Firstly watch crucial level for first strong signal of deeper correction beginning

Technical Analysis,Research & Weekly Outlook

(Jun 22 to Jun 26,2020)

Nifty-EOD Chart Analysis

(Corrective Waves & Averages)

Nifty-EOD Chart (19-Jun-2020):-Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 completion at 12430.50 on 20-01-2020 and Wave-A of "corrective ABC Waves" beginning

2- Corrective Wave-A completion at 7511.10 on 24-03-2020 and Wave-B beginning

3- Wave-B continuation with recent top formation at 10328.5 on 08-06-2020

4- SMA(Simple Moving Averages)

A- 5-Day SMA is at 9988

B- 13-Day SMA is at 10029

C- 55-Day SMA is at 9336

D- 200-Day SMA is at 10917

Conclusions from EOD chart analysis

(Corrective Waves & Averages)

Wave-A of "corrective ABC Waves" started after Impulsive Wave-5 completion at 12430.50 on 20-01-2020. Corrective Wave-A completed at 7511.10 on 24-03-2020 and Wave-B begun which is in continuation with recent top formation at 10328.5 on 08-06-2020 and no confirmation of its completion yet.

Nifty closed above the Short Term(5,13) and Intermediate Term(55) averages last Friday therefore Short and Intermediate Term trends are up but Long Term Trend is down because Nifty closed below its decider 200-Day SMA(200).

Nifty-EOD Chart Analysis

(Waves B structure)

Nifty-EOD Chart (19-Jun-2020):-Technical Patterns and Formations in EOD charts

1- Corrective Wave-A completion at 7511.10 on 24-03-2020 and Wave-B beginning

2- Wave-a of Wave-B completion at 9889.05 on 30-04-2020

3- Wave-b of Wave-B completion at 8806.75 on 16-05-2020

4- Wave-c of Wave-B continuation with recent top formation at 10328.5 on 08-06-2020

5- Short Term correction of Wave-c of Wave-B completed at 9544.35 on 12-06-2020

6- Wave-c of Wave-B continuation with recent top formation at 10272.4 on 19-06-2020 after Short Term correction completion.

Conclusions from EOD chart analysis

(Waves B structure)

Wave-B started after Wave-A completion at 7511.10 on 24-03-2020 and now its Wave-c of Wave-B is on with recent top formation at 10328.5 on 08-06-2020.

Short Term correction of Wave-c of Wave-B begun which completed at 9544.35 on 12-06-2020. Now Wave-c of Wave-B continuation with recent top formation at 10272.4 on 19-06-2020 after Short Term correction completion and no signal of its completion yet on EOD Charts.

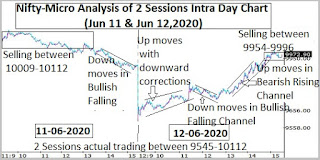

Nifty-Intra Day Chart Analysis

(19-06-2020)

Nifty-Intra Day Chart (19-Jun-2020):-Technical Patterns formation in today intraday charts

1- Consolidation between 10073-10136 with Down moves in Bullish Falling Channel within it

1- Up moves in Bearish Rising Channel

3- Selling between 10184-10224

4- Selling between 10231-10272

5- Whole day actual trading between 10073-10272

Conclusions from intra day chart analysis

Although last Friday closing was at the top of the day and also at the highest of last 6 sessions that Pull Back Rally which started from 9544.25 on 12-06-2020 but higher levels good selling was seen and up moves after 11:00 AM were also in Bearish Rising Channel therefore signals of on going Pull Back Rally completion and its correction beginning.

As more than first one hour consolidation between 10073-10136 with Down moves in Bullish Falling Channel within it therefore firstly sustaining it beyond should be watched in the beginning of next week for correction and decisive big down moves beginning confirmations.

Conclusions

(After Putting All Studies Together)

1- Long term trend is down.

2- Intermediate term trend is up.

3- Short term trend is up.

Impulsive Wave-5 completed at 12430.50 on 20-01-2020 and after that Wave-A begun which completed at 7511.10 on 24-03-2020 and Wave-B begun which is on.

Now Wave-c of Wave-B continuation with recent top formation at 10328.5 on 08-06-2020 and no confirmation of its completion yet. Short Term correction of Wave-c of Wave-B developed which completed at 9544.35 on 12-06-2020 and up moves of Wave-c of Wave-B begun which are in continuation with recent top formation at 10272.4 on 19-06-2020.

As good selling patterns formations at higher levels of the day on 19-06-2020 and firstly down moves will be seen in the beginning of next week therefore firstly following supports should be watched in next week:-

1- 10073-10136

2- 9966-9987

3- 9729-9818

4- 9660-9775

5- 9445-9520

Immediate resistances of Nifty(updated in previous weekly Outlook also) are lying between 10234-10328 and Nifty closed near the lower levels of this range at 10244.40 after fresh selling within and below(10231-10272 and 10184-10224) this range on 19-06-2020. As firstly down moves are expected in the beginning of next week therefore firstly sustaining beyond 10184 should be watched in next week because if Nifty will sustain below it then it will give first strong signal of Wave-B completion at 10328.5 on 08-06-2020 after almost double top formation at 10272.4 on 19-06-2020.

As 10184 will generate first strong signal of Wave-B completion at 10328.5 on 08-06-2020 and resultant correction will be considered towards and below the bottom of Wave-A(7511.10) therefore it has become crucial level hence should be firstly watched in the coming week for it.