Huge Bearish Pattern formation in last 11 months

Technical Analysis,Research & Weekly Outlook

(Aug 19 to Aug 23,2013)

Nifty-EOD Chart (16-Aug-2013):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- 4531.15 on 20-12-2011(Rally beginning after 13 Months correction completion)

2- Wave-1(5629.95 on 22-02-2012)

3- Wave-2(4770.35 on 04-06-2012)

4- Wave-3(6111.80 on 29-01-2013)

5- Wave-4(5477.20 on 10-04-2012)

6- Wave-5(6229.45 on 20-05-2013) and 'ABC' correction continuation.

7- Wave-A(5566.25 on 24-06-2013)

8- Wave-B(6093.35 on 23-07-2013)

9- Wave-C continuation with bottom formation at 5486.85 on 07-08-2013

10 Pull Back Rally termination and bottom formation at 5496.05 on 16-08-2013.

Waves Structure of 'ABC' Correction

Nifty-EOD Chart (16-Aug-2013):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Wave-4(5477.20 on 10-04-2012)

2- Wave-5(6229.45 on 20-05-2013) and 'ABC' correction continuation.

3- Wave-A(5566.25 on 24-06-2013)

4- Wave-B(6093.35 on 23-07-2013)

5- Wave-C continuation with bottom formation at 5486.85 on 07-08-2013

6- Pull Back Rally top formation at 5754.55 on 14-08-2013.

10 Pull Back Rally termination and bottom formation at 5496.05 on 16-08-2013.

11 Months huge most Bearish Head and Shoulders patterns formation from 14-09-2012 to 16-08-2013

Nifty-EOD Chart (16-Aug-2013):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- 11 Months huge Head and Shoulders patterns formation

2- Neckline at 5477.20

3- Long Term Trend turning down confirmations through Nifty sustaining below Long Term Trend decider 200-Day EMA(today at 5776)

Nifty-Intra Day Chart (Aug 13 to Aug 16,2013):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in last 3 Sessions intraday charts

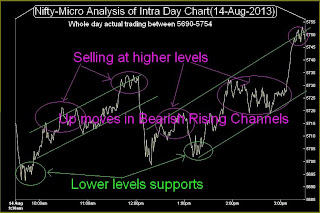

1- Up moves in Bearish Rising Channel on 13 and 14 Aug 2013.

2- 2 Days up moves reversed in 1 hour on 14 Aug 2013

3- Follow up selling after 1st hour huge fall

3- 3 Sessions actual trading between.

Conclusions from 3 Sessions intra day chart analysis

Although strong up moves on 13 and 14 Aug 2013 but in Bearish Rising Channel therefore we told:-

1- In Technical Analysis and Market Outlook(14-08-2013):-

Nifty will not be able to cross next resistance range(5740-5765) and fresh down moves will begin after development of follow up selling in the coming sessions.

2-In Technical Analysis and Market Outlook(16-08-2013):-

1- Bearish Rising Channels therefore high possibility of today trading range breaking down

2-once sustaining below today lowest(5690) will mean termination of on going Pull Back Rally

As 2 sessions up moves were in Bearish Rising Channel therefore Nifty whole 2 sessions up moves become zero in first hour and Nifty formed 5578 at 10:11 AM on 16-08-2013. As was told in both above mentioned previous sessions same happened and down moves begun after development of follow up selling as well as Nifty reversed from 5754 and could not cross 5765.

Follow up selling was also seen after 1st hour sharp fall on 16-08-2013 therefore intraday charts of last Friday are suggesting more down moves in the coming sessions.

Conclusions (After Putting All Indicators Together)

All trends turned down after huge fall on 16-08-2013 and Indian markets are in Bear phase. Correction of whole rally between 4531.15-6229.45 was told many times in previous Weekly Analysis and it is being continuously seen. just click Weekly Outlook for:-

1- Retracement levels whole rally between 4531.15-6229.45

2- Detailed analysis of Waves structure.

Most Bearish huge Head and Shoulders patterns formation developed in last 11 Months and its neckline is at 5477.20 which is between next gap support(5447-5526). As all trends are down and such huge Bearish pattern neckline broken down also therefore high possibility of sustaining below gap support lowest(5447).

As we don't want to create panic through updating next expected levels after sustaining below 5447 therefore only giving next following support levels upto 4779:-

1- 5210-5270

2- 5075-5140

3- 4779-4880

It is confirm that Indian markets are in Bear phase and Economic Outlook is also gloomy in the next months as well as political uncertainty can not be ruled out after next General Elections therefore Indian markets will remain in the grip of Bears. Pull Back and Relief rallies will be seen after regular intervals after intraday or 1/2 day consolidations but until complete consolidation will not complete on Intraday,EOD and Weekly charts till then Long Term Trend will not reverse.

Bear Market Trading Strategy

Mouth water lower levels of good stocks nowadays but it should also be kept in mind that Stocks levels remain different in Bull and Bear markets and present levels are Bear markets rates and may be more down also after Bear markets deepening. "Buying in falling markets is like catching Falling Knief resultant one's hand full of one's own Blood" therefore just wait before any investment and get confirmation of bottom formation as well as consolidation completion on Daily charts. Firstly buying should be done for Short or Intermediate Term and should be converted into Long Term only after stock sustaining above Long Term decider 200 Day EMA otherwise must be squared up.

Bounce Back or Pull Back Rallies may be seen any day after lower levels intraday supports and 2/3 hours consolidations because Bear Markets remains highly volatile therefore both side(up and down) trading opportunities will be seen in good amount.