Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Trading "calls" from our "Software" with more than "90% accuracy"

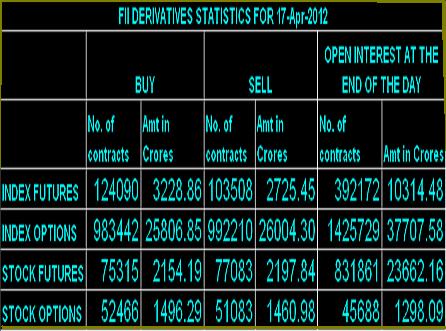

FII & DII trading activity in Capital Market Segment on 17-Apr-2012

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(17-Apr-2012)

Main features of today trading are as follows

1- Green closing.

2- White Candle.

3- Closing near Day's highs after highly volatile market.

Ratios

Nifty Put Call Ratio:1.03

Nifty P/E Ratio(17-Apr-2012):18.63

Advances & Declines

BSE Advances : 1662

BSE Declines : 1178

NSE Advances : 860

NSE Declines : 565

Nifty Open Interest Changed Today

Nifty- 5200 CE(Apr)- +5000(+0.15%)

Nifty- 5200 PE(Apr)- +888650(+14.01%)

Nifty- 5300 CE(Apr)- +16750(+0.34%)

Nifty- 5300 PE(Apr)- +993250(+29.33%)

Nifty- 5400 CE(Apr)- +343450(+4.60%)

Nifty- 5400 PE(Apr)- +376900(+22.75%)

Closing

Nifty- closed at 5,289.70(+63.50 Points & +1.22%)

Sensex- closed at 17,357.94(+206.99 Points & +1.21% )

CNX Midcap - closed at 7,672.00(+67.60 Points & +0.89%)

BSE Smallcap- closed at 6,880.36(+43.10 Points & +0.63%)

1- Green closing.

2- White Candle.

3- Closing near Day's highs after highly volatile market.

Ratios

Nifty Put Call Ratio:1.03

Nifty P/E Ratio(17-Apr-2012):18.63

Advances & Declines

BSE Advances : 1662

BSE Declines : 1178

NSE Advances : 860

NSE Declines : 565

Nifty Open Interest Changed Today

Nifty- 5200 CE(Apr)- +5000(+0.15%)

Nifty- 5200 PE(Apr)- +888650(+14.01%)

Nifty- 5300 CE(Apr)- +16750(+0.34%)

Nifty- 5300 PE(Apr)- +993250(+29.33%)

Nifty- 5400 CE(Apr)- +343450(+4.60%)

Nifty- 5400 PE(Apr)- +376900(+22.75%)

Closing

Nifty- closed at 5,289.70(+63.50 Points & +1.22%)

Sensex- closed at 17,357.94(+206.99 Points & +1.21% )

CNX Midcap - closed at 7,672.00(+67.60 Points & +0.89%)

BSE Smallcap- closed at 6,880.36(+43.10 Points & +0.63%)

Nifty Spot-Levels & Trading Strategy for 18-04-2012

Nifty Spot-Levels

R3 5412

R2 5355

R1 5322

Avg 5265

S1 5232

S2 5175

S3 5142

Nifty Spot-Trading Strategy

H6 5380 Trgt 2

H5 5359 Trgt 1

H4 5338 Long breakout

H3 5313 Go Short

H2 5305

H1 5297

L1 5280

L2 5272

L3 5264 Long

L4 5239 Short Breakout

L5 5218 Trgt 1

L6 5197 Trgt 2

R3 5412

R2 5355

R1 5322

Avg 5265

S1 5232

S2 5175

S3 5142

Nifty Spot-Trading Strategy

H6 5380 Trgt 2

H5 5359 Trgt 1

H4 5338 Long breakout

H3 5313 Go Short

H2 5305

H1 5297

L1 5280

L2 5272

L3 5264 Long

L4 5239 Short Breakout

L5 5218 Trgt 1

L6 5197 Trgt 2

Nifty(Apr Fut)-Levels & Trading Strategy for 18-04-2012

Nifty(Apr Fut)-Levels

R3 5459

R2 5392

R1 5355

Avg 5288

S1 5251

S2 5184

S3 5147

Nifty(Apr Fut)-Trading Strategy

H6 5424 Trgt 2

H5 5400 Trgt 1

H4 5376 Long breakout

H3 5347 Go Short

H2 5338

H1 5328

L1 5309

L2 5299

L3 5290 Long

L4 5261 Short Breakout

L5 5237 Trgt 1

L6 5213 Trgt 2

R3 5459

R2 5392

R1 5355

Avg 5288

S1 5251

S2 5184

S3 5147

Nifty(Apr Fut)-Trading Strategy

H6 5424 Trgt 2

H5 5400 Trgt 1

H4 5376 Long breakout

H3 5347 Go Short

H2 5338

H1 5328

L1 5309

L2 5299

L3 5290 Long

L4 5261 Short Breakout

L5 5237 Trgt 1

L6 5213 Trgt 2

Nifty(Apr Fut)-Levels & Trading Strategy for 18-04-2012

Nifty(Apr Fut)-Levels

R3 5459

R2 5392

R1 5355

Avg 5288

S1 5251

S2 5184

S3 5147

Nifty(Apr Fut)-Trading Strategy

H6 5424 Trgt 2

H5 5400 Trgt 1

H4 5376 Long breakout

H3 5347 Go Short

H2 5338

H1 5328

L1 5309

L2 5299

L3 5290 Long

L4 5261 Short Breakout

L5 5237 Trgt 1

L6 5213 Trgt 2

R3 5459

R2 5392

R1 5355

Avg 5288

S1 5251

S2 5184

S3 5147

Nifty(Apr Fut)-Trading Strategy

H6 5424 Trgt 2

H5 5400 Trgt 1

H4 5376 Long breakout

H3 5347 Go Short

H2 5338

H1 5328

L1 5309

L2 5299

L3 5290 Long

L4 5261 Short Breakout

L5 5237 Trgt 1

L6 5213 Trgt 2

Bank Nifty(Apr Fut)-Levels & Trading Strategy for 18-04-2012

Bank Nifty(Apr Fut)-Levels

R3 11137

R2 10897

R1 10735

Avg 10495

S1 10333

S2 10093

S3 9931

Bank Nifty(Apr Fut)-Trading Strategy

H6 10987 Trgt 2

H5 10890 Trgt 1

H4 10794 Long breakout

H3 10683 Go Short

H2 10646

H1 10609

L1 10536

L2 10499

L3 10462 Long

L4 10351 Short Breakout

L5 10255 Trgt 1

L6 10158 Trgt 2

R3 11137

R2 10897

R1 10735

Avg 10495

S1 10333

S2 10093

S3 9931

Bank Nifty(Apr Fut)-Trading Strategy

H6 10987 Trgt 2

H5 10890 Trgt 1

H4 10794 Long breakout

H3 10683 Go Short

H2 10646

H1 10609

L1 10536

L2 10499

L3 10462 Long

L4 10351 Short Breakout

L5 10255 Trgt 1

L6 10158 Trgt 2

Pre-Closing Outlook(17-04-2012)

Firstly high volatility after 50 basis points Repo Rates cut by RBI and lower levels supports as well as higher bottom formation also with closing near day's higher levels today are strong indications of rally after correction completion.

Following lines were told yesterday in Market capped between 5175-5305:-

1- Free Trading zone between 5231-5275 and expected that Nifty will firstly trade and prepare for next moves within this range,break out of this range will be first indication

2- sustaining beyond 5175-5305 will be next decisive trend confirmation.

3- strong multiple resistances at higher levels also therefore equally complete consolidation is required to sustaining above next Resistance(5275-5305) and until Nifty will not sustain above 5305 till then any decisive up move will not be considered

4-Nifty will trade next 2/3 sessions between 5175-5305 and prepare.

All above 4 projections of yesterday proved accurate today. Good support and strong moves today but rally beginning confirmations are must after correction completion through sustaining above minimum above 1st Resistance and that is at 5305.

Following lines were told yesterday in Market capped between 5175-5305:-

1- Free Trading zone between 5231-5275 and expected that Nifty will firstly trade and prepare for next moves within this range,break out of this range will be first indication

2- sustaining beyond 5175-5305 will be next decisive trend confirmation.

3- strong multiple resistances at higher levels also therefore equally complete consolidation is required to sustaining above next Resistance(5275-5305) and until Nifty will not sustain above 5305 till then any decisive up move will not be considered

4-Nifty will trade next 2/3 sessions between 5175-5305 and prepare.

All above 4 projections of yesterday proved accurate today. Good support and strong moves today but rally beginning confirmations are must after correction completion through sustaining above minimum above 1st Resistance and that is at 5305.

Mid-session Outlook-2(17-04-2012)

Firstly lower levels support before Credit Policy today and after that again higher bottom formation and support therefore first signal of upmoves but sustaining above 5265 should also be watched for strong indication.

Mid-session Outlook(17-04-2012)

Market shoot up after RBI announcement of 50 basis points Repo Rates cut but could not cross Selling range of 13-04-20129(Resistance between 5275-5305). Following lines were told yesterday in Market capped between 5175-5305:-

"multiple resistances at higher levels also therefore equally complete consolidation is required to sustaining above next Resistance(5275-5305) and until Nifty will not sustain above 5305 till then any decisive up move will not be considered"

Market is not prepared for any side decisive moves therefore following topic was posted yesterdaY:-

Market capped between 5175-5305

Detailed analysis have already been updated in above topic yesterday therefore just click above topic link and go through.

"multiple resistances at higher levels also therefore equally complete consolidation is required to sustaining above next Resistance(5275-5305) and until Nifty will not sustain above 5305 till then any decisive up move will not be considered"

Market is not prepared for any side decisive moves therefore following topic was posted yesterdaY:-

Market capped between 5175-5305

Detailed analysis have already been updated in above topic yesterday therefore just click above topic link and go through.

Pre-open Outlook(17-04-2012)

Sentiment is depressed today morning because most Asian markets are trading in Red.

RBI Credit Policy at 11:00AM today and volatility immediately before and after its announcement may be seen. As RBI expressed worries on inflation in Micro Economic Review yesterday evening therefore cofusion on rates cut increased and SGX Nifty is more than 40 points today morning.

Market is capped between 5175-5305 today and follow up moves before and after Credit Policy will decide next market as well as break out of this range will be next moves confirmations.

Detailed analysis has already been updated yesterday in following topic:-

Market capped between 5175-5305

RBI Credit Policy at 11:00AM today and volatility immediately before and after its announcement may be seen. As RBI expressed worries on inflation in Micro Economic Review yesterday evening therefore cofusion on rates cut increased and SGX Nifty is more than 40 points today morning.

Market is capped between 5175-5305 today and follow up moves before and after Credit Policy will decide next market as well as break out of this range will be next moves confirmations.

Detailed analysis has already been updated yesterday in following topic:-

Market capped between 5175-5305

Market capped between 5175-5305

Nifty-Micro Analysis of 2 days Intra Day Chart

(Apr 13 & Apr 16,2012)

Nifty-Intra Day Chart (Apr 13 & Apr 16,2012):-

|

| Just click on chart for its enlarged view |

1- Selling and Resistance between 5275-5305 on 13-04-2012

2- Mixed Patterns between 5200-5236 after Panic Bottom on 13-04-2012

3- Support and Consolidation between 5190-5205 on 16-04-2012

4- Mixed Patterns between 5217-5231 on 16-04-2012

5- Free Trading zone between 5231-5275

Conclusions from 2 days intra day chart analysis

Strong old support range of 5175-5236 was told many times in last one week and Nifty traded whole day today between this range within 5183.50-5233.50 with lower levels supports and intraday consolidation patterns. Certainly mentioned old support range has strengthened today but strong multiple resistances at higher levels also therefore equally complete consolidation is required to sustaining above next Resistance(5275-5305) and until Nifty will not sustain above 5305 till then any decisive up move will not be considered. As strong supports are lying between 5175-5236 therefore more selling is also equally required to sustain below.

Free Trading zone between 5231-5275 and expected that Nifty will firstly trade and prepare for next moves within this range,break out of this range will be first indication and sustaining beyond 5175-5305 will be next decisive trend confirmation. If any big news will not be visible then expected that Nifty will trade next 2/3 sessions between 5175-5305 and prepare.

Detailed Technical analysis have been posted with EOD and Intraday charts in following topics in last 3 days. Just click Topic Link below and understand Indian markets:-

1- Last corrective Wave before Strong Bullish Rally

2- Strong Rally Confirmations from Long Term Charts

3- Crucial Supports and Resistances of 36 sessions Correction

4- Lower Tops and Lower Bottoms Formation In On Going Correction

5- Correction is on & Firstly Watch Next Supports

6- Next Monday Asian markets reaction on Western Markets Bloodshed

7- Panic bottom formation on 13-04-2012

8- Market capped between Supports and Resistances

FII & DII trading activity in Capital Market Segment on 16-Apr-2012

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(16-Apr-2012)

Main features of today trading are as follows

1- Benchmark Indices closed in Green.

2- White Candle.

3- Closing near the higher levels of the day.

Ratios

Nifty Put Call Ratio:0.92

Nifty P/E Ratio(16-Apr-2012):18.41

Advances & Declines

BSE Advances : 1554

BSE Declines : 1258

NSE Advances : 811

NSE Declines : 620

Nifty Open Interest Changed Today

Nifty- 5100 CE(Apr)- -268550(-25.41%)

Nifty- 5100 PE(Apr)- +81050(+1.35%)

Nifty- 5200 CE(Apr)- +260100(+8.47%)

Nifty- 5200 PE(Apr)- -97850(-1.52%)

Nifty- 5300 CE(Apr)- +495700(+10.70%)

Nifty- 5300 PE(Apr)- +110100(+3.35%)

Closing

Nifty- closed at 5,226.20(+18.75 Points & +0.36%)

Sensex- closed at 17,150.95(+56.44 Points & +0.33% )

CNX Midcap - closed at 7,604.40(+24.80 Points & +0.33%)

BSE Smallcap- closed at 6,837.26(+38.03 Points & +0.56%)

1- Benchmark Indices closed in Green.

2- White Candle.

3- Closing near the higher levels of the day.

Ratios

Nifty Put Call Ratio:0.92

Nifty P/E Ratio(16-Apr-2012):18.41

Advances & Declines

BSE Advances : 1554

BSE Declines : 1258

NSE Advances : 811

NSE Declines : 620

Nifty Open Interest Changed Today

Nifty- 5100 CE(Apr)- -268550(-25.41%)

Nifty- 5100 PE(Apr)- +81050(+1.35%)

Nifty- 5200 CE(Apr)- +260100(+8.47%)

Nifty- 5200 PE(Apr)- -97850(-1.52%)

Nifty- 5300 CE(Apr)- +495700(+10.70%)

Nifty- 5300 PE(Apr)- +110100(+3.35%)

Closing

Nifty- closed at 5,226.20(+18.75 Points & +0.36%)

Sensex- closed at 17,150.95(+56.44 Points & +0.33% )

CNX Midcap - closed at 7,604.40(+24.80 Points & +0.33%)

BSE Smallcap- closed at 6,837.26(+38.03 Points & +0.56%)

Nifty Spot-Levels & Trading Strategy for 17-04-2012

Nifty Spot-Levels

R3 5295

R2 5264

R1 5245

Avg 5214

S1 5195

S2 5164

S3 5145

Nifty Spot-Trading Strategy

H6 5276 Trgt 2

H5 5264 Trgt 1

H4 5253 Long breakout

H3 5239 Go Short

H2 5235

H1 5230

L1 5221

L2 5216

L3 5212 Long

L4 5198 Short Breakout

L5 5187 Trgt 1

L6 5175 Trgt 2

R3 5295

R2 5264

R1 5245

Avg 5214

S1 5195

S2 5164

S3 5145

Nifty Spot-Trading Strategy

H6 5276 Trgt 2

H5 5264 Trgt 1

H4 5253 Long breakout

H3 5239 Go Short

H2 5235

H1 5230

L1 5221

L2 5216

L3 5212 Long

L4 5198 Short Breakout

L5 5187 Trgt 1

L6 5175 Trgt 2

Nifty(Apr Fut)-Levels & Trading Strategy for 17-04-2012

Nifty(Apr Fut)-Levels

R3 5351

R2 5304

R1 5276

Avg 5229

S1 5201

S2 5154

S3 5126

Nifty(Apr Fut)-Trading Strategy

H6 5323 Trgt 2

H5 5306 Trgt 1

H4 5289 Long breakout

H3 5268 Go Short

H2 5261

H1 5254

L1 5241

L2 5234

L3 5227 Long

L4 5206 Short Breakout

L5 5189 Trgt 1

L6 5172 Trgt 2

R3 5351

R2 5304

R1 5276

Avg 5229

S1 5201

S2 5154

S3 5126

Nifty(Apr Fut)-Trading Strategy

H6 5323 Trgt 2

H5 5306 Trgt 1

H4 5289 Long breakout

H3 5268 Go Short

H2 5261

H1 5254

L1 5241

L2 5234

L3 5227 Long

L4 5206 Short Breakout

L5 5189 Trgt 1

L6 5172 Trgt 2

Bank Nifty(Apr Fut)-Levels & Trading Strategy for 17-04-2012

Bank Nifty(Apr Fut)-Levels

R3 10824

R2 10662

R1 10574

Avg 10412

S1 10324

S2 10162

S3 10074

Bank Nifty(Apr Fut)-Trading Strategy

H6 10742 Trgt 2

H5 10683 Trgt 1

H4 10624 Long breakout

H3 10555 Go Short

H2 10532

H1 10509

L1 10464

L2 10441

L3 10418 Long

L4 10349 Short Breakout

L5 10290 Trgt 1

L6 10231 Trgt 2

R3 10824

R2 10662

R1 10574

Avg 10412

S1 10324

S2 10162

S3 10074

Bank Nifty(Apr Fut)-Trading Strategy

H6 10742 Trgt 2

H5 10683 Trgt 1

H4 10624 Long breakout

H3 10555 Go Short

H2 10532

H1 10509

L1 10464

L2 10441

L3 10418 Long

L4 10349 Short Breakout

L5 10290 Trgt 1

L6 10231 Trgt 2

Pre-Closing Outlook(16-04-2012)

Whole day trading today between crucial and strong support range(5175-5236) with lower levels supports and intraday consolidation patterns.

RBI Credit Policy led moves market will be seen tomorrow and sustaining beyond above mentioned range will be next decisive trend confirmation therefore should be firstly watched.

RBI Credit Policy led moves market will be seen tomorrow and sustaining beyond above mentioned range will be next decisive trend confirmation therefore should be firstly watched.

Mid-session Outlook(16-04-2012)

Following strong support range has been posted more than 5 times in last 7 sessions Outlooks;-

5175-5236

Nifty is trading between this range since opening today and firstly sustaining beyond this range should be watched.

Possibilities of next moves beyond this range has already been updated in 8 Outlooks which have been posted in last 3 days.

Now volatility within this range is suggesting to adopt Cautious approach.

5175-5236

Nifty is trading between this range since opening today and firstly sustaining beyond this range should be watched.

Possibilities of next moves beyond this range has already been updated in 8 Outlooks which have been posted in last 3 days.

Now volatility within this range is suggesting to adopt Cautious approach.

Last corrective Wave before Strong Bullish Rally

Technical Dissection,Next Direction & Crucial Supports of On Going Correction

Nifty-EOD Chart (13-Apr-2012):-

|

| Just click on chart for its enlarged view |

1- Bullish Flag Pattern(Falling Channel) in on going Correction

2- C.W.-1(5171.45 on 07-03-2012)

3- C.W.-2(5499.40 on 14-03-2012)

4- C.W.-3(5135.95 on 29-03-2012)

5- C.W.-4(5378.75 on 03-04-2012)

6- C.W.-5 is on

(C.W.:Corrective Waves)

Nifty-EOD Chart (13-Apr-2012):-

|

| Just click on chart for its enlarged view |

1- Two times support at 200 Day SMA in on going correction and 200-Day SMA is today at 5145.

Conclusions from EOD chartS analysis

Downward Corrective Wave-5 continuation in on going correction and next supports at lower levels are as follows:-

1- 5175-5236

2- 5136-5167

3- Two times support at 200 Day SMA in on going correction and 200-Day SMA is today at 5145.

Fibonacci Retracement Levels(5629-4532) of on going correction are as follows-

13.0%- 5486

23.6%- 5369

27.0%- 5332

38.2%- 5209

50.0%- 5080

61.8%- 4950

70.7%- 4852

76.4%- 4790

78.6%- 4765

88.6%- 4656

Conclusions (After Putting All Studies Together)

Nifty traded more than one hour on 13-04-2012 between 5200-5236 and within above mentioned 1st Support range which is strong support also. Next support range(5136-5167) below 5175 is most crucial because Nifty got 2 times support at 200 Day SMA in on going correction and 200-Day SMA(today at 5145) is lying within this range therefore support getting possibility at or near about Long Term Trend deciding 200-Day SMA can not be ruled out. Firstly above mentioned supports should be watched in the beginning of next week but C.W.-5 is on and bottom B3 formations below 5135.95 can not be ruled out.

Just click following topic Link to understand on going correction nature:-

Lower Tops and Lower Bottoms Formation In On Going Correction

Multiple resistances at higher levels and complete consolidations and base formation will not be seen till then Impulsive Sub Wave-3 after correction completion can not be considered. Although least possibility of sustaining below 200-Day SMA but correction is on and following 3 Crucial Fibonacci Retracement Levels should also be kept in mind.

Crucial 3 Fibonacci Retracement Levels(5629-4532)

1- 38.2%- 5209(Aleady broken down)

2- 50.0%- 5080(Testing possibility can not be ruled out in any correction)

3- 61.8%- 4950(Testing possibility can not be ruled out in any correction)

As Bullish Flag Pattern(Falling Channel) formations in on going Correction therefore finally Indian markets will get supports at any of above levels. Firstly correction completion and and after that Strong rally in the form of Sub Wave-3 will generate to form new highs above 6000(Nifty). As soon as Indian markets will start consolidation and base formation then will be updated according to our last 5 years record.

Subscribe to:

Comments (Atom)