7790-7992 will confirm more than 3 % one sided decisive moves

Technical Analysis,Research & Weekly Outlook

(May 02 to May 06,2016)

Nifty-EOD Chart (29-Apr-2016):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

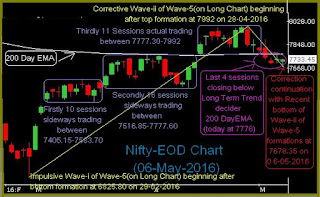

1- Impulsive Wave-i of Wave-5(on Long Chart) beginning after bottom formation at 6825.80 on 29-02-2016

2- Firstly 10 sessions sideways trading between 7405.15-7583.70

3- Secondly 16 sessions sideways trading between 7516.85-7777.60

4- Thirdly last 10 Sessions actual trading between 7790-7992

5- Rally continuation with Recent top of Wave-i of Wave-5 formations at 7992 on 28-04-2016

Conclusions from EOD chart analysis

It is the peculiar character of post Budget 2016-17 rally is that Nifty is turning sideways after every 1/2 sessions decisive up moves for the last 36 sessions and now also Nifty is range bound within 7790-7992 for the last 10 Sessions as well as finally sustaining beyond this trading range will decide next Trend.

Previous 10 Sessions intraday charts analysis

Nifty-Intra Day Chart (Apr 13 to Apr 29,2016):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in last 10 Sessions intraday charts

1- Previous 9 sessions actual trading between 7796-7992 with lower levels supports and higher levels selling

2- Previous 9 sessions trading range broken down on 29-04-2016

3- Closing within Previous 9 sessions trading range after lower levels consolidation on 29-04-2016

4- 10 Sessions actual trading between 7790-7992

Conclusions from 10 Sessions intra day chart analysis

Previous 9 sessions actual trading between 7796-7992 with lower levels supports and higher levels selling and this trading range was broken down on 29-04-2016 but Nifty closed also within Previous 9 sessions trading range at 7849.80 same day after lower levels good consolidation and 100 points recovery also therefore still Nifty will be understood sideways within 10 Sessions actual trading range between 7790-7992 and finally sustaining beyond this range will decide next more than 3% moves.

Previous 4 Sessions intraday charts analysis

Nifty-Intra Day Chart (Apr 26 to Apr 29,2016):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in last 4 Sessions intraday charts

1- Support between 7823-7852 on 26-04-2016

2- Selling between 7963-7991 on 26,27 & 28-04-2016

3- Sharp fall on 28-04-2016

4- Good consolidation on on 29-04-2016

5- 4 Sessions actual trading between 7790-7992

Conclusions from 4 Sessions intra day chart analysis

As good lower levels consolidation and equally good higher levels selling also in last 4 sessions therefore firstly Nifty has to prepare for next decisive moves within last 4 Sessions actual trading range(7790-7992) and expected that Nifty will firstly trade and prepare for next decisive moves within this crucial range in the beginning of next week.

Intra Day Chart Analysis(29-04-2016)

Nifty-Intra Day Chart (29-Apr-2016):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in today intraday charts

1- Down moves in Bullish Falling Channel

2- Consolidation Patterns between 7790-7810

3- Whole day actual trading between 7790-7889

Conclusions from intra day chart analysis

Although most Asian markets were trading in deep Red after more than 1% negative closing of US markets last Thursday but Indian markets traded most time flat to positive in first 3 hours and moved down sharply only after deep Red opening of European markets. As Indian markets flat closing amid all the Global markets closing in Red and some closed more than 2.5% down also therefore it is clear that Indian markets completely out performed all Global markets last Friday which is a sign of Indian markets strength.

AS firstly down moves in Bullish Falling Channel and after that lower levels consolidation between 7790-7810 therefore it will be immediate support of Nifty and until Nifty will not sustain below 7790 after complete selling till then decisive down moves will not be seen and follow up consolidation in the beginning on next week will mean first strong signal of last Thursday started correction completion as well.

Conclusions (After Putting All Studies Together)

Trends of Nifty are as follows:-

1- Short Term Trend is sideways between 7790-7992.

2- Intermediate Term Trend is up

3- Long Term Trend is up after last 10 sessions closing above it decider 200 Day EMA(today at 7777).

As post Budget Rally is correcting in sideways trading range and deeper correction is not being seen as well as Long Term Trend turning up confirmation through last 10 sessions closing above it decider 200 Day EMA(today at 7777) therefore still rally continuation will be considered but follow up consolidation is must within last 10 sessions trading range(7790-7992) because good selling was seen between 7963-7991 in last 4 sessions.

Intraday good consolidation above 7790 last Friday and it will be understood first indication of some up moves in the beginning of next week but until nifty will not sustain above 7992 after complete consolidation till then decisive up moves will not be seen therefore firstly sustaining beyond 7790-7992 should be watched in next week for more than 3 % one sided decisive moves.