11080 will confirm only a strong Pull Back Rally amid finally correction continuation expectations

Technical Analysis,Research & Weekly Outlook

(Aug 05 to Aug 09,2019)

Nifty-EOD Chart Analysis(Waves structure)

Nifty-EOD Chart (02-Aug-2019):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-1 beginning from 6825.80 on 29-02-2016 after 1 financial year(2015-16) correction completion.

2- Impulsive Wave-1 completion at 8968.70 on 07-09-2016 and corrective Wave-2 beginning

3- Corrective Wave-2 completion at 7893.80 on 26-12-2016 and impulsive Wave-3 beginning

4- Impulsive Wave-3 completion at 11760.20 on 28-08-2018 and corrective Wave-4 beginning

5- Corrective Wave-4 completion at 10004.55 on 26-10-2018 and impulsive Wave-5 beginning

6- Impulsive Wave-5 completion after life time top formation at 12103.00 on 03-06-2019 and corrective Wave-A beginning

7- Corrective Wave-A continuation with recent bottom formation at 10848.95 on 02-08-2019

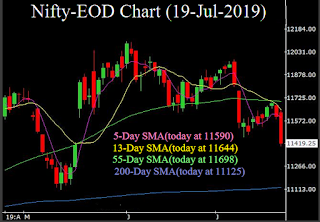

Nifty-EOD Chart Analysis(Corrective Waves)

Nifty-EOD Chart (02-Aug-2019):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 completion after life time top formation at 12103.00 on 03-06-2019 and corrective Wave-A of "ABC" correction beginning

2- Corrective Wave-A continuation with recent bottom formation at 10848.95 on 02-08-2019

4- Long Term Trend decider 200-Day SMA(today at 11154)

5- Short Term Indicator "Stochastic" is showing positive divergence in Oversold zone.

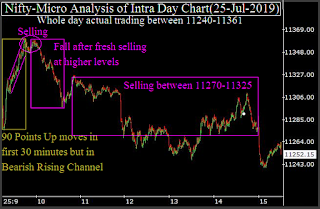

Nifty-Intra Day Chart Analysis(02-Aug-2019)

Nifty-Intra Day Chart (02-Aug-2019):-

|

| Just click on chart for its enlarged view |

Technical Patterns formation in today intraday charts

1- Consolidation between 10849-10892(Immediate Supports)

2- Down moves in Bullish Falling Channel

3- Mixed Patterns formation between 10971-11080

4- Whole day actual trading between 10849-11080

Conclusions from EOD chart analysis(Waves structure)

As correction begun after 5 impulsive Waves completion therefore it will correct whole 27 months rally which started on 29-02-2016 from 6825.80 and completed at 12103.00 on 03-06-2019 and will correct 5278 points of this rally in "ABC Waves structure". Now the journey of its corrective Wave-A is on and no confirmation of its completion yet because lowest of on going correction was formed recently on last Friday.

Conclusions from EOD chart analysis(Corrective Waves)

Corrective Wave-A of "ABC" correction continuation and with forceful down moves last 4 consecutive sessions closing below Long Term Trend decider 200-Day SMA(today at 11154) therefore Long Term Trend turning down confirmation.

As Nifty is moving down and Short Term Indicator "Stochastic" is moving up in Oversold zone therefore positive divergence development which is an indication of Pull Back rally in the coming sessions.

Conclusions from intra day chart analysis(02-Aug-2019)

Although firstly slipping after 50 points weaker opening but lower levels consolidation developed therefore 231 points strong recovery was seen. As Indian markets are in the grip of Bears therefore higher levels selling was also seen in last 2 hours.

As both lower levels supports and higher levels selling on 02-08-2019 therefore firstly nifty has to trade and prepare within and near about 10849-11080 in the beginning of next week and finally valid break out of this range will confirm next decisive moves.

Conclusions (After Putting All Studies Together)

All the trends have turned down during corrective Wave-A of "ABC" correction journey and no indication of its Wave-B beginning because firstly down moves have to stop and consolidation patterns have to develop on intraday and EOD charts,until it will not happen till then corrective Wave-A continuation will be considered.

Corrective Wave-A of that 5 Waves rally is very much on which started from 6825.80 on 29-02-2016 and finished at 12103.00 on 03-06-2019 after gaining 5278 points in 27 months and Nifty will correct whole this rally points-wise and time-wise.

Fibonacci Retracement levels of Wave-1 to Wave-5(6825-12103) are as follows which were updated in 2 previous Weekly Outlooks also:-

1- 13.0%-11,416(Retraced)

2- 23.6%-10,857(Retraced)

3- 27.0%-10,677

4- 38.2%-10,086(Crucial)

5- 50.0%-9,464(Crucial)

6- 61.8%-8,841(Crucial)

7- 70.7%-8,371

8- 76.4%-8,070

9- 78.6%-7,954

10-88.6%-7,426

Next supports of Nifty are as follows:-

1- 10583-10694(strong)

2- 10540-10567

3- 10468-10494

4- 10347-10405

Next resistances of Nifty are as follows:-

1- 11086-11145

2- 11270-11361

3- 11467-11493

4- 11511-11543

5- 11637-11700

Expected that on going correction will stay long within above mentioned 1st supports(10583-10694) because multiple supports are lying between and just below it as well as 27.0% retracement levels is also within it at 10,677.

As good consolidation between and above 10849-10892 last Friday therefore this range will be immediate supports of Nifty and if follow up supports develops in the beginning of next week then only a strong Pull Back Rally will be seen because consolidation was seen between 10881-11005 last Thursday also. As valid break out of last 2 sessions highest(11080) will be its beginning confirmation therefore should also be watched amid finally correction continuation expectations.