Minimum Target of Nifty at 8844.55

Technical Analysis,Research & Weekly Outlook

(May 30 to Jun 03,2016)

Nifty-EOD Chart (27-May-2016):- |

| Just click on chart for its enlarged view |

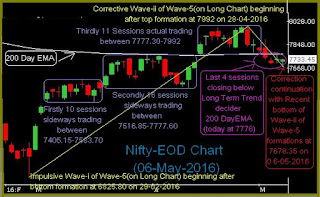

1- Impulsive Wave-1 beginning after bottom formation at 6825.80 on 29-02-2016

2- Wave-1(7992 on 28-04-2016)

3- Wave-2(7678.35 on 06-05-2016)

4- Wave-3 continuation with top formation at 8164.20 on 27-05-2016

5- 28 Sessions trading range(7678-7992) broken out forcefully on 26-05-2016

6- Long Term Trend turning up confirmation after confirmation of sustaining above its decider 200 Day EMA(today at 7786)

Conclusions from EOD chart analysis

All trends turning up confirmations after the confirmation of sustaining above Long Term Trend decider 200 Day EMA(today at 7786) in previous week. As 28 Sessions trading range(7678-7992) also broken out forcefully on 26-05-2016 therefore Wave-3 beginning confirmation also in previous week after Wave-2 completion confirmations at 7678.35 on 06-05-2016. Wave-3 is very much on towards its minimum target at 8844.55. Calculations of Wave-3 minimum target is as follows:-

As per Elliott Wave theory "Wave-3 should not be shorter than both Wave-1 and Wave-5". Impulsive Wave-3 is on and it should gain more points than Wave-1 gained.

Wave-1 gained 7992-6825.80=1166.20 Points

Wave-3 started from 7678.35 and and as per Elliott Wave theory it should gain minimum 1166.20 points because it can not be shorter than Wave-1 therefore its minimum target is at:-

8844.55=7678.35(Wave-3 started)+1166.20(Wave-1 gained)

As strong rally in last 3 sessions and very Short Term oscillators have turned overbought therefore very Short Term correction possibility can not be ruled out any day in next week but finally last week started rally will remain continued towards 8844.55 with only very Short Term and sideways corrections.

Next resistances above previous week highest are as follows:-

1- 8260-8315

2- 8470-8520

3- 8575-8652