Rally continuation & Watch crucial levels also for the confirmation of Upward Trends strength

Technical Analysis,Research & Weekly Outlook

(Mar 06 to Mar 10,2023)

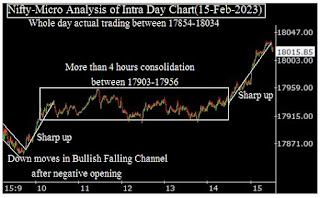

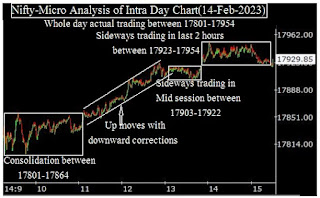

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (03-Mar-2023):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-(i) of Wave-[(iii)] of Wave-1 completion at 18887.6 on 01-12-2022 and corrective Wave-(ii) of Wave-[(iii)] of Wave-1 beginning

2- Corrective Wave-(ii) of Wave-[(iii)] of Wave-1 continuation with recent bottom formations at 17255.2 on 28-02-2023.

3- Stochastic- %K(5) line has intersected %D(3) line upward and its both lines are rising from Over sold zone.

4- Stochastic:- %K(5)- 53.35 & %D(3)- 35.61.

5- In MACD- MACD line has intersected Average line downward and its both lines are falling in negative zone.

6- MACD(26,12)- -209.26 & EXP(9)- -64.83 & Divergence- -144.43

Conclusions from EOD chart analysis

(Stochastic & MACD)

Impulsive Wave-(i) of Wave-[(iii)] of Wave-1 completed at 18887.6 and its corrective Wave-(ii) sarted which is in continuation with recent bottom formations at 17255.2 on 26-02-2023 and no confirmation of its completion yet on EOD charts.

Positions of Daily indicators are as follows:-

1- In Stochastic- %K(5) line has intersected %D(3) line upward and its both lines are rising from Over sold zone therefore showing signals of Short Term up moves continuation in next week.

2- In MACD- MACD line has intersected Average line downward and its both lines are falling in negative zone therefore indicating Downward trend formations.

As according to Stochastic up moves will be firstly seen therefore during or after up moves completion if MACD starts to show Upward trend formation signals through MACD line Upward intersection of Average line then decisive more up moves will be seen otherwise decisive down moves will be seen after Short Term up moves completion confirmations.

Nifty-EOD Chart Analysis

(Averages)

Nifty-EOD Chart (03-Mar-2023):-

Technical Patterns and Formations in EOD charts

Averages:-

A- 5-Day SMA is today at 17412

B- 21-Day SMA is today at 17710

C- 55-Day SMA is today at 17895

D- 100-Day SMA is today at 18012

E- 200-Day SMA is today at 17404

Conclusions from EOD chart analysis

(Averages)

Although Nifty tested Long Term Trend decider 200-Day SMA 4 times in previous week but finally closed well above it after big up moves last Friday which is first sign of strong rally beginning. Expected that Nifty will counter above mentioned Short and Intermediate Term Averages in the coming week/weeks therefore sustaining them beyond should be firstly watched for the confirmations of fresh rally beginning above 18000.

Nifty-Last 7 Sessions intraday

charts analysis

Nifty-Intra Day Chart (Feb 23 to Mar 03,2023):-

Technical Patterns formation in last 7 Sessions intraday charts

1- Selling(Resistances) in last 7 Sessions are as follows:-

A- Previous resistances are between 17544-17601

2- Consolidation(Supports) in last 7 Sessions are as follows:-

A- 17536-17577

B- 17452-17493

C- 17307-17333

D- 17256-17304

3- Last 7 Sessions actual trading between 17256-17644

Conclusions from 7 Sessions

intra day chart analysis

As lower levels good consolidation within previous 7 Sessions trading range therefore last Friday closing was near the higher levels of this range. As last resistances of previous 7 sessions trading range were between 17544-17601 therefore Nifty traded with consolidation and volatility within and near about this range more than 4 hours last Friday between 17536-17644 as well as prepare for next big moves in next week.

It is confirm that finally sustaining beyond 17536-17644 will generate mext one sided decisive moves therefore should be firstly watched in next week.

Nifty-Intra Day Chart Analysis

(03-Mar-2023)

Nifty-Intra Day Chart (03-Mar-2023):-

Technical Patterns formation in today intraday charts

1- Consolidation after strong opening between 17452-17493

2- Up moves with downward corrections

3- Consolidation in Mid-session between 17536-17577

4- Volatility in last 3 hours between 17586-17644

5- Whole day actual trading between 17428-17644

Conclusions from intraday

chart analysis

As firstly consolidation after strong opening and after that Up moves with downward corrections as well as follow up consolidation in Mid-session therefore up moves remained contnued till last hour. Although 1.57% positive closing but volatility was also seen in last 3 hours between 17586-17644 and last Friday closing was 50 points below intraday highest therefore Nifty will firstly trade and prepare for next decisive moves between 17586-1764 in the beginning of next week.

It should be kept in mind that lower levels good intraday consolidation was seen last Friday therefore until complete selling will not develop till then decisive down moves will not be seen and once fresh consolidation will mean again strong up moves beginning above last Friday highest(17644).

Conclusions

(After putting all studies together)

1- Short Term Trend is down and it will be up after sustaining above its decider 21-Day SMA(17710).

2- Intermediate Term Trend is down and it will be abovw after sustaining above its decider 55-Day SMA(17895).

3- Long Term Trend is up but at stake and its future will be decided through sustaining beyond its decider 200-Day SMA which is today at 17404.

Wave-(ii) of Wave-[(iii)] started from 18887.6 and in continuation with recent bottom formations at 17255.2 as well as no confirmation of its completion yet.

Strong intraday rally gaining 1.57% points with closing at 17594.35 was seen last Friday which was at last 7 sessions highest closing. As Nifty traded more than 4 hours between 17536-17644 with consolidation and volatility last Friday which was within and near about last resistances of previous 7 sessions trading range(17256-17601) and Short Term indicator Stochastic is also showing more up moves signals therefore firstly up moves are expected towards following resistances in the beginning of next week:-

1- 17651-17685

2- 17736-17755

3- 17773-17800(Gap resistance)

4- 17866-17891

5- 17902-17924

6- 17949-18022

7- 18069-18132

8- 18155-18192

9- 18216-18240

10- 18345-18387(Strong resistances)

Next crucial levels above last Friday closing are as follows:-

1- Short Term Trend decider 21-Day SMA(17710).

2- Intermediate Term Trend decider 55-Day SMA(17895).

3- Previous 24 sessions(23-12-2022 to 25-01-2023) trading range highest(18265).

Although firstly rally will remain continued in the beginning of next week but above mentioned multiple resistances are also lying above last Friday highest therefore continuous consolidation is also required for rally continuation and above mentioned crucial levels should also be watched for the confirmation of Upward Trends strength.