Levels will confirm the life and size of Short Term expected correction

Technical Analysis,Research & Weekly

Outlook(Sep 13 to Sep 17,2021)

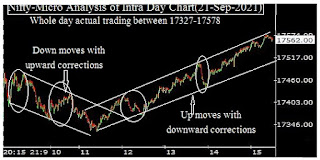

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (09-Sep-2021):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 continuation with recent high and new life time top formation at 17436.50 on 07-09-2021

2- Stochastic- %K(5) is at 76.16 & %D(3) is at 82.71

3- Stochastic- %K(5) line has intersected %D(3) line downward and both lines are falling in Over bought zone.

4- Stochastic is showing negative divergence.

4- In MACD- MACD line has intersected Average line upward.

5- In MACD- Both lines are rising in positive zone.

Conclusions from EOD chart analysis

(Stochastic & MACD)

As in Stochastic %K(5) line has intersected %D(3) line downward and both lines are falling in Over bought zone as well as it is showing negative divergence therefore Stochastic is suggesting that Short Term correction is on cards.

As in MACD both lines are rising in positive zone after MACD line upward intersection of Average line therefore it is showing that up trend is still intact and suggesting for on going rally continuation in next week.

Nifty-Last 5 Sessions

intraday charts analysis

Nifty-Intra Day Chart (Sep 03 to Sep 09,2021):-

Technical Patterns formation in last 5 Sessions intraday charts

1- Selling(Resistances) in last 5 sessions are as follows:-

A- 17339-17379

B- 17394-17436

2- Consolidation(Supports) in last 5 sessions are as follows:-

A- 17213-17270

3- 5 Sessions actual trading between 17213-17436

Conclusions from 5 Sessions

intra day chart analysis

Last 5 sessions trading just near and below life time highest with above mentioned immediate supports and resistances which are equally strong therefore firstly Nifty will have to trade and prepare for next decisive moves beyond this range and that will be done in next week. Let Nifty do it then will be decided according to intraday charts patterns formations and finally its confirmation will be sustaining beyond/forceful break out of last 5 Sessions trading range(17213-17436).

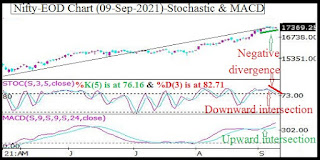

Nifty-Intra Day Chart

Analysis(09-Sep-2021)

Nifty-Intra Day Chart (09-Sep-2021):-

Technical Patterns formation in today intraday charts

1- Lower levels supports

2- Selling between 17341-17368

3- Selling between 17339-17353

4- Down moves in Bullish Falling Channel

5- Sharp up

6- Selling between 17364-17379

7- Whole day actual trading between 17303-17379

Conclusions from intra day chart analysis

Although last Thursday closing was near the top of the day but lower levels only supports and consolidation was not seen and only 15 minutes consolidation developed through Down moves in Bullish Falling Channel after 02:30 PM.

As higher levels good intraday selling patterns formations therefore if fresh selling develops in next week also then decisive down moves will be seen below day's lowest(17303).

Conclusions

(After Putting All Studies Together)

1- Long Term Trend is up.

2- Intermediate Term Trend is up.

3- Short Term Trend is sideways between 17213-17436 for the last 5 sessions.

Most Bullish rally continuation and no indication of its completion on EOD and intraday charts yet but emergence of Short Term correction indication after:-

1- Last 5 sessions sideways between 17213-17436.

2- Intraday selling patterns formation in last 4 sessions.

3- Stochastic indicator has started to generate Short Term correction signals.

As MACD indicator showing some more up moves possibilities and in Bull markets correction is completed within sideways trading also therefore deeper correction will be seen only after sustaining below/forceful break down of last 5 Sessions trading range(17213-17436) and if does not happen then Short Term correction will be completed within or near about 17213-17436.

Firstly sustaining beyond/forceful break out of last 5 Sessions trading range(17213-17436) should be watched in next week for the life and size of Short Term expected correction.