Finally rally above life time highest expectations after Short Term correction

Technical Analysis,Research & Weekly Outlook

(May 24 to May 28,2021)

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (21-May-2021):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C completion and Impulsive Wave-1 beginning from 7511.10 on 24-03-2020

2- Impulsive Wave-1 completion at 11794.30 on 31-08-2020 and corrective Wave-2 beginning

3- Corrective Wave-2 completion at 10790.20 on 24-09-2020 and Impulsive Wave-3 beginning

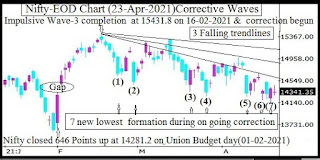

4- Impulsive Wave-3 completion after new life time top formation at 15431.8 on 16-02-2021

5- Corrective Wave-4 completion indications at 14151.4 on 22-04-2021 and Impulsive Wave-5 beginning indications

6- Up moves continuation with recent high formation at 15190.00 on 21-05-2021

7- Last 73 sessions sideways trading between 14152-15431 with Bullish flag formation .

Conclusions from EOD chart analysis

(Waves structure)

Impulsive Wave-3 completion after new life time top formation at 15431.8 on 16-02-2021 and after that corrective Wave-4 started which is in continuation.

Although last 73 sessions like big sideways correction between 14152-15431 but with Bullish flag formation within it therefore emergence of up moves expectations above 15431.

As now Pull back rally continuation after bottom formations at 14151.4 on 22-04-2021 and its recent top formations at 15190.00 on 21-05-2021 as well as no indication of its completion yet on EOD charts therefore on going Pull back rally continuation is expected.

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (21-May-2021):-

Technical Patterns and Formations in EOD charts

1- 73 sessions Bullish flag upward broken out

1- Stochastic %K(5) is at 78.26 & %D(3) is at 81.19

2- Stochastic- %K(5) line and %D(3) line are kissing Overbought zone

3- MACD line is above Average line and its both lines are moving up.

4- Last 64 sessions sideways trading between 14152-15431

Conclusions from EOD chart analysis

(Stochastic & MACD)

As Bullish flag pattern developed in the last 73 sessions sideways trading between 14152-15431 and its upward falling trend line has been broken out therefore strong indications of rally continuation above life time highest(15431.8) in the coming week/weeks

As in Stochastic Indicator %K & %D both lines are kissing in Overbought zone therefore first indication Short Term correction beginning but before it selling patterns are required on EOD charts which has not been seen yet hence let selling patterns firstly develop then Short Term correction will be seen.

As in MACD Indicator both lines are moving upward and MACD line has intersected Average line upward therefore it's showing upward trend hence rally continuation expectations

Nifty-Intra Day Chart Analysis

(21-May-2021)

Nifty-Intra Day Chart (21-May-2021):-

Technical Patterns formation in today intraday charts

1- Up moves after strong opening

2- Up moves in Bearish Rising Channel

3- Consolidation between 15078-15117

4- Up moves continuation

5- Whole day actual trading between 14986-15190

Conclusions from intra day chart analysis

Although firstly up moves continuation after positive opening but some selling was also seen through Up moves in Bearish Rising Channel. As selling absorbed and consolidation developed between 15078-15117 therefore Up moves continuation and closing was at the top of the day.

As intraday selling patterns were not seen last Friday therefore immediate big down moves will not be considered but sentiment turned heated after strong rally hence some down moves towards consolidation range(15078-15117) can not be ruled out next Monday.

Expected that Nifty will firstly trade and prepare for next moves above 15078 and finally sustaining it beyond will confirm next Short Term Trend which should be firstly watched in next week.

Conclusions

(After Putting All Studies Together)

1- Long Term Trend is up.

2- Intermediate Term Trend is up

3- Short Term Trend is up.

1- Next resistances are as follows:-

A- 15201-15241

B- 15262-15319

C- 15335-15421

2- Next supports are as follows:-

A- 15078-15117

B- 14833-14856(Weak supports)

C- 14787-14814(Weak supports)

D- 14732-14754(Weak supports)

E- 14592-14650

F- 14527-14578(Strong supports)

As corrective Wave-4 continuation with sideways trading between 14152-15431 for the last 73 sessions and Bullish flag pattern developed within it as well as its upward falling trend line broken out in previous week therefore strong signals of Wave-4 completion at 14151.4 on 22-04-2021 and Impulsive Wave-5 formations for fresh rally above life time highest(15431.8).

As in Short Term indicator Stochastic both lines are moving into Overbought zone,sentiment has turned heated up after last one month rally and above mentioned 3 resistances above last week highest therefore indications of Short Term correction but selling patterns have not developed yet on intraday charts and EOD charts therefore correction will not be seen immediately.Let firstly selling patterns develop accordingly then correction will be considered.

Although finally rally above life time highest(15431.8) expectations but after Short Term correction(1 to 3 weeks) and fresh consolidation which will be seen in the coming week/weeks.