Technical Analysis,Research & Weekly Outlook

(Mar 31 to Apr 04,2014)

Nifty-EOD Chart (28-Mar-2014):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Bottom formation at 5118.85 on 28-08-2013 and Wave-1 beginning

2- Wave-1(6142.50 on 19-09-2013)

3- Wave-2(5700.95 on 01-10-2013)

4- Wave-i of Wave-3(6415.25 on 09-12-2013)

5- Wave-ii of Wave-3(5933.30 on 04-02-2014)

6- Wave-iii of Wave-3 continuation with new highest formation at 6702.60 on 28-03-2014

Conclusions from EOD chart analysis

With technical calculations following prediction was done on 21-10-2013 in Minimum target of Nifty at 6724.60:-

Nifty is well set for rally towards minimum target at 6724.60

As was told 5 months before and repeated more than 10 times since 21-10-2013, has been proved almost accurate after recent top formation at 6702.60 on 28-03-2014

All trends are up and Bullish market Wave-iii of Wave-3 continuation towards those higher levels which can not be easily imagined at this moment because following minimum waves are still left:-

1- Wave-iii of Wave-3 continuation and no signal of its termination yet.

2- Corrective Wave-iv of Wave-3 will start after on going Wave completion and this corrective will correct whole that up move which started from 5933.30.

3- Impulsive Wave-v of Wave-3 will start after previous corrective wave completion and this Wave will form new high above the top of Wave-iii of Wave-3. It should also be kept in mind that Wave-iii of Wave-3 top formations confirmation has not been seen yet.

4- Wave-v of Wave-3 completion will mean termination of Wave-3 and corrective Wave-4 beginning.

5- Corrective Wave-4 will correct whole up moves which started from 5700.95.

6- Impulsive Wave-5 will start towards new top formation above the top of Wave-3.

As per Waves structures too much higher levels above 6702.60 are still left and those higher levels will be seen in the coming months and years.

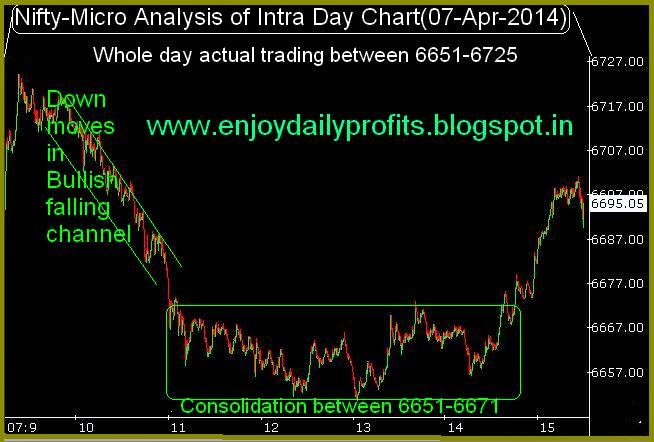

Nifty-Intra Day Chart (28-Mar-2014):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in today intraday charts

1- Consolidation between 6644- 6664

2- Whole day actual trading between 6644-6702

Conclusions from intra day chart analysis

New intraday high formation at 6702.60 on 28-03-2014 after lower levels good consolidation but when Nifty was trading near the lowest of the day then we were not bearish therefore we clearly told at 12:48 PM on 28-03-2014 in Mid-session Outlook(28-03-2014)

new intraday lowest formation 15 minutes before at 6643.80 but as such selling patterns were not seen today.

As lower levels good consolidation on 31-03-2014 therefore until Nifty will not sustain below the lowest of the day(6643.80) after complete selling till then decisive down moves will not be considered.

Conclusions (After Putting All Studies Together)

At present impulsive Wave-iii of Wave-3 continuation and no signal of its completion yet. Until complete selling patterns will not develop till then correction or decisive down moves will not be seen. As Short Term indicators are over bought therefore correction is due but will not be seen immediately because:-

1- 11 Sessions most time trading range(6433-6574) broken out in previous week.

2- Good intraday consolidation seen at lower levels in previous session(28-03-2014).

Bullish markets following character should also be kept in mind:-

1- Markets consolidate at higher levels also.

2- Some times markets correct time wise not price wise.

3- Some times markets complete its correction in sideways moves and deeper correction is not seen.

Indian markets are completely Bullish and let complete selling patterns develop then will updated according to intraday selling patterns analysis and until it will not happen till then on going rally will remain continued towards new tops formation.