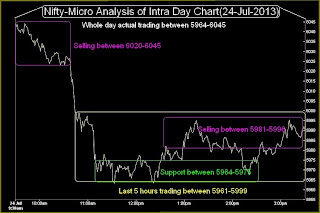

Nifty-Intra Day Chart (Jul 26 & Jul 29,2013):-

Technical Patterns and Formations in last 2 Sessions intraday charts

1- 2 Sessions Down moves within Bullish Falling Channel.

3- 2 Sessions actual trading between 5827-5944

Long Term Trend is up, Intermediate and Short Term Trends turned down after the beginning on going Wave-C correction. Last 2 sessions continuous down moves but within Bullish Falling Channel therefore sharp up moves or intraday volatility can not be ruled out after any positive announcement in RBI Credit policy tomorrow and/or FOMC meet after 30-31 July 2013.

As corrective Wave-C continuation and finally down moves are expected therefore volatility for the cutting of both sides stop losses is expected in the coming sessions,as it was seen today and both new intraday high and new intraday low formation was seen after 12:30 PM in Nifty Jul Fut.

|

| Just click on chart for its enlarged view |

1- 2 Sessions Down moves within Bullish Falling Channel.

3- 2 Sessions actual trading between 5827-5944

Conclusions from 2 Sessions intra day chart analysis

Long Term Trend is up, Intermediate and Short Term Trends turned down after the beginning on going Wave-C correction. Last 2 sessions continuous down moves but within Bullish Falling Channel therefore sharp up moves or intraday volatility can not be ruled out after any positive announcement in RBI Credit policy tomorrow and/or FOMC meet after 30-31 July 2013.

As corrective Wave-C continuation and finally down moves are expected therefore volatility for the cutting of both sides stop losses is expected in the coming sessions,as it was seen today and both new intraday high and new intraday low formation was seen after 12:30 PM in Nifty Jul Fut.