidations with higher bottom formation therefore expected that Nifty will not easily sustain below next supports 7248 but up moves in Bearish Rising Channel were also seen in last 2 hours therefore firstly next trend confirmations is also required. Both consolidation and Bearish patterns seen between 7275-7245 today therefore firstly follow up moves with sustaining beyond today trading range should be watched for next immediate trend confirmations.

As huge selling yesterday therefore equally good consolidation is also required for fresh up moves therefore trading patterns of coming 2/3 sessions should be firstly watched. Follow up consolidation and sustaining above 7248 should be firstly watched in the coming sessions because that will mean fresh rally beginning after correction completion.

Correction continuation and signals of consolidation process beginning today,let it complete then fresh rally will be seen and following supports should be firstly watched:-

1- Support between 7248-7287

2- Support between 7193-7229

3- Supports between 7082-7102

|

| Just click on chart for its enlarged view |

1- Consolidation between 7275-7310

2- Higher bottom formation

3- Up moves in Bearish Rising Channel

4- Whole day actual trading between 7275-7245

Conclusions from intra day chart analysis

Correction continuation after huge selling under most heated sentiment due to Modi's Govt oath taking ceremony on 26-05-2014 and whole day negative zone trading today as well as -0.56% closing today. As lower levels consolidations with higher bottom formation therefore expected that Nifty will not easily sustain below next supports 7248 but up moves in Bearish Rising Channel were also seen in last 2 hours therefore firstly next trend confirmations is also required. Both consolidation and Bearish patterns seen between 7275-7245 today therefore firstly follow up moves with sustaining beyond today trading range should be watched for next immediate trend confirmations.

As huge selling yesterday therefore equally good consolidation is also required for fresh up moves therefore trading patterns of coming 2/3 sessions should be firstly watched. Follow up consolidation and sustaining above 7248 should be firstly watched in the coming sessions because that will mean fresh rally beginning after correction completion.

Correction continuation and signals of consolidation process beginning today,let it complete then fresh rally will be seen and following supports should be firstly watched:-

1- Support between 7248-7287

2- Support between 7193-7229

3- Supports between 7082-7102

Pre-closing Outlook(27-05-2014)

As today intraday patterns are showing consolidations formations with higher bottom formation as well therefore expected that Nifty will not sustain below 1st supports range(7248-7287) and consolidate for fresh rally between 7248-7563.

Next trend first indication will be sustaining beyond 7248-7350 and should be firstly watched for confirmation.

Mid-session Outlook(27-05-2014)

As correction started after selling with huge volume on the back of most heated sentiment due to Modi's Govt oath taking yesterday therefore Short Term correction continuation between 10 sessions range(7082-7563). Nifty will be understood range bound within mentioned range and sustaining it beyond will be next big moves confirmation.

Detailed analysis with all crucial levels have already been updated in previous Outlook yesterday and at present correction continuation will be considered. Although generation of minor consolidation signals from today first 2 hours intraday chart formations but complete consolidation is required for decisive up moves,let it happen then will be updated accordingly.

Detailed analysis with all crucial levels have already been updated in previous Outlook yesterday and at present correction continuation will be considered. Although generation of minor consolidation signals from today first 2 hours intraday chart formations but complete consolidation is required for decisive up moves,let it happen then will be updated accordingly.

Technical Analysis and Market Outlook(27-05-2014)

Nifty-Intra Day Chart (26-May-2014):-

Technical Patterns and Formations in today intraday charts

1- First 5 hours selling between 7430-7504

2- Sharp fall

3- Whole day actual trading between 7270-7504

As most heated sentiment on Modi's Govt oath taking day therefore strong recovery after gap up opening but huge selling/profit booking on the back of encouraging news and resultant sharp fall after 5 hours selling.

Previous last resistances were as follows:-

1- Resistances between 7358-7432

2- Resistances between 7450-7563

As selling seen within above Resistance ranges therefore complete consolidation is required for decisive up moves above 7563. Next supports are as follows:-

1- Support between 7248-7287

2- Support between 7193-7229

3- Supports between 7082-7102

If higher levels good Resistances then lower levels equally strong supports also therefore Indian markets are not technically prepared for any side decisive moves. Expected that Nifty will remain sideways between 7082-7563 and prepare for next strong moves. Till now same view of sideways market as was updated on 19-05-2014 in following topic:-

|

| Just click on chart for its enlarged view |

1- First 5 hours selling between 7430-7504

2- Sharp fall

3- Whole day actual trading between 7270-7504

Conclusions from intra day chart analysis

As most heated sentiment on Modi's Govt oath taking day therefore strong recovery after gap up opening but huge selling/profit booking on the back of encouraging news and resultant sharp fall after 5 hours selling.

Previous last resistances were as follows:-

1- Resistances between 7358-7432

2- Resistances between 7450-7563

As selling seen within above Resistance ranges therefore complete consolidation is required for decisive up moves above 7563. Next supports are as follows:-

1- Support between 7248-7287

2- Support between 7193-7229

3- Supports between 7082-7102

If higher levels good Resistances then lower levels equally strong supports also therefore Indian markets are not technically prepared for any side decisive moves. Expected that Nifty will remain sideways between 7082-7563 and prepare for next strong moves. Till now same view of sideways market as was updated on 19-05-2014 in following topic:-

Mid-session Outlook(26-05-2014)

Following lines were told on 23-05-2014 in Pre-closing Outlook(23-05-2014)

1- rally continuation is expected in the coming week

2- but follow up consolidation is must because

3- following 2 last resistances are just above today highest:-

1- Resistances between 7358-7432

2- Resistances between 7450-7563

Most heated sentiment on Modi's Govt oath taking day and whole day trading within above mentioned Resistances but selling/profit booking also seen within mentioned resistance ranges.

1- rally continuation is expected in the coming week

2- but follow up consolidation is must because

3- following 2 last resistances are just above today highest:-

1- Resistances between 7358-7432

2- Resistances between 7450-7563

Most heated sentiment on Modi's Govt oath taking day and whole day trading within above mentioned Resistances but selling/profit booking also seen within mentioned resistance ranges.

All trends are up but very Short Term Trend will be understood sideways between 7300-7504 and finally sustaining beyond this range should be watched for next immediate trend confirmation.

Pre-closing Outlook(23-05-2014)

Although firstly some selling at higher levels but lower levels consolidation also between both previous resistances(7287-7320) today therefore rally continuation is expected in the coming week but follow up consolidation is must because following 2 last resistances are just above today highest:-

1- Resistances between 7358-7432

2- Resistances between 7450-7563

1- Resistances between 7358-7432

2- Resistances between 7450-7563

Mid-session Outlook(23-05-2014)

Following 2 resistance ranges were updated on 19-05-2014 in Sideways Market between 7082-7563:-

1- Selling between 7358-7432

2- Selling between 7450-7563

Indian markets sharply up immediately up immediately after opening and outperformed Global cues also. Nifty crossed both resistance ranges(7287and 7320) and tested above mentioned 1st resistance range but retraced also after high formation at 7365.35. As some selling also seen at higher levels today therefore view is cautious despite good recovery today.

1- Selling between 7358-7432

2- Selling between 7450-7563

Indian markets sharply up immediately up immediately after opening and outperformed Global cues also. Nifty crossed both resistance ranges(7287and 7320) and tested above mentioned 1st resistance range but retraced also after high formation at 7365.35. As some selling also seen at higher levels today therefore view is cautious despite good recovery today.

Live Proofs of our Accurate Predictions and Levels

Technical Analysis and Market Outlook

(23-05-2014)

Nifty-Intra Day Chart (22-May-2014):- |

| Just click on chart for its enlarged view |

1- Up moves with Bearish Rising Channel formation

2- Selling between 7293-7319

3- Down moves in Bullish Falling Channel

4- Consolidation between 7259-7274

5- Whole day actual trading between 7259-7319

Conclusions from intra day chart analysis

Sentiment turned Bullish yesterday morning because all the Global markets were strong therefore good recovery from lower levels after positive opening. As without required force up moves with Bearish Rising Channel formation therefore When Nifty was trading near the highest of the day at 7312 at 12:55 PM then we told following lines in Mid-session Outlook(22-05-2014):-

1- today up moves are without force and and showing Bearish Rising Channel formation

2- sustaining above 7287 is still required for next decisive up moves confirmations

Live Proofs of our Accurate Predictions

When Nifty was trading near higher levels of the day then we showed our doubts on further up moves and resultant Nifty slipped exactly from those levels and lost more than 50 points.

Following lines were told on 21-05-2014 in Technical Analysis and Market Outlook(22-05-2014):-

follow up moves with sustaining beyond following levels and crucial ranges will be firstly watched in the coming sessions:-

1- 7246-7287(For first indication)

2- 7194-7320(For next decisive moves)

3- 7082-7563(For next big moves)

Live Proof of our Accurate Levels

7320 was given for next decisive up moves on 21-05-2014 and Nifty retraced from 7319.55 yesterday.

Certainly sideways market and above mentioned ranges will next decisive trend confirmation therefore should be watched today and in the coming sessions.

Live Proofs of our Accurate Predictions

Pre-closing Outlook(22-05-2014)

When Nifty was trading near the highest of the day at 7312 at 12:55 PM then following lines were told in Mid-session Outlook(22-05-2014):-

1- today up moves are without force and and showing Bearish Rising Channel formation

2- sustaining above 7287 is still required for next decisive up moves confirmations

When Nifty was trading near higher levels of the day then we showed our doubts and resultant Nifty slipped exactly from those levels and now Nifty is trading at 7262 after loosing more than 50 points.

We told for sideways market in all the Outlooks of this week and Indian markets are sideways within our given range. Although we told many times repeating again that Indian market will prepare for next trend within side ways range and next trend deciding levels have been updated in following topic yesterday:-

Mid-session Outlook(22-05-2014)

As all the Global markets were strong therefore sentiment turned strong and recovery from lower levels after positive opening as well as trading above last 3 sessions highest(7287) for the last 2 hours. As today up moves are without force and and showing Bearish Rising Channel formation also therefore sustaining above 7287 is still required for next decisive up moves confirmations.

Technical Analysis and Market Outlook(22-05-2014)

Nifty-Intra Day Chart (May 19 to May 21,2014):-

Technical Patterns and Formations in last 3 Sessions intraday charts

1- Most time trading with Mixed Patterns between 7246-7287

2- Lower levels supports below 7246 and higher levels selling above 7287 in last 3 sessions.

2- 3 Sessions actual trading between 7194-7320

As sentiment turned most heated on Election results day therefore higher levels good selling and profit booking seen between 7358-7563 on 16-05-2014 therefore complete consolidation is required for next decisive up moves above 7563. As it was expected therefore following line was told on 19-05-2014 in Sideways Market between 7082-7563:-

Short Term correction seen and most time trading with mixed Patterns between 7246-7287 in last 3 sessions therefore sustaining beyond this range should be firstly watched for next trend first indication. Supports below 7246 and higher levels selling above 7287 in last 3 sessions therefore Nifty may trade between 7194-7320 amid volatility.

Although some indications of consolidation in last 2 sessions but not as much clear,follow up moves with sustaining beyond following levels and crucial ranges will be firstly watched in the coming sessions:-

1- 7246-7287(For first indication)

2- 7194-7320(For next decisive moves)

3- 7082-7563(For next big moves)

|

| Just click on chart for its enlarged view |

1- Most time trading with Mixed Patterns between 7246-7287

2- Lower levels supports below 7246 and higher levels selling above 7287 in last 3 sessions.

2- 3 Sessions actual trading between 7194-7320

Conclusions from 3 Sessions intra day chart analysis

As sentiment turned most heated on Election results day therefore higher levels good selling and profit booking seen between 7358-7563 on 16-05-2014 therefore complete consolidation is required for next decisive up moves above 7563. As it was expected therefore following line was told on 19-05-2014 in Sideways Market between 7082-7563:-

"oscillators are overbought and sentiment is over heated after Modi victory therefore Short Term correction possibility can not be ruled out"

Short Term correction seen and most time trading with mixed Patterns between 7246-7287 in last 3 sessions therefore sustaining beyond this range should be firstly watched for next trend first indication. Supports below 7246 and higher levels selling above 7287 in last 3 sessions therefore Nifty may trade between 7194-7320 amid volatility.

Although some indications of consolidation in last 2 sessions but not as much clear,follow up moves with sustaining beyond following levels and crucial ranges will be firstly watched in the coming sessions:-

1- 7246-7287(For first indication)

2- 7194-7320(For next decisive moves)

3- 7082-7563(For next big moves)

Mid-session Outlook-2(21-05-2014)

More than 12 hours trading between 7246-7287 with consolidation indications in this week and this range broken down but when Nifty was trading below 7246 then following guidance was posted in previous Outlook today:-

1- without required force therefore sustaining below 7246 is must

2- today intraday patterns are showing consolidation indications therefore up moves hopes are still alive after follow up consolidation in the coming sessions.

1- without required force therefore sustaining below 7246 is must

2- today intraday patterns are showing consolidation indications therefore up moves hopes are still alive after follow up consolidation in the coming sessions.

Now Nifty is trading above 7246 after more than 40 points recovery from lower levels and sustaining it beyond should be firstly watched now for next immediate trend confirmation.

Mid-session Outlook(21-05-2014)

First 3 hours trading between 7246-7287 and this range broen down but without required force therefore sustaining below 7246 is must for decisive down moves below 7246 and should be firstly watched now.

Although Nifty is trading below 7246 but today intraday patterns are showing consolidation indications al so therefore up moves hopes are still alive after follow up consolidation in the coming sessions.

Although Nifty is trading below 7246 but today intraday patterns are showing consolidation indications al so therefore up moves hopes are still alive after follow up consolidation in the coming sessions.

Live Proofs of our Accurate Levels

Post-open Outlook(21-05-2014)

Following conclusions with levels were told in all 3 Outlooks of last 2 sessions:-

Sustaining beyond 7246-7287 will be next big moves confirmation and sustaining beyond this range should be firstly watched for next trend first indication.

Nifty traded in first hour today exactly within our given levels:-

1st hour of today trading range is 7246-7287.15

Same conclusion that sustaining beyond 7246-7287 should be firstly watched for next trend first indication because most time trading within this range in last 2 sessions with mixed patterns formations.

Subscribe to:

Posts (Atom)