It is seen first time that INFY results are declared after opening of market and below expectations also. Market has taken it negative and trading weak and INFY is 6.5% down. News based market and will be better to draw final conclusion from 3/4 hoours intra day charts foemations and market response on all these developments.

Trading "calls" from our "Software" with more than "90% accuracy"

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Pre-Open Market Outlook(15-04-2011)

Technical positions and forthcoming markets possibilities have already been discussed with intra Day and EOD charts in following topics ln last 2 days:-

1- Market is well prepared for Sharp Rally

2- Resistances crossed on 13-04-2011

3- Post-closing Report(13-04-2011) & 15 Apr 2011 Outlook

4- Nifty-Micro Analysis of Intra Day Chart(13-04-2011)

RIL and INFTEC results have power to trigger decisive direction to Indian markets and INFTEC Audited Results & Final Dividend announcement today at that time when Indian markets are well set to shoot up. Rocket is at launching pad,count down has been started,only sparking is left and that will be done by INFTEC results today.

Whatsoever may be sentiment today morning but today expected first trading range is 5875-5945. Sentiment may be heated today morning and in such mood profit booking possibility can not be ruled out therefore its confirmation is also required today.

Forceful break out and sustaining above 5940 today will be confirmation of fast moves toward 6120. Nifty trading within 5875-5945 will mean final view formation through 3/4 hours intraday charts analysis.

Possibilities have been discussed but as per my view strong rally above 5940 will trigger from today,

1- Market is well prepared for Sharp Rally

2- Resistances crossed on 13-04-2011

3- Post-closing Report(13-04-2011) & 15 Apr 2011 Outlook

4- Nifty-Micro Analysis of Intra Day Chart(13-04-2011)

RIL and INFTEC results have power to trigger decisive direction to Indian markets and INFTEC Audited Results & Final Dividend announcement today at that time when Indian markets are well set to shoot up. Rocket is at launching pad,count down has been started,only sparking is left and that will be done by INFTEC results today.

Whatsoever may be sentiment today morning but today expected first trading range is 5875-5945. Sentiment may be heated today morning and in such mood profit booking possibility can not be ruled out therefore its confirmation is also required today.

Forceful break out and sustaining above 5940 today will be confirmation of fast moves toward 6120. Nifty trading within 5875-5945 will mean final view formation through 3/4 hours intraday charts analysis.

Possibilities have been discussed but as per my view strong rally above 5940 will trigger from today,

Market is well prepared for Sharp Rally

|

| Just click on chart for its enlarged view |

Wave-5 is on,all trends are up,minute resistances near 5940,crossing it by force and sustaining above will spark blasing rally in Indian markets toward minimum 6120.

Watch only 5940 for next move Confirmations

Resistances crossed on 13-04-2011

|

| Just click on chart for its enlarged view |

Nifty-Micro Analysis of 10 Days-Intra Day Chart

It is clear from 10 days intra day chart that Nifty crossed stronger resistance range (5870-5910) and closed above at 5911 on 13-04-2011. Minute resistance is near 5940 and it has no strength.

Wave-5 is on,all trends are up and Nifty by force crossing or sustaining above 5940 tomorrow will confirm strong rally toward minimum 6120.

Post-closing Report(13-04-2011) & 15 Apr 2011 Outlook

Indian markets participated Crude $7 sudden fall fuelled global markets rally and closed with good gains. Main features are as follows:-

1- Long White Bullish candle.

2- All the sectoral Indices positive closing.

3- Crossed 1st resistance(5830)

4- Traded and closed within immediate last resistance of the rally(5870-5940).

Ratios:

Nifty Put Call Ratio: 0.91

Nifty P/E Ratio(13-04-2011):22.43

Advances & Declines:-

BSE ADVANCES : 1973

BSE DECLINES : 975

NSE ADVANCES : 1068

NSE DECLINES : 356

Nifty Open Interest Changed Today:-

Nifty- 5800 CE(28APR2011)- -1428700(-26.60%)

Nifty- 5800 PE(28APR2011)- +1885550(+38.58%)

Nifty- 5900 CE(28APR2011)- -1244900(-19.76%)

Nifty- 5900 PE(28APR2011)- +2905550(+107.84%)

Nifty- 6000 CE(28APR2011)- +152150(+2.05%)

Nifty- 6000 PE(28APR2011)- +1241000(+80.58%)

Closing :-

Nifty- closed at 5,911.50(+125.80 Points & +2.17%)

Sensex- closed at 19,696.86(+434.32 Points & +2.25% )

CNX MIDCAP - closed at 8,349.05(+119.10 Points & +1.45%)

BSE SMALL CAP- closed at 8,823.46(+113.55 Points & +1.30%)

Nifty-Micro Analysis of Intra Day Chart(13-04-2011):-

15 Apr 2011 Outlook:-

5th Wave is on,Long term and intermediate term trends were up and short term trend turned up after sharp surge on 13-04-2011. Short term correction has been completed and up ward force was so high that market consolidated at higher levels and shoot up. Last resistance range of on going rally is between 5870-5940 and Nifty has cleared this resistance upto 5823 on 13-04-2011.

Correction has been completed in blasting manner and sustaining above 5940 will mean fire works in Indian markets and then Nifty will test minimum 6120 in the coming week/weeks.

Expected that Nifty will sustain above 5940 in the coming week and fresh rally will be seen. For strong rally confirmation just watch sustaining above 5940 only.

1- Long White Bullish candle.

2- All the sectoral Indices positive closing.

3- Crossed 1st resistance(5830)

4- Traded and closed within immediate last resistance of the rally(5870-5940).

Ratios:

Nifty Put Call Ratio: 0.91

Nifty P/E Ratio(13-04-2011):22.43

Advances & Declines:-

BSE ADVANCES : 1973

BSE DECLINES : 975

NSE ADVANCES : 1068

NSE DECLINES : 356

Nifty Open Interest Changed Today:-

Nifty- 5800 CE(28APR2011)- -1428700(-26.60%)

Nifty- 5800 PE(28APR2011)- +1885550(+38.58%)

Nifty- 5900 CE(28APR2011)- -1244900(-19.76%)

Nifty- 5900 PE(28APR2011)- +2905550(+107.84%)

Nifty- 6000 CE(28APR2011)- +152150(+2.05%)

Nifty- 6000 PE(28APR2011)- +1241000(+80.58%)

Closing :-

Nifty- closed at 5,911.50(+125.80 Points & +2.17%)

Sensex- closed at 19,696.86(+434.32 Points & +2.25% )

CNX MIDCAP - closed at 8,349.05(+119.10 Points & +1.45%)

BSE SMALL CAP- closed at 8,823.46(+113.55 Points & +1.30%)

Nifty-Micro Analysis of Intra Day Chart(13-04-2011):-

|

| Just click on chart for its enlarged view |

5th Wave is on,Long term and intermediate term trends were up and short term trend turned up after sharp surge on 13-04-2011. Short term correction has been completed and up ward force was so high that market consolidated at higher levels and shoot up. Last resistance range of on going rally is between 5870-5940 and Nifty has cleared this resistance upto 5823 on 13-04-2011.

Correction has been completed in blasting manner and sustaining above 5940 will mean fire works in Indian markets and then Nifty will test minimum 6120 in the coming week/weeks.

Expected that Nifty will sustain above 5940 in the coming week and fresh rally will be seen. For strong rally confirmation just watch sustaining above 5940 only.

Nifty-Micro Analysis of Intra Day Chart(13-04-2011)

Indian markets participated global markets Crude $7 down rally today. As up move was expected therefore following line was told in Pre-Open Market Outlook(13-04-2011):-

"recovery from lower levels after getting intra day support is possible today"

Although up move was expected after some consolidation but view changed after analysing first half intraday chart and following lines were told at 09:54AM in Post-open Outlook(13-04-2011):-

"Market showed strength and if Nifty sustains above 5800 today then correction completion will be considered."

As sentiment recovered after sudden Crude price fall therefore sentiment enthused and Indian markets sharply surged after higher levels consolidation and up move was above rising trend line with 5 intraday consolidation patterns. Mentioned all the points were told also in all the 5 outlooks which were posted during trading hours on 13-04-2011.

Intra Day Chart(13-04-2011)

Intra day consolidation at 5 levels and no distribution pattern on 13-04-2011.

"recovery from lower levels after getting intra day support is possible today"

Although up move was expected after some consolidation but view changed after analysing first half intraday chart and following lines were told at 09:54AM in Post-open Outlook(13-04-2011):-

"Market showed strength and if Nifty sustains above 5800 today then correction completion will be considered."

As sentiment recovered after sudden Crude price fall therefore sentiment enthused and Indian markets sharply surged after higher levels consolidation and up move was above rising trend line with 5 intraday consolidation patterns. Mentioned all the points were told also in all the 5 outlooks which were posted during trading hours on 13-04-2011.

Intra Day Chart(13-04-2011)

|

| Just click on chart for its enlarged view |

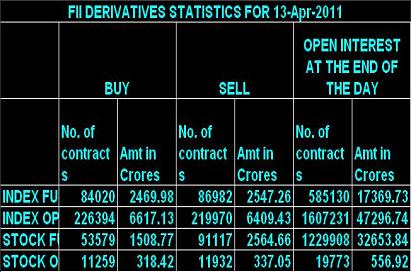

FII & DII trading activity in Capital Market Segment on 13-Apr-2011

| ||||||||||||||||

| ||||||||||||||||

Bank Nifty(Apr Fut)-Levels & Trading Strategy for 15-04-2011

Bank Nifty(Apr Fut)-Levels

R3 12424

R2 12171

R1 12037

Avg 11784

S1 11650

S2 11397

S3 11263

Bank Nifty(Apr Fut)-Trading Strategy

H6 12302 Trgt 2

H5 12209 Trgt 1

H4 12115 Long breakout

H3 12009 Go Short

H2 11973

H1 11938

L1 11867

L2 11832

L3 11796 Long

L4 11690 Short Breakout

L5 11596 Trgt 1

L6 11503 Trgt 2

R3 12424

R2 12171

R1 12037

Avg 11784

S1 11650

S2 11397

S3 11263

Bank Nifty(Apr Fut)-Trading Strategy

H6 12302 Trgt 2

H5 12209 Trgt 1

H4 12115 Long breakout

H3 12009 Go Short

H2 11973

H1 11938

L1 11867

L2 11832

L3 11796 Long

L4 11690 Short Breakout

L5 11596 Trgt 1

L6 11503 Trgt 2

Pre-closing(13-04-2011)

As $7 Cheaper Crude therefore excessive filled Jet tanks are flying all the global markets and Indian markets are shooting like rocket. First resistance(5830) is crossed and now travelling within next resistance 5870-5940.

Encouraging news and Strong global cues led rally today and correction is complete after higher levels condolidation. Last hurdle is 5940 and its crossing will mean 6120 fast.As correction is complete today therefore 6120 is expected in the coming week and for confirmation just watch crossing of 5940.

Correction completion possibility was told in all the today outlooks which were started after first half hour today.

Encouraging news and Strong global cues led rally today and correction is complete after higher levels condolidation. Last hurdle is 5940 and its crossing will mean 6120 fast.As correction is complete today therefore 6120 is expected in the coming week and for confirmation just watch crossing of 5940.

Correction completion possibility was told in all the today outlooks which were started after first half hour today.

Mid-session Outlook-2 (13-04-2011)

Crude price $7 fall fuelled global rally and European markets opened with good gains after all Asian markets lower levels recovery. Nifty is also sustaining above 5830 therefore it is strong indication of completiion of correction and higher levels consolidation after positive global news and global markets cues.

Today intra day charts are also suggesting strong cues led higher level consolidation therefore correction completion possibility is high now.

Mid-session Outlook(13-04-2011)

As crude price is more than $7 down in last 2 days therefore strong recovery in all the Asian markets and Indian markets today. Nifty crossed 5830,trading above and sustaining above also will mean clearance of immediate resistance and correction completion confirmation also. Today rally is news based therefore sustaining above first resistance(5830) is must for 100% confirmation.

Post-open Outlook-2(13-04-2011)

Global sentiment changed today after sharp fall in Crude rates therefore US and European futures are positive and all the Asian markets also recovered from lower levels. Sentiment reversed therefore Indian markets recovered and trading positive.

INFTEC audited results & final dividend will be declared on 15-Apr-2011 and market is up in expectation of good results also and Nifty is trading between immediate resistance range and crossing 5830 will be correction completion confirmation.

INFTEC audited results & final dividend will be declared on 15-Apr-2011 and market is up in expectation of good results also and Nifty is trading between immediate resistance range and crossing 5830 will be correction completion confirmation.

Post-open Outlook(13-04-2011)

Following line was told in Pre-open Outlook today:-

"recovery from lower levels after getting intra day support is possible today"

Nifty recovered 65 points from lower levels within first half hour today. Market showed strength and if Nifty sustains above 5800 today then correction completion will be considered.

"recovery from lower levels after getting intra day support is possible today"

Nifty recovered 65 points from lower levels within first half hour today. Market showed strength and if Nifty sustains above 5800 today then correction completion will be considered.

Correction is very much on & Wait for Consolidation

Pre-Open Market Outlook(13-04-2011)

All the Asian markets were down yesterday and SGX Nifty is trading 50 points down today therefore anyone can say for today weak Indian markets after getting negative cues but today weakness was proved at 05:45PM on 11-04-2011 through Nifty-Micro Analysis of Intra Day Chart(11-04-2011). Today weak Indian market was clearly told even before the declaration of FII & DII trading figures on that day.

Whatsoever will happen today,has alreay been told in all the outlooks posted on 11-04-2011 now today first intraday levels have to be decided which are as follows:-

1st trading range- 5730-5760

Technicals and correction levels have already been posted therefore just click following link which was posted on 10-04-2011 and go through topic to understand Indian markets present technical positions and retracement levels:-

Firstly Correction and then Consolidation Before Decisive Rally

Correction is on and in this process next possibilitis and watching levels are as follows:-

1- Expected that Nifty will not finally sustain below 5561

2- 200 Day EMA is today at 5610 and also expected that Nifty will not sustain below it.

3- 100 Day EMA is today at 5669 and will be watched for supports getting possibility.

4- 55 Day EMA is today at 5647 and also will be watched for supports getting possibility.

5- 1st Gap will give support(5529-5561)

Short term trend is down. Long term and Intermediate term trendS are up and will be down after sustaining below 5610 and 5647 respectively.

Weak market and negative closing expected with intra day voltality and recovery from lower levels after getting intra day support is possible today.

Following lines have been told many times since previous week and being repeated again:-

Correction is on,it will take its own time in this process,let it complete and consolidation start then up moves and long positions will be considered.

All the Asian markets were down yesterday and SGX Nifty is trading 50 points down today therefore anyone can say for today weak Indian markets after getting negative cues but today weakness was proved at 05:45PM on 11-04-2011 through Nifty-Micro Analysis of Intra Day Chart(11-04-2011). Today weak Indian market was clearly told even before the declaration of FII & DII trading figures on that day.

Whatsoever will happen today,has alreay been told in all the outlooks posted on 11-04-2011 now today first intraday levels have to be decided which are as follows:-

1st trading range- 5730-5760

Technicals and correction levels have already been posted therefore just click following link which was posted on 10-04-2011 and go through topic to understand Indian markets present technical positions and retracement levels:-

Firstly Correction and then Consolidation Before Decisive Rally

Correction is on and in this process next possibilitis and watching levels are as follows:-

1- Expected that Nifty will not finally sustain below 5561

2- 200 Day EMA is today at 5610 and also expected that Nifty will not sustain below it.

3- 100 Day EMA is today at 5669 and will be watched for supports getting possibility.

4- 55 Day EMA is today at 5647 and also will be watched for supports getting possibility.

5- 1st Gap will give support(5529-5561)

Short term trend is down. Long term and Intermediate term trendS are up and will be down after sustaining below 5610 and 5647 respectively.

Weak market and negative closing expected with intra day voltality and recovery from lower levels after getting intra day support is possible today.

Following lines have been told many times since previous week and being repeated again:-

Correction is on,it will take its own time in this process,let it complete and consolidation start then up moves and long positions will be considered.

Post-closing Report(11-04-2011) & 13 Apr 2011 Outlook

Correction was told daily in last week and also told weak Indian markets in those 7 topics which were posted for this week trading in last 3 days. Although Business News Channels were telling for positive IIP above 5.2% but Weak market was told in Post-open Outlook before the announcement of IIP Data when Nifty was at 5819.

Main features of today trading are as follows

1- Gap down

2- Trading Range- 5785-5830

3- Selling patterns between- 5792-5830

4- Panic selling by retailers after Japan Quake news therefore minor support possible in last 1 hour.

5- Red Bearish Candle

6- Closing near lows after whole day selling.

Ratios:

Nifty Put Call Ratio:0.98

Nifty P/E Ratio(08-04-2011):22.18

Advances & Declines

BSE ADVANCES :1110

BSE DECLINES :1786

NSE ADVANCES : 441

NSE DECLINES : 976

Nifty Open Interest Changed Today

Nifty- 5700 CE(28APR2011)- +126450(+4.83%)

Nifty- 5700 PE(28APR2011)- +466000(+7.20%)

Nifty- 5800 CE(28APR2011)- +874000(+19.43%)

Nifty- 5800 PE(28APR2011)- -398550(-7.33%)

Nifty- 5900 CE(28APR2011)- -55400(-0.87%)

Nifty- 5900 PE(28APR2011)- -532200(-16.30%)

Closing

Nifty- closed at 5,785.70(-56.30 Points & -0.96%)

Sensex- closed at 19,262.54(-188.91 Points & -0.97%)

CNX MIDCAP - closed at 8,229.95(-58.35 Points & -0.70%)

BSE SMALL CAP- closed at 8,709.91(-62.64 Points & -0.71%)

Nifty-Micro Analysis of Intra Day Chart(11-04-2011):-

13 Apr 2011 Outlook

Selling proved in previous week between 5855-5945 and follow up selling between 5792-5830 today and no consolidation pattern today except last 1 hour intraday support possibility due to retailers panic selling after Japan Quake news.

Opening will depend on global sentiments but expected that Nifty will finally sustain below 5800 and weak markets expected. Market require complete consolidation after mentioned selling and until that will not happen till then Indian markets will not move up.

Correction is on and let it complete then rally will begin therefore will be better to wait for completion of correction and consolidation process. Technicals and correction levels have already been posted therefore just click and go through following topic to understand Indian markets present technical positions:-

Firstly Correction and then Consolidation Before Decisive Rally

Main features of today trading are as follows

1- Gap down

2- Trading Range- 5785-5830

3- Selling patterns between- 5792-5830

4- Panic selling by retailers after Japan Quake news therefore minor support possible in last 1 hour.

5- Red Bearish Candle

6- Closing near lows after whole day selling.

Ratios:

Nifty Put Call Ratio:0.98

Nifty P/E Ratio(08-04-2011):22.18

Advances & Declines

BSE ADVANCES :1110

BSE DECLINES :1786

NSE ADVANCES : 441

NSE DECLINES : 976

Nifty Open Interest Changed Today

Nifty- 5700 CE(28APR2011)- +126450(+4.83%)

Nifty- 5700 PE(28APR2011)- +466000(+7.20%)

Nifty- 5800 CE(28APR2011)- +874000(+19.43%)

Nifty- 5800 PE(28APR2011)- -398550(-7.33%)

Nifty- 5900 CE(28APR2011)- -55400(-0.87%)

Nifty- 5900 PE(28APR2011)- -532200(-16.30%)

Closing

Nifty- closed at 5,785.70(-56.30 Points & -0.96%)

Sensex- closed at 19,262.54(-188.91 Points & -0.97%)

CNX MIDCAP - closed at 8,229.95(-58.35 Points & -0.70%)

BSE SMALL CAP- closed at 8,709.91(-62.64 Points & -0.71%)

Nifty-Micro Analysis of Intra Day Chart(11-04-2011):-

|

| Just click on chart for its enlarged view |

Selling proved in previous week between 5855-5945 and follow up selling between 5792-5830 today and no consolidation pattern today except last 1 hour intraday support possibility due to retailers panic selling after Japan Quake news.

Opening will depend on global sentiments but expected that Nifty will finally sustain below 5800 and weak markets expected. Market require complete consolidation after mentioned selling and until that will not happen till then Indian markets will not move up.

Correction is on and let it complete then rally will begin therefore will be better to wait for completion of correction and consolidation process. Technicals and correction levels have already been posted therefore just click and go through following topic to understand Indian markets present technical positions:-

Firstly Correction and then Consolidation Before Decisive Rally

FII & DII trading activity in Capital Market Segment on 11-Apr-2011

| ||||||||||||||||

| ||||||||||||||||

Subscribe to:

Posts (Atom)