Strong signals of deeper correction beginning from next week

Technical Analysis,Research & Weekly Outlook

(Feb 17 to Feb 21,2020)

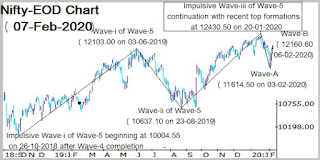

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (14-Feb-2020):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-1 beginning from 6825.80 on 29-02-2016 after 1 financial year(2015-16) correction completion.

2- Impulsive Wave-1 completion at 8968.70 on 07-09-2016 and corrective Wave-2 beginning

3- Corrective Wave-2 completion at 7893.80 on 26-12-2016 and impulsive Wave-3 beginning

4- Impulsive Wave-3 completion at 11760.20 on 28-08-2018 and corrective Wave-4 beginning

5- Corrective Wave-4 completion at 10004.55 on 26-10-2018 and impulsive Wave-5 beginning

6- Impulsive Wave-5 continuation with new life time high formation at 12430.50 on 20-01-2020

Nifty-EOD Chart Analysis

(Wave-iii of Wave-5 structure)

Nifty-EOD Chart (14-Feb-2020):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Corrective Wave-ii of Wave-5 completion at 10637.10 on 23-08-2019 and impulsive Wave-iii beginning

2- Impulsive Wave-iii of Wave-5 continuation with recent top formations at 12430.50 on 20-01-2020

3- Wave-A completion at 11614.50 on 03-02-2020

4- Wave-B completion at 12246.70 on 14-02-2020

Nifty-Intra Day Chart Analysis

(14-Feb-2020)

Nifty-Intra Day Chart (14-Feb-2020):-

|

| Just click on chart for its enlarged view |

Technical Patterns formation in today intraday charts

1- Selling between 12194-12246

2- Sharp fall

3- Selling between 12124-12183

4- Whole day actual trading between 12092-12246

Conclusions from EOD chart analysis

1- Long Term Trend is up after moving above its decider 200 Day SMA(today at 11663.40)

2- Intermediate Term Trend sideways.

3- Short Term Trend has turned sideways.

Conclusions from EOD chart(Impulsive Wave-iii of Wave-5) analysis

Although impulsive Wave-iii of Wave-5 continuation with recent top formations at 12430.50 on 20-01-2020 but its correction is on of which Wave-A completed at 11614.50. Now its Wave-B continuation with signals of its completion at 12246.70 on 14-02-2020 because last Friday lowest was below the lowest of last 4 sessions after same day new top formations of Wave-B at 12246.70.

Conclusions from intra day chart analysis

Although strong up move after positive opening but selling developed in first hour therefore sharp fall was seen in Mid-Session. 3 Hours follow up selling was also seen after that therefore almost whole day trading will be understood with good selling hence fresh down moves are expected below last Friday lowest(12,091.20) in the beginning of next week.

Conclusions

(After Putting All Studies Together)

As Nifty-EOD Chart Analysis(5th Wave structure) has already been updated in previous weekly Outlook(Feb 10 to Feb 14,2020) therefore waves structure of its Wave-iii of Wave-5 has been updated in next week weekly Outlook because that is in continuation now.

Following line was told on 08-02-2020 in "Firstly watch level in next week for the life and length of expected correction":-

until Nifty will sustain above 12216 till then correction completion will not be considered.

Although Nifty moves up to 12246.70 but could not sustain and sharp fall was seen last Friday as well as Nifty closed at 12113.45 after loosing 133 points from higher levels.

Wave-B of Wave-iii of Wave-5 continuation with recent top formation at 12246.70 last Friday but slipped sharply same day from there and formed last 4 sessions lowest at 12091.20 and closed also just above last 4 sessions lowest therefore it will be understood strong signal of Wave-C formation in next week for slipping below the bottom of Wave-A(11614.50)

Firstly sustaining beyond 12099 should be watched next Monday because sustaining below it will mean sharp fall towards following next supports:-

1- 11983-12021

2- 11922-11951

3- 11615-11705

As strong signals of Wave-C formation developed last Friday therefore correction is expected in next week which may be deeper also.