| ||||||||||||||||

| ||||||||||||||||

Trading "calls" from our "Software" with more than "90% accuracy"

Trading Calls

More than "12 years" old "only site of whole world"

with more than "9700 accurate Outlooks" of

"Indian Stock Markets"

FII & DII trading activity in Capital Market Segment on 18-Jan-2013

Indian Stock Markets Closing Reports(18-Jan-2013)

1- Benchmark Indices closed in Green while CNX Midcap and CNX Smallcap closed in Red.

2- Good opening after strong global cues but mixed closing and most Indices closed with small gains or small loss.

3- Small White candle formation.

Ratios

Index Options Put Call Ratio: 1.07

Total Options Put Call Ratio: 0.96

Nifty P/E Ratio(18-Jan-2013):18.30

Advances & Declines

BSE Advances : 1,272

BSE Declines : 1,675

NSE Advances : 569

NSE Declines : 873

Nifty Open Interest Changed Today

Nifty- 5700 CE(Jan)- -15,300(-2.30%)

Nifty- 5700 PE(Jan)- -515,400(-10.26%)

Nifty- 5800 CE(Jan)- 8,550(0.93%)

Nifty- 5800 PE(Jan)- -230,550(-2.85%)

Nifty- 5900 CE(Jan)- -149,350(-9.00%)

Nifty- 5900 PE(Jan)- 468,850(5.63%)

Nifty- 6000 CE(Jan)- -216,650(-5.01%)

Nifty- 6000 PE(Jan)- 753,650(10.29%)

Nifty- 6100 CE(Jan)- 415,500(7.04%)

Nifty- 6100 PE(Jan)- 421,500(21.66%)

Closing

Sensex- closed at 20,039.04(75.01 Points & 0.38%)

Nifty- closed at 6,064.40(25.20 Points & 0.42%)

CNX Midcap - closed at 8,591.35(-1.50 Points & -0.02%)

CNX Smallcap- closed at 3,783.65(-3.50 Points & -0.09%)

Nifty Spot-Levels & Trading Strategy for 21-01-2013

R3 6117

R2 6100

R1 6082

Avg 6065

S1 6047

S2 6030

S3 6012

Nifty Spot-Trading Strategy

H6 6099 Trgt 2

H5 6091 Trgt 1

H4 6083 Long breakout

H3 6073 Go Short

H2 6070

H1 6067

L1 6060

L2 6057

L3 6054 Long

L4 6044 Short Breakout

L5 6036 Trgt 1

L6 6028 Trgt 2

Nifty(Jan Fut)-Levels & Trading Strategy for 21-01-2013

R3 6126

R2 6110

R1 6092

Avg 6076

S1 6058

S2 6042

S3 6024

Nifty(Jan Fut)-Trading Strategy

H6 6108 Trgt 2

H5 6100 Trgt 1

H4 6092 Long breakout

H3 6083 Go Short

H2 6080

H1 6077

L1 6070

L2 6067

L3 6064 Long

L4 6055 Short Breakout

L5 6047 Trgt 1

L6 6039 Trgt 2

Bank Nifty(Jan Fut)-Levels & Trading Strategy for 21-01-2013

R3 12944

R2 12884

R1 12798

Avg 12738

S1 12652

S2 12592

S3 12506

Bank Nifty(Jan Fut)-Trading Strategy

H6 12858 Trgt 2

H5 12825 Trgt 1

H4 12792 Long breakout

H3 12752 Go Short

H2 12738

H1 12725

L1 12698

L2 12685

L3 12671 Long

L4 12631 Short Breakout

L5 12598 Trgt 1

L6 12565 Trgt 2

Nifty Spot-Weekly Levels & Trading Strategy(Jan 21 to Jan 25,2013)

R3 6231

R2 6157

R1 6110

Avg 6036

S1 5989

S2 5915

S3 5868

Nifty Spot-Weekly Trading Strategy

H6 6187 Trgt 2

H5 6158 Trgt 1

H4 6130 Long breakout

H3 6097 Go Short

H2 6086

H1 6075

L1 6052

L2 6041

L3 6030 Long

L4 5997 Short Breakout

L5 5969 Trgt 1

L6 5940 Trgt 2

Bank Nifty Spot-Weekly Levels & Trading Strategy(Jan 21 to Jan 25,2013)

R3 13189

R2 13048

R1 12864

Avg 12723

S1 12539

S2 12398

S3 12214

Bank Nifty Spot-Weekly Trading Strategy

H6 13007 Trgt 2

H5 12933 Trgt 1

H4 12858 Long breakout

H3 12769 Go Short

H2 12739

H1 12709

L1 12650

L2 12620

L3 12590 Long

L4 12501 Short Breakout

L5 12426 Trgt 1

L6 12352 Trgt 2

NIFTY-Jan Put Option-Buying Trade

NIFTY-Jan Put Option(6000)-Buy-Positional-SL-14-TGT-64-CMP-28.50(Lalit39)

Pre-Closing Outlook(18-01-2013)

Although strong Global markets and good opening in Indian markets but we were not Bullish and showed our doubts with technical reasons in all the today Outlooks. First 5 hours trading between 6060-6082 and this range broken down after 02:15 PM but before that we told following lines:-

1- At 01:04:PM-"Selling patterns formations at higher levels today"

2- At 11:23 AM-"Minor profit booking at higher levels today,view is cautious and until Nifty will not cross today high(6083) till then next up move will not be considered and valid break down of 6065 will mean that correction about which we have already updated in previous 2 Outlooks"

1- At 01:04:PM-"Selling patterns formations at higher levels today"

2- At 11:23 AM-"Minor profit booking at higher levels today,view is cautious and until Nifty will not cross today high(6083) till then next up move will not be considered and valid break down of 6065 will mean that correction about which we have already updated in previous 2 Outlooks"

Same view yet which was updated at 11:23 AM today.

Mid-session Outlook(18-01-2013)

As selling between 6030-6065 in last 3 sessions therefore Nifty could not sustain at higher levels retested 6065 at 10:48 AM today. Minor profit booking at higher levels today,view is cautious and until Nifty will not cross today high(6083) till then next up move will not be considered and valid break down of 6065 will mean that correction about which we have already updated in previous 2 Outlooks.

Post-open Outlook(18-01-2013)

Although Nifty Jan Fut. has not shown required strength but Nifty Spot is above 6065 after gaining sufficiently required points. As such strong opening and trading so much positive is very much possible in today like heated sentiment therefore next decisive up moves confirmation through sustaining above 6065 after follow up consolidation is still required because selling between 6030-6065 in last 3 sessions.

Pre-open Outlook(18-01-2013)

All the Asian markets are in Green with Nikkei and Hang Sang are more than 2% and 1% up respectively therefore sentiment is strong today morning therefore positive opening will be seen in Indian markets. Good selling seen between 6030-6065 in last 3 sessions therefore complete consolidation is required for sustaining above 6065. As Bull Markets consolidate at higher levels and up moves possibilities up to 6331 are still alive therefore rally continuation after follow up consolidation can not be ruled out but follow up selling in heated sentiment today will mean straight fall toward 5970 also.

12 Sessions sideways trading between 5950-6065 with good selling between 6030-6065 in last 3 sessions therefore market is well prepared for down moves also but strong Global markets and declaration of RIL Quaeterly results today therefore firstly follow up buying/selling will be watched and valid break out of 6030-6065 will give following moves confirmations;-

1- Above 6065 will mean rally continuation towards 6239.95/6331

2- Below 6030 will mean sharp down toward 5970/5950.

12 Sessions sideways trading between 5950-6065 with good selling between 6030-6065 in last 3 sessions therefore market is well prepared for down moves also but strong Global markets and declaration of RIL Quaeterly results today therefore firstly follow up buying/selling will be watched and valid break out of 6030-6065 will give following moves confirmations;-

1- Above 6065 will mean rally continuation towards 6239.95/6331

2- Below 6030 will mean sharp down toward 5970/5950.

Down Moves Possibility also within 12 Sessions Range

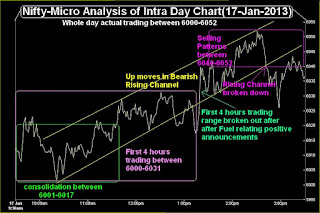

Nifty-Intra Day Chart (17-Jan-2013):-

Technical Patterns and Formations in today intraday charts

1- First 4 hours trading between 6000-6031

1- consolidation between 6001-6017

3- First 4 hours trading range broken out after after Fuel relating positive announcements

4- Selling Patterns between 6040-6052

5- Rising Channel broken down

6- Whole day Up moves in Bearish Rising Channel

7- Whole day actual trading between 6000-6052

First 4 hours trading between 6000-6031 with consolidation between 6001-6017 and first 4 hours trading range broken out after after Fuel relating positive announcements but selling patterns formations also between 6040-6052 therefore market could not sustain at higher levels and slipped. As Whole day Up moves in Bearish Rising Channel therefore this channel also broken down after higher levels seling and closing seen below it today.

12 Sessions trading between 5950-6065 with following immediate supports and resistances:

1- Supports- 5970-6017

2- Resistances- 6030-6065

Intraday selling was seen in previous sessions between 6030-6065 and again selling patterns formations between this range today therefore previous resistance becomes stronger and down moves between 5950-6065 can not be ruled out in the coming sessions. As last 2 hours trading between 6030-60652 was Fuel relating positive announcements generated and market forces reacts in their own manner after such news therefore therefore valid break out of 6030-6065 should be firstly watched tomorrow for next down moves confirmations between 12 sessions range(5950-6065)

If global markets does not gives any side strong sentiment then Nifty will firstly trade between today trading range(6000-6052). As higher levels selling today therefore down moves are possible between 5970-6000.

|

| Just click on chart for its enlarged view |

1- First 4 hours trading between 6000-6031

1- consolidation between 6001-6017

3- First 4 hours trading range broken out after after Fuel relating positive announcements

4- Selling Patterns between 6040-6052

5- Rising Channel broken down

6- Whole day Up moves in Bearish Rising Channel

7- Whole day actual trading between 6000-6052

Conclusions from intra day chart analysis

First 4 hours trading between 6000-6031 with consolidation between 6001-6017 and first 4 hours trading range broken out after after Fuel relating positive announcements but selling patterns formations also between 6040-6052 therefore market could not sustain at higher levels and slipped. As Whole day Up moves in Bearish Rising Channel therefore this channel also broken down after higher levels seling and closing seen below it today.

12 Sessions trading between 5950-6065 with following immediate supports and resistances:

1- Supports- 5970-6017

2- Resistances- 6030-6065

Intraday selling was seen in previous sessions between 6030-6065 and again selling patterns formations between this range today therefore previous resistance becomes stronger and down moves between 5950-6065 can not be ruled out in the coming sessions. As last 2 hours trading between 6030-60652 was Fuel relating positive announcements generated and market forces reacts in their own manner after such news therefore therefore valid break out of 6030-6065 should be firstly watched tomorrow for next down moves confirmations between 12 sessions range(5950-6065)

If global markets does not gives any side strong sentiment then Nifty will firstly trade between today trading range(6000-6052). As higher levels selling today therefore down moves are possible between 5970-6000.

FII & DII trading activity in Capital Market Segment on 17-Jan-2013

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(17-Jan-2013)

1- Benchmark Indices closed in Green except CNX SMALLCAP.

2- Diesel deregulation positive news led up moves but not sustaining at higher levels also.

3- White Candle formations.

Ratios

Index Options Put Call Ratio: 1.00

Total Options Put Call Ratio: 0.93

Nifty P/E Ratio(17-Jan-2013): 18.20

Advances & Declines

BSE Advances : 1,380

BSE Declines : 1,503

NSE Advances : 656

NSE Declines : 779

Nifty Open Interest Changed Today

Nifty- 5700 CE(Jan)- -4,650(-0.69%)

Nifty- 5700 PE(Jan)- -47,050(-0.92%)

Nifty- 5800 CE(Jan)- 5,550(0.60%)

Nifty- 5800 PE(Jan)- 669,050(8.96%)

Nifty- 5900 CE(Jan)- -4,200(-0.25%)

Nifty- 5900 PE(Jan)- 806,800(10.34%)

Nifty- 6000 CE(Jan)- -116,500(-2.62%)

Nifty- 6000 PE(Jan)- 1,452,350(24.57%)

Nifty- 6100 CE(Jan)- -421,700(-6.57%)

Nifty- 6100 PE(Jan)- 138,850(7.41%)

Closing

Sensex- closed at 19,964.03(146.40 Points & 0.74%)

Nifty- closed at 6,039.20(37.35 Points & 0.62%)

CNX Midcap - closed at 8,592.85(25.80 Points & 0.30%)

CNX Smallcap- closed at 3,787.15(-1.75 Points & -0.05%)

Nifty Spot-Levels & Trading Strategy for 18-01-2013

R3 6130

R2 6091

R1 6065

Avg 6026

S1 6000

S2 5961

S3 5935

Nifty Spot-Trading Strategy

H6 6104 Trgt 2

H5 6089 Trgt 1

H4 6074 Long breakout

H3 6056 Go Short

H2 6050

H1 6044

L1 6033

L2 6027

L3 6021 Long

L4 6003 Short Breakout

L5 5988 Trgt 1

L6 5973 Trgt 2

Nifty(Jan Fut)-Levels & Trading Strategy for 18-01-2013

R3 6156

R2 6114

R1 6084

Avg 6042

S1 6012

S2 5970

S3 5940

Nifty(Jan Fut)-Trading Strategy

H6 6126 Trgt 2

H5 6110 Trgt 1

H4 6093 Long breakout

H3 6073 Go Short

H2 6067

H1 6060

L1 6047

L2 6040

L3 6034 Long

L4 6014 Short Breakout

L5 5997 Trgt 1

L6 5981 Trgt 2

Bank Nifty(Jan Fut)-Levels & Trading Strategy for 18-01-2013

R3 12931

R2 12853

R1 12771

Avg 12693

S1 12611

S2 12533

S3 12451

Bank Nifty(Jan Fut)-Trading Strategy

H6 12850 Trgt 2

H5 12814 Trgt 1

H4 12778 Long breakout

H3 12734 Go Short

H2 12719

H1 12704

L1 12675

L2 12660

L3 12646 Long

L4 12602 Short Breakout

L5 12565 Trgt 1

L6 12529 Trgt 2

Subscribe to:

Posts (Atom)