Firstly rally continuation and finally 17436-18351 will confirm next big moves

Technical Analysis,Research & Weekly Outlook

(Apr 04 to Apr 08,2020)

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (01-Apr-2020):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-1 beginning from 7511.10 on 24-03-2020

2- Impulsive Wave-1 completion at 11794.30 on 31-08-2020

3- Corrective Wave-2 completion at 10790.20 on 24-09-2020

4- Impulsive Wave-3 completion at 15431.8 on 16-02-2021

5- Corrective Wave-4 completion at 14151.4 on 22-04-2021

6- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC" correction beginning.

7- Corrective Wave-A completion at 16410.20 on 20-12-2021

8- Wave-B completion at 18351.00 on 18-01-2022.

9- Wave-C bottom formation at 15671.5 on 08-03-2022

10- Pull Back Rally continuation with recent top formation at 17703.70 on 01-04-2022

Conclusions from EOD chart analysis

(Waves structure)

Waves structure which begun through its Impulsive Wave-1 from 7511.10 on 24-03-2020 completed after its 5th Wave termination at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC" correction started. Wave-C bottom of "ABC" correction formed at 15671.5 on 08-03-2022 and after that Pull Back Rally begun which is in continuation with recent top formation at 17703.70 on 01-04-2022.

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (01-Apr-2020):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC" correction beginning.

2- Corrective Wave-A completion at 16410.20 on 20-12-2021

3- Wave-B completion at 18351.00 on 18-01-2022.

4- Wave-C bottom formation at 15671.5 on 08-03-2022

5- Pull Back Rally continuation with recent top formation at 17703.70 on 01-04-2022

6- Stochastic- %K(5) line has intersected %D(3) line upward and its both lines are rising within Over bought zone.

7- Stochastic:- %K(5)- 91.16 & %D(3)- 82.59.

8- In MACD- MACD line has intersected Average line /upward and its both lines are rising in positive zone.

9- MACD(26,12)- 459.70 & EXP(9)- 322.03 & Divergence- 137.67

Conclusions from EOD chart analysis

(Stochastic & MACD)

Although Pull Back Rally continuation after Wave-C bottom formation at 15671.5 on 08-03-2022 and no confirmation of its completion yet on intraday and EOD charts but both lines of Short term indicator Stochastic have moved into bought zone and showing first signal of Short Term correction beginning. As both lines of MACD are rising in positive zone therefore confirming that upward trend is completely intact.

Nifty-EOD Chart Analysis

(Averages)

Nifty-EOD Chart (01-Apr-2020):-

Technical Patterns and Formations in EOD charts

1-Averages

A- 5-Day SMA is today at 17436

B- 21-Day SMA is today at 16915

C- 55-Day SMA is today at 17214

D- 100-Day SMA is today at 17315

E- 200-Day SMA is today at 17078

Conclusions from EOD chart analysis

(Averages)

As Nifty has closed above all the Short to Long Term Averages and some Averages have started to rise also therefore suggesting that Indian markets are in Bullish mode and on going Pull Back rally will remain continued.

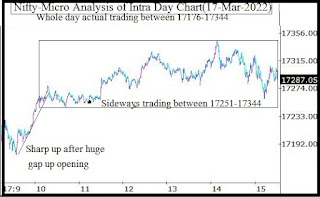

Nifty-Intra Day Chart Analysis

(01-Apr-2020)

Nifty-Intra Day Chart (01-Apr-2020):-

Technical Patterns formation in today intraday charts

1- Up moves after weaker opening

2- Consolidation between 17512-17553

3- Consolidation between 17568-17597

4- Sharp 125 Points jump was seen in last half hour

5- Whole day actual trading between 17423-17703

Conclusions from intra day chart analysis

Although weaker opening but after that recovery from lower levels and 2 times sideways good consolidation also therefore sharp 125 Points jump was seen in last half hour and closing was at the top of the day.

As good consolidation between 17512-17597 therefore rally will remain continued and until complete selling will not develop till then Nifty will not sustain below 17512.As sentiment has turned heated after last Friday strong rally therefore some intraday correction can not be ruled between and near about 17597-17703 before fresh decisive rally above 17703.

Conclusions

(After putting all studies together)

All the trends are up and Pull Back Rally continuation towards next psychological level at 18000. As Nifty has closed above Long Term Trend decider 200-Day SMA(today at 17078) in last 11 sessions therefore confirming that Long Term Trend has turned up and on going rally will remain continued as well as until complete selling patterns will not develop on intraday and EOD charts till then any big correction will not be seen because Nifty has closed above last 35 sessions trading range also.

As both lines of Short term indicator Stochastic have moved into bought zone and showing first signal of Short Term correction beginning as well as sentiment has turned heated therefore Short Term correction may begin also any day but intraday charts have not shown selling patterns formations yet therefore let complete selling patterns develop on intraday charts then Short Term correction will begin hence remain watchful also.

Next resistances above last Friday highest(17703.70) are as follows:-

1- 17795-17832

2- 17959-18129

3- 18292-18321

4- 18379-18458

5- 18548-18604

Next supports above last Friday closing(17670.50) are as follows:-

1- 17568-17597

2- 17512-17553

3- 17436-17485

4- 17344-17387(Gap Support)

5- 17236-17387

6- 17138-17185

7- 17004-17081

Wave-C bottom was formed at 15671.5 and Nifty has moved up 2031 points from this levels as well as Long Term Trend has turned up therefore strong signals of Wave-C completion at 15671.5 and news Waves structure formation from this level for fresh rally above life time highest(18604.50),its confirmation will be after moving the top of Wave-B at 18351.00.

Firstly rally continuation expectations in next week and until Nifty will not sustain below 17436 till then deeper correction will not be seen as well as moving above 18351 will confirm rally above life time highest therefore Nifty will trade and prepare for next big moves between 17436-18351 in the coming week/weeks as well as finally confirm next big moves after moving beyond this range.