Nifty moved below 5557 therefore mentioned range is broken down and more down moves confirmations.

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Trading "calls" from our "Software" with more than "90% accuracy"

Mid-session Outlook-2(27-07-2011)

Nifty moved below 5557 therefore mentioned range is broken down and more down moves confirmations.

Mid-session Outlook(27-07-2011)

Nifty is trading between 5557-3391 since opening and minor intraday support at lower levels and resistance at higher levels seen within this range. Nifty will trade range bound between this 5557-5606 in the coming hours. As mixed trading patterns seen between this range today and yesterday after credit policy therefore break out this range will form decisive very short term trend and should be watched first.

Pre-open Outlook(27-07-2011)

Technical Positions,today Outlook and next possibilities have already been explained in following topics yesterday therefore not being repeated today:-

1- RBI Credit Policy led Long Engulfing Bearish Candle reversed Technical Formations

2- Nifty-Micro Analysis of Intra Day Chart For 27-07-2011

Asian markets are mixed after US markets Red closing yesterday and US Futures is also flat today therefore Sentiment is quiet and Nifty will open and firstly trade between last 4 hours range of yesterday(5560-5605). As trading patterns were mixed between mentioned range yesterday therefore Nifty will first trade between this range and prepare for next moves.

Let market final reaction come through mentioned range break out then next trend will get confirmation. Expected that Nifty will trade and hover around 5560-5605 after flat opening and its break out as well as sustaining beyond will be next moves confirmation.

1- RBI Credit Policy led Long Engulfing Bearish Candle reversed Technical Formations

2- Nifty-Micro Analysis of Intra Day Chart For 27-07-2011

Asian markets are mixed after US markets Red closing yesterday and US Futures is also flat today therefore Sentiment is quiet and Nifty will open and firstly trade between last 4 hours range of yesterday(5560-5605). As trading patterns were mixed between mentioned range yesterday therefore Nifty will first trade between this range and prepare for next moves.

Let market final reaction come through mentioned range break out then next trend will get confirmation. Expected that Nifty will trade and hover around 5560-5605 after flat opening and its break out as well as sustaining beyond will be next moves confirmation.

RBI Credit Policy led Long Engulfing Bearish Candle reversed Technical Formations

Technical Analysis and Research & Market Outlook For 27-07-2011

Nifty-EOD Chart(26-Jul-2011):-

Technical Patterns and Formations in EOD charts

Indian markets could not digest 50 basis points rise in key policy rates by RBI and crashed 55 points in 5 minutes after its announcement. Nifty closed 105 points down. Today Candle is Long Engulfing Bearish as well as it reversed all the following Technical Formations:-

1- Nifty traded and closed last 4 hours between previous 10 days trading range(5497-5654) on 26-07-2011.

2- Nifty traded and closed last 4 hours between 5 months range(5350-5600) on 26-07-2011.

3- Moved and closed below 3 crucial EMAs(8,21,200).

4- All trends turned sideways.

5- Daily MACD downward cross over.

6- Falling Trendline Broken down.

7- Pennant pattern again in existence.

Conclusions

Nifty traded last 10 days between 5497-5654 and today traded most of the time below 5600 after Credit policy announcement with mixed intraday patterns,as selling signals are also seen below 5600 therefore more down moves are possible because RBI Credit Policy gave big jolt to fundamentals also.

RBI Credit Policy generated fall reversed above mentioned 7 Bullish patterns and sustaining below 5600 will be confirmation of Indian markets again turning into 5 months old range(5350-5600) bound market as well as its possibility is higher now.

Nifty-EOD Chart(26-Jul-2011):-

|

| Just click on chart for its enlarged view |

Indian markets could not digest 50 basis points rise in key policy rates by RBI and crashed 55 points in 5 minutes after its announcement. Nifty closed 105 points down. Today Candle is Long Engulfing Bearish as well as it reversed all the following Technical Formations:-

1- Nifty traded and closed last 4 hours between previous 10 days trading range(5497-5654) on 26-07-2011.

2- Nifty traded and closed last 4 hours between 5 months range(5350-5600) on 26-07-2011.

3- Moved and closed below 3 crucial EMAs(8,21,200).

4- All trends turned sideways.

5- Daily MACD downward cross over.

6- Falling Trendline Broken down.

7- Pennant pattern again in existence.

Conclusions

Nifty traded last 10 days between 5497-5654 and today traded most of the time below 5600 after Credit policy announcement with mixed intraday patterns,as selling signals are also seen below 5600 therefore more down moves are possible because RBI Credit Policy gave big jolt to fundamentals also.

RBI Credit Policy generated fall reversed above mentioned 7 Bullish patterns and sustaining below 5600 will be confirmation of Indian markets again turning into 5 months old range(5350-5600) bound market as well as its possibility is higher now.

Nifty-Micro Analysis of Intra Day Chart For 27-07-2011

Nifty-Intra Day Chart(26-Jul-2011):-

|

| Just click on chart for its enlarged view |

Last 4 fours mixed patterns between- 5560-5605

Conclusions

Sharp fall after RBI Credit policy and Nifty traded last 4 hours between 5560-5605 with intraday mixed patterns. As Nifty traded most of the time below 5600 and selling signals are also seen therefore more down moves are possible because RBI Credit Policy gave big jolt to fundamentals today.

Nifty sustaining below 5600 will be confirmation of again turning into range bound mode between 5350-5600 and next moves confirmation range is sustaining beyond 5560-5605.

FII & DII trading activity in Capital Market Segment on 26-Jul-2011

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(26-Jul-2011)

Main features of today trading are as follows

1- Long Black Candle.

2- All the Indices closed in Red.

3- Sharp fall after RBI credit policy.

Ratios

Nifty Put Call Ratio: 0.97

Nifty P/E Ratio(26-Jul-2011): 20.22

Advances & Declines

BSE ADVANCES : 955

BSE DECLINES : 1961

NSE ADVANCES : 361

NSE DECLINES : 1062

Nifty Open Interest Changed Today

Nifty- 5500 CE(Jul)- +2686700(+82.95%)

Nifty- 5500 PE(Jul)- -206700(-1.80%)

Nifty- 5600 CE(Jul)- +3196750(+55.26%)

Nifty- 5600 PE(Jul)- -2789000(-26.00%)

Nifty- 5700 CE(Jul)- +1914300(+21.05%)

Nifty- 5700 PE(Jul)- -3617450(-42.92%)

Closing

Nifty- closed at 5,574.85(-105.45 Points & -1.86%)

Sensex- closed at 18,518.22(-353.07 Points & -1.87% )

CNX MIDCAP - closed at 8,119.30(-95.60 Points & -1.16%)

BSE SMALL CAP- closed at 8,437.68(-67.74 Points & -0.80%)

1- Long Black Candle.

2- All the Indices closed in Red.

3- Sharp fall after RBI credit policy.

Ratios

Nifty Put Call Ratio: 0.97

Nifty P/E Ratio(26-Jul-2011): 20.22

Advances & Declines

BSE ADVANCES : 955

BSE DECLINES : 1961

NSE ADVANCES : 361

NSE DECLINES : 1062

Nifty Open Interest Changed Today

Nifty- 5500 CE(Jul)- +2686700(+82.95%)

Nifty- 5500 PE(Jul)- -206700(-1.80%)

Nifty- 5600 CE(Jul)- +3196750(+55.26%)

Nifty- 5600 PE(Jul)- -2789000(-26.00%)

Nifty- 5700 CE(Jul)- +1914300(+21.05%)

Nifty- 5700 PE(Jul)- -3617450(-42.92%)

Closing

Nifty- closed at 5,574.85(-105.45 Points & -1.86%)

Sensex- closed at 18,518.22(-353.07 Points & -1.87% )

CNX MIDCAP - closed at 8,119.30(-95.60 Points & -1.16%)

BSE SMALL CAP- closed at 8,437.68(-67.74 Points & -0.80%)

Nifty Spot-Levels & Trading Strategy for 27-07-2011

Nifty Spot-Levels

R3 5822

R2 5765

R1 5669

Avg 5612

S1 5516

S2 5459

S3 5363

Nifty Spot-Trading Strategy

H6 5727 Trgt 2

H5 5692 Trgt 1

H4 5658 Long breakout

H3 5616 Go Short

H2 5602

H1 5588

L1 5559

L2 5545

L3 5531 Long

L4 5489 Short Breakout

L5 5455 Trgt 1

L6 5420 Trgt 2

R3 5822

R2 5765

R1 5669

Avg 5612

S1 5516

S2 5459

S3 5363

Nifty Spot-Trading Strategy

H6 5727 Trgt 2

H5 5692 Trgt 1

H4 5658 Long breakout

H3 5616 Go Short

H2 5602

H1 5588

L1 5559

L2 5545

L3 5531 Long

L4 5489 Short Breakout

L5 5455 Trgt 1

L6 5420 Trgt 2

Nifty(Jul Fut)-Levels & Trading Strategy for 27-07-2011

Nifty(Jul Fut)-Levels

R3 5806

R2 5754

R1 5664

Avg 5612

S1 5522

S2 5470

S3 5380

Nifty(Jul Fut)-Trading Strategy

H6 5716 Trgt 2

H5 5684 Trgt 1

H4 5652 Long breakout

H3 5613 Go Short

H2 5600

H1 5587

L1 5560

L2 5547

L3 5534 Long

L4 5495 Short Breakout

L5 5463 Trgt 1

L6 5431 Trgt 2

R3 5806

R2 5754

R1 5664

Avg 5612

S1 5522

S2 5470

S3 5380

Nifty(Jul Fut)-Trading Strategy

H6 5716 Trgt 2

H5 5684 Trgt 1

H4 5652 Long breakout

H3 5613 Go Short

H2 5600

H1 5587

L1 5560

L2 5547

L3 5534 Long

L4 5495 Short Breakout

L5 5463 Trgt 1

L6 5431 Trgt 2

Bank Nifty(Jul Fut)-Levels & Trading Strategy for 27-07-2011

Bank Nifty(Jul Fut)-Levels

R3 11722

R2 11578

R1 11344

Avg 11200

S1 10966

S2 10822

S3 10588

Bank Nifty(Jul Fut)-Trading Strategy

H6 11489 Trgt 2

H5 11403 Trgt 1

H4 11317 Long breakout

H3 11213 Go Short

H2 11179

H1 11144

L1 11075

L2 11040

L3 11006 Long

L4 10902 Short Breakout

L5 10816 Trgt 1

L6 10730 Trgt 2

R3 11722

R2 11578

R1 11344

Avg 11200

S1 10966

S2 10822

S3 10588

Bank Nifty(Jul Fut)-Trading Strategy

H6 11489 Trgt 2

H5 11403 Trgt 1

H4 11317 Long breakout

H3 11213 Go Short

H2 11179

H1 11144

L1 11075

L2 11040

L3 11006 Long

L4 10902 Short Breakout

L5 10816 Trgt 1

L6 10730 Trgt 2

Pre-closing Outlook(26-07-2011)

RBI 440 Volts interest rates shock to Indian markets and its impact will be decided through sustaining beyond 5600. Nifty traded most on the time below 5600 after Credit policy announcement and also closing below but if Nifty sustains below 5600 tomorrow again then Indian markets will enter into range bound mode between 5350-5600.

Just watch sustaining beyond 5600 tomorrow for nrxt moves confirmations.

RBI raises key policy rates by 50 bps

Mid-session Outlook(26-07-2011)

The Reserve Bank of India (RBI) on Tuesday raised repo rate by 50 basis points to 8 per cent and reverse repo to 7 per cent in its policy meet to arrest rising inflation.

This step is big jolt to Indian industry and stock markets therefore sharp fall was seen. Although such huge fall was unexpected but minor fall was seen and following precautionary lines were precautionary lines were posted at 08:07:00 AM today:-

"sentiment is heated therefore voltality after minor profit booking may be seen. As markets have to trade between resistances therefore fresh consolidation is must and long positions should be created after intraday consolidations"

RBI today step is problemsome for fundamentals and firstly sustaining beyond 5600 should be watched for next moves first indication.

The Reserve Bank of India (RBI) on Tuesday raised repo rate by 50 basis points to 8 per cent and reverse repo to 7 per cent in its policy meet to arrest rising inflation.

This step is big jolt to Indian industry and stock markets therefore sharp fall was seen. Although such huge fall was unexpected but minor fall was seen and following precautionary lines were precautionary lines were posted at 08:07:00 AM today:-

"sentiment is heated therefore voltality after minor profit booking may be seen. As markets have to trade between resistances therefore fresh consolidation is must and long positions should be created after intraday consolidations"

RBI today step is problemsome for fundamentals and firstly sustaining beyond 5600 should be watched for next moves first indication.

Bullish markets 8 confirmations in Charts on 25-07-2011

Technical Analysis and Research For 26-07-2011

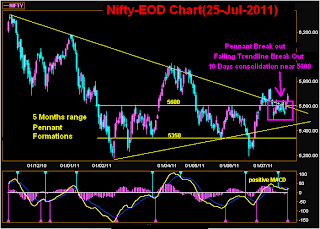

Nifty-EOD Chart(25-Jul-2011):-

8 Bullish patterns in charts are as follows

1- 10 Days trading range(5497-5654) broken out confirmation on 25-07-2011.

2- 5 months range(5350-5600) broken out confirmations on 25-07-2011.

3- Sustaining above all crucial EMAs(8,21,55,200) confirmation.

4- All trends turning up confirmation.

5- Daily MACD upward cross over.

6- Weekly MACD upward cross over

7 Falling Trendline Break Out.

8- Pennant Break out.

Next resistances are as follows

1- 5675-5699(Last one hour mixed intraday patterns and today follow up buying/selling will decide next immediate moves)

2- 5700-5740(Resistance and consolidation requires for crossing 5740)

Conclusions

Yesterday rally gave Bullish markets beginning confirmations and should be expected that market will consolidate near about above mentioned resistances as well as cross 5740 in the coming sessions.

Asian markets are little positive today morning therefore firstly range bound market expected between 5665-5700. RBI credit policy today and its announcements may also show decisive direction to Indian markets but voltality possibility can not be ruled out.

Positive closing is expected after consolidations between 5665-5700 but sentiment is heated therefore voltality after minor profit booking may be seen. As markets have to trade between resistances therefore fresh consolidation is must and long positions should be created after intraday consolidations.

Nifty-EOD Chart(25-Jul-2011):-

|

| Just click on chart for its enlarged view |

1- 10 Days trading range(5497-5654) broken out confirmation on 25-07-2011.

2- 5 months range(5350-5600) broken out confirmations on 25-07-2011.

3- Sustaining above all crucial EMAs(8,21,55,200) confirmation.

4- All trends turning up confirmation.

5- Daily MACD upward cross over.

6- Weekly MACD upward cross over

7 Falling Trendline Break Out.

8- Pennant Break out.

Next resistances are as follows

1- 5675-5699(Last one hour mixed intraday patterns and today follow up buying/selling will decide next immediate moves)

2- 5700-5740(Resistance and consolidation requires for crossing 5740)

Conclusions

Yesterday rally gave Bullish markets beginning confirmations and should be expected that market will consolidate near about above mentioned resistances as well as cross 5740 in the coming sessions.

Asian markets are little positive today morning therefore firstly range bound market expected between 5665-5700. RBI credit policy today and its announcements may also show decisive direction to Indian markets but voltality possibility can not be ruled out.

Positive closing is expected after consolidations between 5665-5700 but sentiment is heated therefore voltality after minor profit booking may be seen. As markets have to trade between resistances therefore fresh consolidation is must and long positions should be created after intraday consolidations.

Nifty-Micro Analysis of Intra Day Chart For 26-07-2011

Nifty-Intra Day Chart(25-Jul-2011):-

|

| Just click on chart for its enlarged view |

1- Consolidation between 5618-5650

2- Mixed patterns between 5675-5699

Conclusions

Most of the time intraday consolidation but last one hour mixed patterns between 5675-5699 just below resistance range. Today rally gave many bullish markets confirmations therefore expected that Nifty will consolidate around next resistance of 5700-5740 and finally cross 5740 in the coming sessions.

FII & DII trading activity in Capital Market Segment on 25-Jul-2011

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(25-Jul-2011)

Main features of today trading are as follows

1- Long White Candle.

2- Rally despite whole day negative global cues.

3- All the Indices closed in Green except FMCG.

Ratios

Nifty Put Call Ratio: 0.99

Nifty P/E Ratio(25-Jul-2011): 20.71

Advances & Declines

BSE ADVANCES : 1609

BSE DECLINES : 1292

NSE ADVANCES : 836

NSE DECLINES : 589

Nifty Open Interest Changed Today

Nifty- 5600 CE(Jul)- -275650(-4.35%)

Nifty- 5600 PE(Jul)- +1996900(+22.48%)

Nifty- 5700 CE(Jul)- +798950(+9.12%)

Nifty- 5700 PE(Jul)- +3375950(+64.24%)

Closing

Nifty- closed at 5,680.30(+46.35 Points & +0.82%)

Sensex- closed at 18,871.29(+148.99 Points & +0.80% )

CNX MIDCAP - closed at 8,214.90(+61.00 Points & +0.75%)

BSE SMALL CAP- closed at 8,505.42(+41.93 Points & +0.50%)

Nifty Spot-Levels & Trading Strategy for 26-07-2011

Nifty Spot-Levels

R3 5798

R2 5749

R1 5714

Avg 5665

S1 5630

S2 5581

S3 5546

Nifty Spot-Trading Strategy

H6 5764 Trgt 2

H5 5745 Trgt 1

H4 5726 Long breakout

H3 5703 Go Short

H2 5695

H1 5687

L1 5672

L2 5664

L3 5656 Long

L4 5633 Short Breakout

L5 5614 Trgt 1

L6 5595 Trgt 2

R3 5798

R2 5749

R1 5714

Avg 5665

S1 5630

S2 5581

S3 5546

Nifty Spot-Trading Strategy

H6 5764 Trgt 2

H5 5745 Trgt 1

H4 5726 Long breakout

H3 5703 Go Short

H2 5695

H1 5687

L1 5672

L2 5664

L3 5656 Long

L4 5633 Short Breakout

L5 5614 Trgt 1

L6 5595 Trgt 2

Nifty(Jul Fut)-Levels & Trading Strategy for 26-07-2011

Nifty(Jul Fut)-Levels

R3 5820

R2 5764

R1 5727

Avg 5671

S1 5634

S2 5578

S3 5541

Nifty(Jul Fut)-Trading Strategy

H6 5784 Trgt 2

H5 5762 Trgt 1

H4 5741 Long breakout

H3 5715 Go Short

H2 5707

H1 5698

L1 5681

L2 5672

L3 5664 Long

L4 5638 Short Breakout

L5 5617 Trgt 1

L6 5595 Trgt 2

R3 5820

R2 5764

R1 5727

Avg 5671

S1 5634

S2 5578

S3 5541

Nifty(Jul Fut)-Trading Strategy

H6 5784 Trgt 2

H5 5762 Trgt 1

H4 5741 Long breakout

H3 5715 Go Short

H2 5707

H1 5698

L1 5681

L2 5672

L3 5664 Long

L4 5638 Short Breakout

L5 5617 Trgt 1

L6 5595 Trgt 2

Bank Nifty(Jul Fut)-Levels & Trading Strategy for 26-07-2011

Bank Nifty(Jul Fut)-Levels

R3 11687

R2 11566

R1 11482

Avg 11361

S1 11277

S2 11156

S3 11072

Bank Nifty(Jul Fut)-Trading Strategy

H6 11606 Trgt 2

H5 11559 Trgt 1

H4 11511 Long breakout

H3 11455 Go Short

H2 11436

H1 11417

L1 11380

L2 11361

L3 11342 Long

L4 11286 Short Breakout

L5 11238 Trgt 1

L6 11191 Trgt 2

R3 11687

R2 11566

R1 11482

Avg 11361

S1 11277

S2 11156

S3 11072

Bank Nifty(Jul Fut)-Trading Strategy

H6 11606 Trgt 2

H5 11559 Trgt 1

H4 11511 Long breakout

H3 11455 Go Short

H2 11436

H1 11417

L1 11380

L2 11361

L3 11342 Long

L4 11286 Short Breakout

L5 11238 Trgt 1

L6 11191 Trgt 2

Subscribe to:

Comments (Atom)