Rally continuation towards 6724.60

Nifty-Intra Day Chart (31-Oct-2013):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in today intraday charts

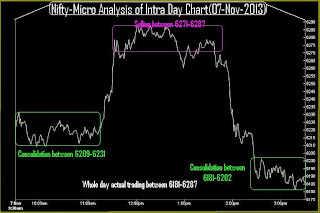

1- Consolidation between 6240-6273

2- Lower levels supports and higher bottom formations.

3- Whole day actual trading between 6240-6309

Conclusions from intra day chart analysis

Nifty crossed 6300 today but all the previous Outlooks of last weeks are live proofs of this fact that we told more than 25 times only for Bullish markets. Even when all were expecting Repo rate hike then also we told following line on 28-10-1913 ie one day before of RBI Credit Policy in Technical Analysis and Market Outlook(29-10-2013):-

finally impulsive Wave-3 will remain continued towards 6724.60 despite whatsoever RBI Credit policy on 29-10-2013 and FOMC declarations on 30-10-2013 night.

Whatsoever was predicted all that proved 100% accurate and:-

1- Nifty closed 119.80 points up after RBI Credit policy on 29-10-2013.

2- Nifty closed 47.45 points up after FOMC declarations today.

All wait for RBI Credit policy and FOMC declarations but we accurately predicted Indian markets well before with full confidence before the happening of above Economic events.

Not only on 28-10-2013 but 'Archive' at the bottom of this 'Blog' is live proof of more than hundreds of such accurate and miraculous predictions in last 4 years. Anyone can verify this fact anytime from the 'Blog Archive'.

Although all the Global markets were weak after FOMC announcements today but Indian markets consolidated more than first 5 hours within flat to negative and range bound quiet moves. As strong recovery in last half hour and closing near the highest of the day today. As no selling seen yet therefore rally continuation towards 6724.60 will be seen in the coming sessions but volatility may be high because sentiment is heated and Short Term Indicators are overbought therefore market has to consolidate also.

Nifty target at 6724.60 has already been updated on 21-10-2013 with calculations and Technical reasons. Just click following topic link and understand:-