Sharp jump after expected BJP victory between 300-370 seats in UP Elections amid Russia-Ukraine war led huge volatility

Technical Analysis,Research & Weekly Outlook

(Mar 07 to Mar 11,2022)

Nifty-Weekly Chart Analysis

(Corrective Waves)

Nifty-Weekly Chart(04-Mar-2022):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC' correction beginning.

2- Corrective Wave-A completion at 16410.20 on 20-12-2021

3- Wave-B completion at 18351.00 on 18-01-2022.

4- Wave-C continuation with recent bottom formation at 16133.8 on 04-03-2022

Conclusions from Weekly chart analysis

(Corrective Waves)

Wave-A of "ABC" correction begun from 18604.50 on 19-10-2021 completed at 16410.20 on 20-12-2021 and Wave-B started. Wave-C begun after Wave-B completion at 18351.00 on 18-01-2022 which is now in continuation with its recent bottom formation at 16133.8 on 04-03-2022 and no indication of its completion yet on EOD and intraday charts.

Nifty-EOD Chart Analysis

(Averages)

Nifty-EOD Chart (04-Mar-2022):-

Technical Patterns and Formations in EOD charts

Averages

A- 5-Day SMA is today at 16561

B- 21-Day SMA is today at 17072

C- 55-Day SMA is today at 17246

D- 100-Day SMA is today at 17527

E- 200-Day SMA is today at 16937

Conclusions from EOD chart analysis

(Averages)

As last 6 Sessions trading was between 16134-16815 and it was below Long Term Trend decider 200-Day SMA(16937) therefore emergence of Long Term Trend turning down strong indication because 200-Day SMA is showing weakness through slipping below all the Intermediate Term averages also.

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (04-Mar-2022):-

Technical Patterns and Formations in EOD charts

1- Stochastic- %K(5) line has intersected %D(3) line downward and its both lines are falling towards Over sold zone.

2- Stochastic:- %K(5)- 34.68 & %D(3)- 43.01.

3- In MACD- MACD line has intersected Average line downward and its both lines are falling in negative zone.

4- MACD(26,12)- -421.26 & EXP(9)- -223.37 & Divergence- -197.89

Conclusions from EOD chart analysis

(Stochastic & MACD)

As in Stochastic both lines are falling towards Over sold zone after downward intersection and in MACD also both lines are falling in negative zone therefore indicators are showing weakness and more down moves possibilities.

Nifty-EOD Chart Analysis

(Fibonacci retracement levels)

Nifty-EOD Chart (04-Mar-2022):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C completion and Impulsive Wave-1 beginning from 7511.10 on 24-03-2020

2- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021

3- Corrective Wave-C continuation with recent bottom formation at 16133.8 on 04-03-2022

4- Fibonacci Retracement levels from Wave-1 to Wave-5(7511.10-18604.45)

13.0%-17,162.40(Corrected)

23.6%-15,986.42

27.0%-15,609.30

38.2%-14,366.79(Crucial)

50.0%-13,057.77(Crucial)

61.8%-11,748.76(Crucial)

70.7%-10,761.50

76.4%-10,129.10

78.6%- 9,885.09

88.6%- 8,775.75

Conclusions from EOD chart analysis

(Fibonacci retracement levels)

Waves structure which started from 7511.10 on 24-03-2020 through its Impulsive Wave-1 beginning had been completed after its Impulsive Wave-5 completion at 18604.50 on 19-10-2021. As "ABC" correction of this whole Waves structure(7511.10-18604.45) will be seen according to above mentioned Fibonacci Retracement levels therefore should be watched in the coming weeks and months for next Long Term Trends confirmations.

Now corrective Wave-C continuation with recent bottom formation at 16133.8 which is below 13.0%(17162) and little above 23.6%(15986) therefore firstly sustaining beyond 15986 should be watched in next week for correction completion indication above it and correction continuation below it as well correction continuation towards next levels at 38.2%(14366).

Nifty-EOD Chart Analysis (Bollinger Band)

Nifty-EOD Chart (04-Mar-2022):-

Technical Patterns and Formations in EOD charts

1- Last 6 sessions trading near Lower Band

2- Last Friday closing below Lower Band

Conclusions from EOD chart analysis

(Bollinger Band)

Bollinger Band is showing clear weakness of Indian markets because Nifty is continuously trading below its Middle Band for the last 29 sessions and post Budget-2022 rally also faced resistance at its Middle Band.

Nifty is hovering around its Lower Band for the last 6 sessions between 16134-16815 and finally break out above 16815 of this range will confirm rally towards Middle Band and 16134 will confirm deeper correction beginning below lower Band.

Nifty-Last 6 Sessions

intraday charts analysis

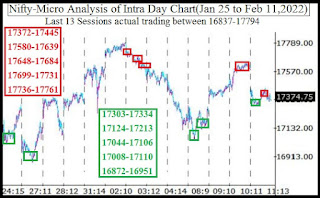

Nifty-Intra Day Chart (Feb 24 to Mar 04,2022):-

Technical Patterns formation in last 6 Sessions intraday charts

1- Selling(Resistances) in last 6 Sessions are as follows:-

A- 16531-16663

B- 16606 16661

C- 16491-16558

2- 8 Hours sideways trading between 16603-16740 on 25-02-2022 & 28-02-2022

3- Huge intraday volatility between 16134-16456 on 04-03-2022

4- Last 6 Sessions actual trading between 16134-16815

Conclusions from

6 Sessions intra day chart analysis

Although 8 Hours sideways trading was seen between 16603-16740 on 25-02-2022 & 28-02-2022 but war escalation news from Ukraine therefore weakness developed on 02-03-2022 which remained continued till last Friday and intraday continuous down moves were seen after that in next 3 sessions.

As huge intraday volatility between 16134-16456 on 04-03-2022 therefore firstly sustaining beyond this range should be watched in the coming week for next decisive moves beginning confirmations because technical positions reverses in such high volatility also.

Conclusions (After putting

all studies together)

All trends are down and Wave-C of "ABC' correction continuation as well as no indication of its completion yet on Weekly,EOD and intraday charts.

As Short Term indicators are suggesting more weakness therefore will be seen also but firstly sustaining beyond last 6 sessions lowest(16134) should be watched in the coming sessions because these 6 sessions trading was at the Lower Band of Bollinger Band and sustaining it beyond will generate next big moves. Last 6 sessions trading was below Long Term Trend decider 200-Day SMA(16937) and once sustaining below last 6 sessions lowest(16134) will mean Long Term Trend turning down confirmation and Wave-C continuation towards 38.2%(14366) retracement level therefore should be firstly 16134 should watched in the coming week/weeks

Exit-Polls of 5 States Assembly election will come on in next week on 7th March after market closing and finally results will be declared during trading hours on 10th March. Although Russia-Ukraine war led huge volatility will be seen but sharp jump of Nifty may also be seen in last 2 sessions of next week after expected BJP victory between 300 to 370 seats in UP Elections.