4 Topics for Next week Trading have already been updated and more topics will also be posted before the opening of next Monday markets.

Trading "calls" from our "Software" with more than "90% accuracy"

Trading Calls

More than "12 years" old "only site of whole world"

with more than "9700 accurate Outlooks" of

"Indian Stock Markets"

Cross-Over of Crucial Resistances

Nifty-EOD Chart(03-Feb-2012):-

1- 6339 on 05-11-2010

2- 4532 on 20-12-2011

3-Nifty closing above trend Reversal 123 Sessions sideways market between 4720-5229.

4- Closing at 5325.85 on 03-02-2012

1- Sustaining above 200 Day(SMA)-5190

2- Sustaining above 200 Day(EMA)-5135

3- Sustaining above 123 sessions sideways trading range(5229)

All trends are up after Dec 2011 sharp rally and cross-Over of above mentioned crucial resistances also in previous week.

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- 6339 on 05-11-2010

2- 4532 on 20-12-2011

3-Nifty closing above trend Reversal 123 Sessions sideways market between 4720-5229.

4- Closing at 5325.85 on 03-02-2012

Three Bullish cross overs on 01-02-2012

1- Sustaining above 200 Day(SMA)-5190

2- Sustaining above 200 Day(EMA)-5135

3- Sustaining above 123 sessions sideways trading range(5229)

Conclusions from EOD chart analysis

All trends are up after Dec 2011 sharp rally and cross-Over of above mentioned crucial resistances also in previous week.

Nifty-Micro Analysis of Intra Day Chart of 03-02-2012

Nifty-Intra Day Chart(03Feb-2012):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in today intraday charts

1- Support between 5256-5271.

2- Sharp surge

3- Up moves in Rising channel with Bearish rising wedge formation.

4- Rising Channel Broken down in last minutes.

5- Whole day trading between 5256-5333

Conclusions from intra day chart analysis

Strong rally after lower levels support but last one hour moves in Rising channel with Bearish rising wedge formation therefore minor intraday correction signals also from Intraday charts formations.

Strong Bullish rally is on and most of the times markets completes very short term and minor corrections within sideways markets or at higher levels also in most Bullish intraday sentiments. Although minor distribution formations but until follow up selling will not develop in the coming sessions till then any decisive down move will not be considered.

Bullish 'W' formations

Nifty-EOD Chart(03-Feb-2012):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Correction begun from 6338 on 05-11-2010

2- Lowest of 13 months correction at 5431.15 on 20-12-2011

3- Gap down opening on 05-08-5011 with intraday high at 5229

4- 123 sessions sideways market after gap down opening on 05-08-5011

5- Bullish 'W' formation at the bottom of 13 months correction.

Conclusions from EOD chart analysis

Strong indication of 13 months down trend reversal through Bullish 'W' formation at the bottom of 13 months correction.

803 Nifty Points Strong Rally from 13th(Fibonacci number) Month

Nifty-Monthly Chart(03-Feb-2012):-

1- Correction begun from 6338 on 05-11-2010

2- 13 Months correction

3- Lowest of 13 months correction at 5431.15 on 20-12-2011

4- 803 Nifty Points Strong Rally begun from 13th Month

Financial markets have a high probability tendency of reversing on a Fibonacci number. As Stong and sharp rally seen from 20-12-2011 in the 13th month and 13 is a Fibonacci number also therefore following possibilities are high:-

1- Lowest of 13 months correction at 5431.15.

2- Correction completion in the 13th month.

3- Trend reversal of 13 months down trend.

Importance of 13 months Fibonacci number is not being told today after watching strong rally but we told about it many times in previous Outlooks as well its importance was updated in following seperate topic on 03-12-2011 also.

Just Click following topic link and understand Indian markets rally in 2012:-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Correction begun from 6338 on 05-11-2010

2- 13 Months correction

3- Lowest of 13 months correction at 5431.15 on 20-12-2011

4- 803 Nifty Points Strong Rally begun from 13th Month

Conclusions from monthly chart analysis

Financial markets have a high probability tendency of reversing on a Fibonacci number. As Stong and sharp rally seen from 20-12-2011 in the 13th month and 13 is a Fibonacci number also therefore following possibilities are high:-

1- Lowest of 13 months correction at 5431.15.

2- Correction completion in the 13th month.

3- Trend reversal of 13 months down trend.

Importance of 13 months Fibonacci number is not being told today after watching strong rally but we told about it many times in previous Outlooks as well its importance was updated in following seperate topic on 03-12-2011 also.

Just Click following topic link and understand Indian markets rally in 2012:-

FII & DII trading activity in Capital Market Segment on 03-Feb-2012

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(03-Feb-2012)

1- All the Indices closed in Green except Metals.

2- Strong rally above 5300.

3- White Candle formations.

Ratios

Nifty Put Call Ratio: 1.10

Nifty P/E Ratio(03-Feb-2012): 18.97

Advances & Declines

BSE Advances : 1713

BSE Declines : 1184

NSE Advances : 879

NSE Declines : 560

Nifty Open Interest Changed Today

Nifty- 5200 CE(Feb)- -435600(-11.44%)

Nifty- 5200 PE(Feb)- +1388950(+29.24%)

Nifty- 5300 CE(Feb)- -631500(-10.93%)

Nifty- 5300 PE(Feb)- +924250(+40.01%)

Nifty- 5400 CE(Feb)- -113050(-2.13%)

Nifty- 5400 PE(Feb)- +341300(+39.50%)

Closing

Nifty- closed at 5,325.85(+55.95 Points & +1.06%)

Sensex- closed at 17,604.96(+173.11 Points & +0.99% )

CNX Midcap - closed at 7,324.15(+98.25 Points & +1.36%)

BSE Smallcap- closed at 6,686.55(+77.58 Points & +1.17%)

Nifty Spot-Levels & Trading Strategy for 06-02-2012

R3 5433

R2 5383

R1 5354

Avg 5304

S1 5275

S2 5225

S3 5196

Nifty Spot-Trading Strategy

H6 5405 Trgt 2

H5 5386 Trgt 1

H4 5368 Long breakout

H3 5346 Go Short

H2 5339

H1 5332

L1 5317

L2 5310

L3 5303 Long

L4 5281 Short Breakout

L5 5263 Trgt 1

L6 5244 Trgt 2

Nifty(Feb Fut)-Levels & Trading Strategy for 06-02-2012

R3 5473

R2 5415

R1 5380

Avg 5322

S1 5287

S2 5229

S3 5194

Nifty(Feb Fut)-Trading Strategy

H6 5439 Trgt 2

H5 5417 Trgt 1

H4 5396 Long breakout

H3 5370 Go Short

H2 5362

H1 5353

L1 5336

L2 5327

L3 5319 Long

L4 5293 Short Breakout

L5 5272 Trgt 1

L6 5250 Trgt 2

Bank Nifty(Feb Fut)-Levels & Trading Strategy for 06-02-2012

R3 10544

R2 10364

R1 10259

Avg 10079

S1 9974

S2 9794

S3 9689

Bank Nifty(Feb Fut)-Trading Strategy

H6 10446 Trgt 2

H5 10378 Trgt 1

H4 10310 Long breakout

H3 10232 Go Short

H2 10206

H1 10180

L1 10127

L2 10101

L3 10075 Long

L4 9997 Short Breakout

L5 9929 Trgt 1

L6 9861 Trgt 2

Nifty Spot-Weekly Levels & Trading Strategy(Feb 06 to Feb 10,2012)

R3 5597

R2 5443

R1 5384

Avg 5230

S1 5171

S2 5017

S3 4958

Nifty Spot-Weekly Trading Strategy

H6 5548 Trgt 2

H5 5495 Trgt 1

H4 5442 Long breakout

H3 5383 Go Short

H2 5364

H1 5344

L1 5305

L2 5285

L3 5266 Long

L4 5207 Short Breakout

L5 5154 Trgt 1

L6 5101 Trgt 2

Bank Nifty Spot-Weekly Levels & Trading Strategy(Feb 06 to Feb 10,2012)

R3 11006

R2 10582

R1 10357

Avg 9933

S1 9708

S2 9284

S3 9059

Bank Nifty Spot-Weekly Trading Strategy

H6 10824 Trgt 2

H5 10657 Trgt 1

H4 10489 Long breakout

H3 10311 Go Short

H2 10251

H1 10192

L1 10073

L2 10014

L3 9954 Long

L4 9776 Short Breakout

L5 9608 Trgt 1

L6 9441 Trgt 2

Pre-Closing Outlook(03-02-2012)

All trends upward confirmations at the weekend and blasting Bullish rally is on. Although minor down moves and very short term corrections may be seen any day after intraday selling but until complete selling patterns will not emerge till then short term correction will not be seen.

Mid-session Outlook(03-02-2012)

Minor intraday down moves and trading between 5256-5279 seen today after Intraday selling between 5272-5289 yesterday. Minor intraday support also seen at lower levels today.

Range of 5256-5289 should be watched for next moves confitmations because mixed technical positions between this range today and yesterday.

Range of 5256-5289 should be watched for next moves confitmations because mixed technical positions between this range today and yesterday.

NIFTY-Feb F&O-1st Shorting of 02-02-2012-Covering

NIFTY Feb F & O(Shorted on 02-02-2012)-Cover immediately-CMP-5286

NIFTY-Feb F&O-1st Shorting of 02-02-2012-Message

NIFTY-Feb F&O-1st Shorting of 02-02-2012-Market will be volatile therefore hold and cover after my covering message

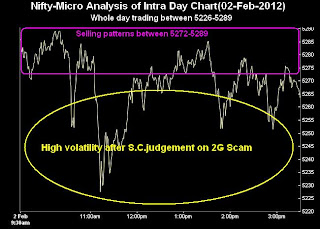

Nifty-Micro Analysis of Intra Day Chart For 03-02-2012

Nifty-Intra Day Chart(02-Feb-2012):-

1- Selling patterns between 5272-5289.

2- High volatility after S.C.judgement on 2G Scam.

3- Doji candle formation

4- Whole day trading between 5226-5289

Intraday supports at lower leves after high volatility due to negative news of S.C.judgement on 2G Scam but clear intraday selling patterns at higher levels also therefore minor intraday correction is due and that will be seen today.

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in today intraday charts

1- Selling patterns between 5272-5289.

2- High volatility after S.C.judgement on 2G Scam.

3- Doji candle formation

4- Whole day trading between 5226-5289

Conclusions from intra day chart analysis

Intraday supports at lower leves after high volatility due to negative news of S.C.judgement on 2G Scam but clear intraday selling patterns at higher levels also therefore minor intraday correction is due and that will be seen today.

FII & DII trading activity in Capital Market Segment on 02-Feb-2012

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(021-Feb-2012)

1- All the Indices closed in Green.

2- Doji candle formation in both NIFTY and SENSEX.

3- S.C.judgement on 2G Scam based highly volatile market today.

Ratios

Nifty Put Call Ratio: 1.16

Nifty P/E Ratio(021-Feb-2012): 18.77

Advances & Declines

BSE Advances : 1575

BSE Declines : 1305

NSE Advances : 802

NSE Declines : 652

Nifty Open Interest Changed Today

Nifty- 5100 CE(Feb)- -284550(-12.01%)

Nifty- 5100 PE(Feb)- +1139800(+20.59%)

Nifty- 5200 CE(Feb)- -153800(-3.81%)

Nifty- 5200 PE(Feb)- +1362450(+37.71%)

Nifty- 5300 CE(Feb)- -24700(-0.42%)

Nifty- 5300 PE(Feb)- +782400(+48.77%)

Closing

Nifty- closed at 5,269.90(+34.20 Points & +0.65%)

Sensex- closed at 17,431.85(+131.27 Points & +0.76% )

CNX Midcap - closed at 7,225.90(+37.50 Points & +0.52%)

BSE Smallcap- closed at 6,608.97(+35.39 Points & +0.54%)

Subscribe to:

Posts (Atom)