As Nifty traded most time between 6304-6319 with selling patterns formations on 27-12-2013 therefore slipped below this range within first half hour today and since then trading between 6290-6309 with intraday selling patterns formations and expected that Nifty will slip below today lowest as well.

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Trading "calls" from our "Software" with more than "90% accuracy"

Post-open Outlook(30-12-2013)

Following lines were told:-

1- In Pre-closing Outlook on 27-12-2013:- "Nifty will firstly slip below 6304 in next week"

2- In Firstly Down Moves towards Next Strong Supports on 29-12-2013:- "firstly slip below 6304/6289/6260/6130 and sustaining beyond 6130 will be watched to understand next trend"

1- In Pre-closing Outlook on 27-12-2013:- "Nifty will firstly slip below 6304 in next week"

2- In Firstly Down Moves towards Next Strong Supports on 29-12-2013:- "firstly slip below 6304/6289/6260/6130 and sustaining beyond 6130 will be watched to understand next trend"

Now Nifty is trading below 6304 and should be kept in mind that fast down moves are possible after valid breaking down of 6260 because that will be confirmation of last 4 sessions selling.

Firstly Down Moves towards Next Strong Supports

Technical Analysis,Research & Weekly Outlook

(Dec 30 to Jan 03,2014)

Nifty-EOD Chart (27-Dec-2013):- |

| Just click on chart for its enlarged view |

1- Bottom formation at 5118.85 on 28-08-2013 and Wave-1 beginning

2- Wave-1(6142.50 on 19-09-2013)

3- Wave-2(5700.95 on 01-10-2013)

4- Wave-i of Wave-3(6342.95 on 03-11-2013)

5- Wave-ii of Wave-3(5972.45 on 13-11-2013)

6- Wave-iii of Wave-3(6415.25 on 09-12-2013)

7- Wave-iv of Wave-3(6129.95 on 18-12-2013)

8- Wave-v of Wave-3 continuation with recent top formation at 6324.90 on 27-12-2013.

Conclusions from EOD chart analysis

All Trends were up and Wave-3 continuation towards minimum target of Nifty at 6724.60. Its calculation has already been updated in following topic on 21-10-2013:-

It must be kept in mind that it is price vice target and not time vice therefore market will take its own time to achieve it.

Nifty-Intra Day Chart (Dec 09 to Dec 27,2013):-

|

| Just click on chart for its enlarged view |

1- Strong support range 6130-6180

2- Resistance between 6360-6387

3- Resistance between 6330-6355

4- Sideways trading between 6260-6324 within only 64 points with higher levels selling in previous week.

5- 14 Sessions actual trading between 6130-6415

Conclusions from 14 Sessions intra day chart analysis

Multiple resistances between 6330-6387 and just below it previous week sideways trading with higher levels selling therefore emergence of down moves possibility.

Nifty-Intra Day Chart (Dec 23 to Dec 27,2013):-

|

| Just click on chart for its enlarged view |

1- Daily higher levels selling in all 4 trading sessions of previous week.

3- 4 Sessions actual trading between 6260-6324

Conclusions from 4 Sessions intra day chart analysis

Previous whole week sideways trading within only 64 points therefore sustaining beyond this range will give big moves. As most time selling patterns seen in last 4 sessions therefore finally down moves are expected in the coming week despite previous week closing near weekly highest levels.

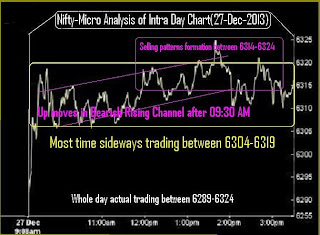

Nifty-Intra Day Chart (27-Dec-2013):-

|

| Just click on chart for its enlarged view |

1- Up moves in Bearish Rising Channel after 09:30 AM.

2- Most time sideways trading between 6304-6319.

3- Selling patterns formation between 6314-6324.

4- Whole day actual trading between 6289-6324.

Conclusions from intra day chart analysis

Most time sideways trading between 6304-6319 with Bearish Rising Channel and higher levels selling patterns formation therefore down moves below 6304 are expected in next week.

Conclusions (After Putting All Indicators Together)

Impulsive Wave-v of impulsive Wave-3 is on with closing near the weekly highest last Friday but most time selling patterns seen in all last 4 sessions of previous week therefore firstly down moves are expected in next week. As strong supports above 6130 also developed in last 14 sessions therefore Nifty will not easily slip below it.

Expected that finally Nifty will sustain above 6415 and move towards minimum 6724.60 but firstly slip below 6304/6289/6260/6130 and sustaining beyond 6130 will be watched to understand next trend but high possibility of up trend beginning after fresh consolidations near about 6130.

As Indian markets are in Bullish phase therefore expected that Nifty will remain range bound in broader range of last 14 sessions 6130-6415 and prepare for next big trend in the coming weeks.

Pre-closing Outlook(27-12-2013)

Following conclusions from today charts were told in both previous Outlooks:-

1- up moves since 09:30 AM are in Bearish Rising Channel therefore next rally confirmation is must through sustaining above 6319

2- Next moves confirmations through sustaing beyond 6304-6319 was told

Although Nifty moves above 6319 but could not sustain and slipped and now trading within mentioned range at 6312 after high formation at 6324.90 because Bearish Rising Channel and expected that Nifty will firstly slip below 6304 in next week.

1- up moves since 09:30 AM are in Bearish Rising Channel therefore next rally confirmation is must through sustaining above 6319

2- Next moves confirmations through sustaing beyond 6304-6319 was told

Although Nifty moves above 6319 but could not sustain and slipped and now trading within mentioned range at 6312 after high formation at 6324.90 because Bearish Rising Channel and expected that Nifty will firstly slip below 6304 in next week.

Mid-session Outlook-2(27-12-2013)

Although strong market today but up moves since 09:30 AM are in Bearish Rising Channel therefore next rally confirmation is must through sustaining above 6319.

Mid-session Outlook(27-12-2013)

As selling yesterday and consolidation was must for decisive up moves therefore sideways trading between 6304-6319 after strong break out of last 3 sessions range. Sustaing beyond this range will be confirmation of:-

1- Valid break out of last 3 sessions range above 6319 and resultant strong rally in next week.

2- False break out of last 3 sessions range below 6304 and resultant firstly down moves and deeper correction confirmation will be below 6260.

1- Valid break out of last 3 sessions range above 6319 and resultant strong rally in next week.

2- False break out of last 3 sessions range below 6304 and resultant firstly down moves and deeper correction confirmation will be below 6260.

Post-open Outlook(27-12-2013)

Forceful break out of last 3 sessions range does mean high possibility of rally continuation after 3 sessions sideways correction completion and confirmation will be after sustaining above 6302 and should be firstly watched today.

Technical Analysis and Market Outlook(27-12-2013)

Nifty-Intra Day Chart (26-Dec-2013):-

Technical Patterns and Formations in today intraday charts

1- High volatility

2- First 2 hours trading with with Bearish Rising Channel.

3- Selling between 6284-6292

4- Whole day trading between 6260-6302

First 2 hours trading with with Bearish Rising Channel and selling patterns formations also between 6284-6292 therefore following lines were told in Mid-session Outlook at 01:01 PM today:-

1- now trading also near the highest levels of today but some indications of selling today

2- next up moves confirmations will be after valid break out above 6292.

As selling therefore Nifty could not sustain above 6292 and closed below it at 6,278.90. Until Nifty will not sustain above 6292 till then next up move will not be considered and valid break out of today trading range(6260-6302) should also be firstly watched for next immediate moves confirmations because technical positions reversed also in today like highly volatile markets.

|

| Just click on chart for its enlarged view |

1- High volatility

2- First 2 hours trading with with Bearish Rising Channel.

3- Selling between 6284-6292

4- Whole day trading between 6260-6302

Conclusions from intra day chart analysis

First 2 hours trading with with Bearish Rising Channel and selling patterns formations also between 6284-6292 therefore following lines were told in Mid-session Outlook at 01:01 PM today:-

1- now trading also near the highest levels of today but some indications of selling today

2- next up moves confirmations will be after valid break out above 6292.

As selling therefore Nifty could not sustain above 6292 and closed below it at 6,278.90. Until Nifty will not sustain above 6292 till then next up move will not be considered and valid break out of today trading range(6260-6302) should also be firstly watched for next immediate moves confirmations because technical positions reversed also in today like highly volatile markets.

Pre-closing Outlook(26-12-2013)

As selling at higher levels today therefore Nifty did not sustaining at higher levels and slipped but high volatility today and until Nifty will not sustaining above 6292 till then next up move will not be considered because selling seen just below it today and selling was updated also in previous Outlook at 01:01 PM today.

Mid-session Outlook(26-12-2013)

Positive zone trading since opening and now trading also near the highest levels of today but some indications of selling today therefore next up moves confirmations will be after valid break out above 6292.

Technical Analysis and Market Outlook(26-12-2013)

Nifty-Intra Day Chart (24-Dec-2013):-

Technical Patterns and Formations in today intraday charts

1- More than 4 hours trading between 6281-6301.

2- Down moves in Bullish Falling Channel.

3- Whole day actual trading between 6262-6301.

Whole day range bound trading between 39 points with firstly more than 4 hours trading between 6281-6301 and without as such selling patterns formations despite afterward down moves and closing near the lowest levels of the day. As down moves in Bullish Falling Channel and first 4 hours trading is also not showing as such intraday selling patterns therefore generation of consolidation signals also in a negaive zone closing day.

Indian markets are not prepared for any side decisive moves and will have to prepare for next trend between 6230-6380 in the coming sessions for next huge moves. Let market prepare for next trend then will be updated according to the confirmations from the intraday charts formations and for confirmations sustaining beyond following ranges should be watched:-

1- 6230-6380(For first strong indications of next trend)

2- 6130-6380(For the confirmations of next trend)

|

| Just click on chart for its enlarged view |

1- More than 4 hours trading between 6281-6301.

2- Down moves in Bullish Falling Channel.

3- Whole day actual trading between 6262-6301.

Conclusions from intra day chart analysis

Whole day range bound trading between 39 points with firstly more than 4 hours trading between 6281-6301 and without as such selling patterns formations despite afterward down moves and closing near the lowest levels of the day. As down moves in Bullish Falling Channel and first 4 hours trading is also not showing as such intraday selling patterns therefore generation of consolidation signals also in a negaive zone closing day.

Indian markets are not prepared for any side decisive moves and will have to prepare for next trend between 6230-6380 in the coming sessions for next huge moves. Let market prepare for next trend then will be updated according to the confirmations from the intraday charts formations and for confirmations sustaining beyond following ranges should be watched:-

1- 6230-6380(For first strong indications of next trend)

2- 6130-6380(For the confirmations of next trend)

Mid-session Outlook(24-12-2013)

Following lines were told yesterday in Technical Analysis and Market Outlook(24-12-2013):-

1- Indian markets are not prepared for any side decisive moves and

2- will firstly prepared for next trend between 6230-6380 in the coming sessions for next huge moves.

As was told same happened and markets traded and preparing for next decisive moves within mentioned range since opening today. Although Nifty slipped from higher levels but not showing as such selling patterns and is a signal of consolidation as well. Now sustaining beyond following ranges should be watched:-

1- 6230-6380(For first strong indications of next trend)

2- 6130-6380(For the confirmations of next trend)

1- Indian markets are not prepared for any side decisive moves and

2- will firstly prepared for next trend between 6230-6380 in the coming sessions for next huge moves.

As was told same happened and markets traded and preparing for next decisive moves within mentioned range since opening today. Although Nifty slipped from higher levels but not showing as such selling patterns and is a signal of consolidation as well. Now sustaining beyond following ranges should be watched:-

1- 6230-6380(For first strong indications of next trend)

2- 6130-6380(For the confirmations of next trend)

Technical Analysis and Market Outlook(24-12-2013)

Nifty-Intra Day Chart (23-Dec-2013):-

Technical Patterns and Formations in today intraday charts

1- Selling between 6267-6315

2- Sharp down moves in last hour.

3- Whole day actual trading between 6272-6315

Although intraday correction through sharp down moves in last hour but its possibility was updated well before its happening and following line was told at 11:56 AM in Mid-session Outlook:-

Next strong resistances are between 6350-6380 and follow up selling seen below this range between 6267-6315 today but impulsive Wave-3 continuation and all trends are up as well as market is not prepared for deeper correction because only one day today selling after good consolidations in previous week.

As complete selling is also required for any big correction and more consolidation is also required for sustaining above 6315 and 6380 therefore Indian markets are not prepared for any side decisive moves and will firstly prepared for next trend between 6230-6380 in the coming sessions for next huge moves.

Expected that finally Nifty will sustain above 6380 and decisive strong rally will be seen after follow up consolidations in the coming sessions/week. Let market prepare then will be updated according to the completion of intraday charts formations in the same manner as being done for the last more than 4 years.

|

| Just click on chart for its enlarged view |

1- Selling between 6267-6315

2- Sharp down moves in last hour.

3- Whole day actual trading between 6272-6315

Conclusions from intra day chart analysis

Although intraday correction through sharp down moves in last hour but its possibility was updated well before its happening and following line was told at 11:56 AM in Mid-session Outlook:-

some indications of profit booking today therefore emergence of minor intraday correction possibility

Next strong resistances are between 6350-6380 and follow up selling seen below this range between 6267-6315 today but impulsive Wave-3 continuation and all trends are up as well as market is not prepared for deeper correction because only one day today selling after good consolidations in previous week.

As complete selling is also required for any big correction and more consolidation is also required for sustaining above 6315 and 6380 therefore Indian markets are not prepared for any side decisive moves and will firstly prepared for next trend between 6230-6380 in the coming sessions for next huge moves.

Expected that finally Nifty will sustain above 6380 and decisive strong rally will be seen after follow up consolidations in the coming sessions/week. Let market prepare then will be updated according to the completion of intraday charts formations in the same manner as being done for the last more than 4 years.

Mid-session Outlook-3(23-12-2013)

Following lines were told at 11:56 AM in Mid-session Outlook:-

1- More than 2 hours positive zone trading between 6288-6310

2- some indications of profit booking today therefore emergence of minor intraday correction possibility

As some indications of profit booking today therefore Nifty slipped below 6288 and if sustains below it only then very Short Term correction will be considered.

1- More than 2 hours positive zone trading between 6288-6310

2- some indications of profit booking today therefore emergence of minor intraday correction possibility

As some indications of profit booking today therefore Nifty slipped below 6288 and if sustains below it only then very Short Term correction will be considered.

Mid-session Outlook-2(23-12-2013)

Quiet range bound market between 6288-6310 since opening and preparing for next blast today because next strong resistances are between 6350-6380 and market require complete consolidations for decisive and strong rally above 6380 as well as complete selling is also required for any big correction. Let market prepare then will be updated according to the completion of intraday charts formations and valid break out of 6288-6310 will be very Short Term trend first signal therefore should be firstly watched now.

Mid-session Outlook(23-12-2013)

More than 2 hours positive zone trading between 6288-6310 with some indications of profit booking today therefore emergence of minor intraday correction possibility and valid break out of this range will be very Short Term trend first signal.

Rally continuation towards 6724.60

Technical Analysis,Research & Weekly Outlook

(Dec 23 to Dec 27,2013)

Nifty-EOD Chart (20-Dec-2013):- |

| Just click on chart for its enlarged view |

1- Rally beginning after 13 Months Wave-2 correction completion at 4531.15 on 20-12-2011.

2- Wave-1(5629.95 on 22-02-2012)

3- Wave-2(4770.35 on 04-06-2012)

4- Wave-3(6111.80 on 29-01-2013)

5- Wave-4(5477.20 on 10-04-2012)

6- Wave-5(6229.45 on 20-05-2013)('ABC'Correction beginning after 17 Months Rally completion)

7- Wave-A(5566.25 on 24-06-2013)

8- Wave-B(6093.35 on 23-07-2013)

9- Wave-C(5118.85 on 28-08-2013)('ABC'Correction completion after 3 Months correction completion)

10- Strong Rally continuation and new all time high formation at 6415.25 on 09-12-2013.

Conclusions from EOD chart analysis

Strong Rally is on after ABC'Correction completion on 28-08-2013,Waves structure of this rally with following conclusions has already been updated 15-12-2013 in "Nifty at Most Crucial and Strong Support Range";-

1- 6141-6156 has become most crucial strong support range and consolidation pattern formation just above it on 13-12-2013

2- emergence of correction completion possibility near about mentioned range

As was told on 15-12-2013 all that proved 100% accurate in previous week and Nifty reversed from 6129.95 after getting support just below 6141 and weekly closing was at the highest of the week after correction completion.

Nifty-EOD Chart (20-Dec-2013):-

|

| Just click on chart for its enlarged view |

1- Bottom formation at 5118.85 on 28-08-2013 and Wave-1 beginning

2- Wave-1(6142.50 on 19-09-2013)

3- Wave-2(5700.95 on 01-10-2013)

4- Wave-i of Wave-3(6342.95 on 03-11-2013)

5- Wave-ii of Wave-3(5972.45 on 13-11-2013)

6- Wave-iii of Wave-3(6415.25 on 09-12-2013)

7- Wave-iv of Wave-3(6129.95 on 18-12-2013)

8- Wave-v of Wave-3 continuation with recent top formation at 6274.25 on 20-12-2013.

Conclusions from EOD chart analysis

Long and Intermediate Term Trends were up and Short Term turned up after correction completion confirmation on 20-12-2013. Now all trends are up and Wave-3 continuation towards minimum target of Nifty at 6724.60. Its calculation has already been updated in following topic on 21-10-2013:-

Conclusions (After Putting All Indicators Together)

Strong rally last Friday after good consolidation above 6130 in previous week therefore until complete selling will not happen till then Nifty will not slip below 6130.As no selling seen at higher levels in previous week therefore no risk of immediate down moves but some resistances up to all time high(6415.25) therefore follow up consolidation is required in next week for sustaining above it.

Rally continuation towards 6724.60 is expected in the coming weeks after follow up consolidations.

Pre-closing Outlook(20-12-2013)

Although Nifty closed at the lowest of the day after loosing 50 points but we were Bullish and posted following topic yesterday:-

As was told 100% same happened and Nifty is now trading 115 points up. and rally continuation is expected in the coming sessions after follow up consolidations because some resistances are higher levels.

As was told 100% same happened and Nifty is now trading 115 points up. and rally continuation is expected in the coming sessions after follow up consolidations because some resistances are higher levels.

Mid-session Outlook-2(20-12-2013)

Good up moves after lower levels supports and consolidation patterns formations but some resistances also seen between 6227-6236 therefore firstly sustaining beyond this range should be watched for next immediate moves confirmations. Now Nifty is trading at 6226.

Mid-session Outlook(20-12-2013)

Sideways trading since opening with lower levels supports and consolidation patterns formations.

Post-open Outlook(20-12-2013)

Positive zone trading since opening today,sustaining above 6203 will be first strong signal of rally after Correction Completion and sustaining beyond 6141-6270 should be firstly for next trend confirmations.

Subscribe to:

Comments (Atom)