As busy therefore Stock Market Outlook of today(11-03-2022) is not being updated.

Trading "calls" from our "Software" with more than "90% accuracy"

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Pull Back Rally continuation

towards next resistances

Nifty-Intra Day Chart Analysis &

Market Outlook(10-03-2022)

Nifty-Intra Day Chart (09-Mar-2022):-

1- Whole day up moves with downward corrections

2- Whole day actual trading between 15991-16418

Conclusions from intra day chart analysis

As whole day up moves with downward corrections and intraday selling patterns were not seen therefore on going Pull Back Rally will remain continued towards next resistances between 17580-17639.

Pull Back rally expectations

Nifty-Intra Day Chart Analysis &

Market Outlook(09-03-2022)

Nifty-Intra Day Chart (08-Mar-2022):-

Technical Patterns formation in today intraday charts

1- Down moves in Bullish Falling Channel

2- Up moves with downward corrections

3- Whole day actual trading between 15672-16028

Conclusions from intra day chart analysis

Some supports were seen also above 15712 yesterday and fresh consolidation was seen below and above it today through Down moves in Bullish Falling Channel therefore up moves were seen in last 2 hours and today closing was at the top of the day. As these up moves were with downward corrections also hence whole day good intraday consolidation will be understood and Pull Back rally will be seen tomorrow if any big negative development does not happen on Russia-Ukraine war front.

Firstly watch levels amid Russia-Ukraine war led high uncertainty

Nifty-Intra Day Chart Analysis &

Market Outlook(10-03-2022)

Nifty-Intra Day Chart (07-Mar-2022):-

Technical Patterns formation in today intraday charts

1- Whole day sideways trading between 15712-15938

2- Whole day actual trading between 15712-15944

Conclusions from intra day chart analysis

As whole day sideways trading between 15712-15938 with lower levels some supports also above 15712 therefore sustaining it beyond should be firstly watched tommrrow for immediate down moves confirmations or a Pull back rally beginning possibility above 15938 amid Russia-Ukraine war led high uncertainty.

Sharp jump after expected BJP victory between 300-370 seats in UP Elections amid Russia-Ukraine war led huge volatility

Technical Analysis,Research & Weekly Outlook

(Mar 07 to Mar 11,2022)

Nifty-Weekly Chart Analysis

(Corrective Waves)

Nifty-Weekly Chart(04-Mar-2022):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC' correction beginning.

2- Corrective Wave-A completion at 16410.20 on 20-12-2021

3- Wave-B completion at 18351.00 on 18-01-2022.

4- Wave-C continuation with recent bottom formation at 16133.8 on 04-03-2022

Conclusions from Weekly chart analysis

(Corrective Waves)

Wave-A of "ABC" correction begun from 18604.50 on 19-10-2021 completed at 16410.20 on 20-12-2021 and Wave-B started. Wave-C begun after Wave-B completion at 18351.00 on 18-01-2022 which is now in continuation with its recent bottom formation at 16133.8 on 04-03-2022 and no indication of its completion yet on EOD and intraday charts.

Nifty-EOD Chart Analysis

(Averages)

Nifty-EOD Chart (04-Mar-2022):-

Technical Patterns and Formations in EOD charts

Averages

A- 5-Day SMA is today at 16561

B- 21-Day SMA is today at 17072

C- 55-Day SMA is today at 17246

D- 100-Day SMA is today at 17527

E- 200-Day SMA is today at 16937

Conclusions from EOD chart analysis

(Averages)

As last 6 Sessions trading was between 16134-16815 and it was below Long Term Trend decider 200-Day SMA(16937) therefore emergence of Long Term Trend turning down strong indication because 200-Day SMA is showing weakness through slipping below all the Intermediate Term averages also.

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (04-Mar-2022):-

Technical Patterns and Formations in EOD charts

1- Stochastic- %K(5) line has intersected %D(3) line downward and its both lines are falling towards Over sold zone.

2- Stochastic:- %K(5)- 34.68 & %D(3)- 43.01.

3- In MACD- MACD line has intersected Average line downward and its both lines are falling in negative zone.

4- MACD(26,12)- -421.26 & EXP(9)- -223.37 & Divergence- -197.89

Conclusions from EOD chart analysis

(Stochastic & MACD)

As in Stochastic both lines are falling towards Over sold zone after downward intersection and in MACD also both lines are falling in negative zone therefore indicators are showing weakness and more down moves possibilities.

Nifty-EOD Chart Analysis

(Fibonacci retracement levels)

Nifty-EOD Chart (04-Mar-2022):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C completion and Impulsive Wave-1 beginning from 7511.10 on 24-03-2020

2- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021

3- Corrective Wave-C continuation with recent bottom formation at 16133.8 on 04-03-2022

4- Fibonacci Retracement levels from Wave-1 to Wave-5(7511.10-18604.45)

13.0%-17,162.40(Corrected)

23.6%-15,986.42

27.0%-15,609.30

38.2%-14,366.79(Crucial)

50.0%-13,057.77(Crucial)

61.8%-11,748.76(Crucial)

70.7%-10,761.50

76.4%-10,129.10

78.6%- 9,885.09

88.6%- 8,775.75

Conclusions from EOD chart analysis

(Fibonacci retracement levels)

Waves structure which started from 7511.10 on 24-03-2020 through its Impulsive Wave-1 beginning had been completed after its Impulsive Wave-5 completion at 18604.50 on 19-10-2021. As "ABC" correction of this whole Waves structure(7511.10-18604.45) will be seen according to above mentioned Fibonacci Retracement levels therefore should be watched in the coming weeks and months for next Long Term Trends confirmations.

Now corrective Wave-C continuation with recent bottom formation at 16133.8 which is below 13.0%(17162) and little above 23.6%(15986) therefore firstly sustaining beyond 15986 should be watched in next week for correction completion indication above it and correction continuation below it as well correction continuation towards next levels at 38.2%(14366).

Nifty-EOD Chart Analysis (Bollinger Band)

Nifty-EOD Chart (04-Mar-2022):-

Technical Patterns and Formations in EOD charts

1- Last 6 sessions trading near Lower Band

2- Last Friday closing below Lower Band

Conclusions from EOD chart analysis

(Bollinger Band)

Bollinger Band is showing clear weakness of Indian markets because Nifty is continuously trading below its Middle Band for the last 29 sessions and post Budget-2022 rally also faced resistance at its Middle Band.

Nifty is hovering around its Lower Band for the last 6 sessions between 16134-16815 and finally break out above 16815 of this range will confirm rally towards Middle Band and 16134 will confirm deeper correction beginning below lower Band.

Nifty-Last 6 Sessions

intraday charts analysis

Nifty-Intra Day Chart (Feb 24 to Mar 04,2022):-

Technical Patterns formation in last 6 Sessions intraday charts

1- Selling(Resistances) in last 6 Sessions are as follows:-

A- 16531-16663

B- 16606 16661

C- 16491-16558

2- 8 Hours sideways trading between 16603-16740 on 25-02-2022 & 28-02-2022

3- Huge intraday volatility between 16134-16456 on 04-03-2022

4- Last 6 Sessions actual trading between 16134-16815

Conclusions from

6 Sessions intra day chart analysis

Although 8 Hours sideways trading was seen between 16603-16740 on 25-02-2022 & 28-02-2022 but war escalation news from Ukraine therefore weakness developed on 02-03-2022 which remained continued till last Friday and intraday continuous down moves were seen after that in next 3 sessions.

As huge intraday volatility between 16134-16456 on 04-03-2022 therefore firstly sustaining beyond this range should be watched in the coming week for next decisive moves beginning confirmations because technical positions reverses in such high volatility also.

Conclusions (After putting

all studies together)

All trends are down and Wave-C of "ABC' correction continuation as well as no indication of its completion yet on Weekly,EOD and intraday charts.

As Short Term indicators are suggesting more weakness therefore will be seen also but firstly sustaining beyond last 6 sessions lowest(16134) should be watched in the coming sessions because these 6 sessions trading was at the Lower Band of Bollinger Band and sustaining it beyond will generate next big moves. Last 6 sessions trading was below Long Term Trend decider 200-Day SMA(16937) and once sustaining below last 6 sessions lowest(16134) will mean Long Term Trend turning down confirmation and Wave-C continuation towards 38.2%(14366) retracement level therefore should be firstly 16134 should watched in the coming week/weeks

Exit-Polls of 5 States Assembly election will come on in next week on 7th March after market closing and finally results will be declared during trading hours on 10th March. Although Russia-Ukraine war led huge volatility will be seen but sharp jump of Nifty may also be seen in last 2 sessions of next week after expected BJP victory between 300 to 370 seats in UP Elections.

Firstly watch levels amid Russia-Ukraine war led high uncertainty and huge volatility

Nifty-Intra Day Chart Analysis & Market Outlook

(02-03-2022)

Nifty-Intra Day Chart (28-Feb-2022):-

Technical Patterns formation in today intraday charts

1- Strong up moves after weaker opening

2- Sideways trading between 16654-16721

3- Sharp up in last hour

4- Whole day actual trading between 16357-16815

Conclusions from intra day chart analysis

Although weaker opening but strong up moves were seen after that. Nifty traded most time sidewways between 16603-16740 on 25-02-2022 and traded almost 3 hours within this range between 16654-16721 on 28-02-2022 also.

As more than 8 hours sideways trading between 16603-16740 in last 2 sessions therefore firstly sustaining beyond this range should be watched in the coming sessions for next decisive moves beginning confirmations amid amid Russia-Ukraine war led high uncertainty and huge volatility.

Immediate supports and resistances have also been updated on 26-02-2022 ln "Watch supports & resistances also amid Russia-Ukraine war led violent volatility" which will decide next big moves therefore should also be watched for its beginning confirmations.

Watch supports & resistances also amid Russia-Ukraine war led

violent volatility

Technical Analysis,Research & Weekly Outlook

(Feb 28 to Mar 04,2022)

Live Proofs of our accurate & profitable Indian Stock Markets Predictions

Following topic was posted in previous week Outlook on 19-02-2022:-

As was told 100% same happened and "Nifty crashed more than 1000 Points" in first 4 sessions of previous week

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (24-Feb-2022):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C completion and Impulsive Wave-1 beginning from 7511.10 on 24-03-2020

2- Impulsive Wave-1 completion at 11794.30 on 31-08-2020

3- Corrective Wave-2 completion at 10790.20 on 24-09-2020

4- Impulsive Wave-3 completion at 15431.8 on 16-02-2021

5- Corrective Wave-4 completion at 14151.4 on 22-04-2021

6- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC' correction beginning.

7- Correction continuation with recent bottom formation at 16203.3 on 24-02-2022

Conclusions from EOD chart analysis(Waves structure)

Waves structure which begun through its Impulsive Wave-1 starting from 7511.10 on 24-03-2020 completed at 18604.50 on 19-10-2021 after its Impulsive Wave-5 completion and Corrective Wave-A of "ABC" correction beginning. Now corrective Wave-C of "ABC' correction continuation with recent bottom formation at 16203.3 on 24-02-2022 and no confirmation of its completion yet.

Nifty-EOD Chart Analysis

(Corrective Waves)

Nifty-EOD Chart (24-Feb-2022):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC' correction beginning.

2- Corrective Wave-A completion at 16410.20 on 20-12-2021

3- Wave-B completion at 18351.00 on 18-01-2022.

4- Wave-C continuation with recent bottom formation at 16203.3 on 24-02-2022

Conclusions from EOD chart analysis

(Corrective Waves)

Corrective Wave-A of "ABC" correction which started from 18604.50 on 19-10-2021 completed at 16410.20 on 20-12-2021 and Wave-B begun. Wave-C begun after Wave-B completion at 18351.00 on 18-01-2022 and now in continuation with its recent bottom formation at 16203.3 on 24-02-2022 and no confirmation of its completion yet on EOD charts.

Nifty-EOD Chart Analysis

(Averages)

Nifty-EOD Chart (24-Feb-2022):-

Technical Patterns and Formations in EOD charts

A- 5-Day SMA is today at 16853

B- 21-Day SMA is today at 17246

C- 55-Day SMA is today at 17405

D- 100-Day SMA is today at 17577

E- 200-Day SMA is today at 16903

Conclusions from EOD chart analysis

(Averages)

Simple Moving Averages(SMA) are suggesting that weakness is deepening In Indian markets because 5-Day SMA and last Friday closing was below Long Term trend decider 200-Day SMA as well as all Short to Intermediate Term decider Averages(SMA) have started to move downward which is also a strong signal of weakness.

Conclusions (After putting all studies together)

All the trends have turned down during on going "ABC' correction and no confirmation of its completion yet on EOD charts.

Russia-Ukraine war led huge volatility was seen in previous week and it will remain continued in next week also according to the length and size of Geo-Political tension. As Long Term Trend is at stake after last 2 sessions below it closing therefore firstly sustaining beyond it should be watched in the coming week/weeks for next trend formation confirmation and final moves Indian markets accordingly.

As violent volatility may be seen in all the Global and Indian markets according to Russia-Ukraine war news flow therefore sustaining beyond following supports and resistances should also be watched for next decisive moves beginning confirmations.

Immediate resistances are as follows:-

A- 17156-17220

B- 17290-17417

C- 17580-17639

D- 17648-17684

E- 17699-17731

F- 17736-17761

Immediate supports are as follows:-

A- 16633-16676

B- 16558-16602

C- 16361-16396

D- 16218-16279

Watch levels for confirmation amid deeper correction beginning possibility

Nifty-Intra Day Chart Analysis &

Market Outlook(24-02-2022)

Nifty-Intra Day Chart (23-Feb-2022):-

Technical Patterns formation in today intraday charts

1- Selling between 17156-17220

2- Sharp fall in last hour

3- Whole day actual trading between 17028-17220

Conclusions from intra day chart analysis

Although firstly up moves after positive opening but good selling between 17156-17220 therefore sharp fall in last hour. Technical positions of last 6 sessions are as follows:-

1- Consolidation between 16844-16981 on 22-02-2022.

2- Good selling above 17156 in 5 sessions of last 6 sessions

Expected that Nifty will firstly trade and prepare for next decisive moves betwen 16844-17156 tomorrow and closing is also expected within this range because good strong consolidation was seen above it on 22-02-2022

As good selling above 17156 therefore Nitfy will not sustain above it and once sustaining below 16844 after complete fresh selling will mean strong signal of deeper correction beginning.

for confirmation

Just watch above mentioned levels for confirmation in the coming 2/3 sessions amid deeper correction beginning possibility

Up moves towards next resistances

Nifty-Intra Day Chart Analysis &

Market Outlook(23-02-2022)

Nifty-Intra Day Chart (22-Feb-2022):-

Technical Patterns formation in today intraday charts

1- 362 Points sharp fall in first 25 minutes

2- Consolidation between 16844-16981(immediate supports)

3- Sharp up

4- Sideways trading between 17062-17148 in last 2 hours

5- Whole day actual trading between 16844-17148

Conclusions from intra day chart analysis

Although firstly 362 Points sharp fall in first 25 minutes but after that good Consolidation between 16844-16981 therefore sharp up moves were seen in Mid-session which will remain continued in the coming session also towards next resistances between 17290-17351.

Correction towards & below

next supports

Nifty-Intra Day Chart Analysis &

Market Outlook(22-02-2022)

Nifty-Intra Day Chart (21-Feb-2022):-

Technical Patterns formation in today intraday charts

1- 205 Points sharp fall in first 25 minutes

2- Slow up moves from lower levels

3- Selling between 17290-17351(immediate Resistances)

4- Down moves with upward corrections

5- Whole day actual trading between 17071-17351

Conclusions from intra day chart analysis

Following lines were told on 19-02-2022 in "Sharp fall & deeper correction on cards":-

1- Averages are suggesting that deeper correction is on cards

2- firstly down moves will be seen in the beginning of next week towards the lowest of last 3 sessions(17220)

3- firstly down moves will be seen towards and below the lowest(17220) of last 3 sessions

As was told 100% same happened and Nifty crashed 205 Points sharp fall in first 25 minutes as well as closed below the lowest of last 3 sessions(17220) on 21-02-2022.

As whole day good selling on 21-02-2022 therefore correction will be seen in the coming sessions towards and below those next supports which have already been updated on 19-02-2022 in "Sharp fall & deeper correction on cards".

Sharp fall & deeper correction

on cards

Technical Analysis,Research & Weekly Outlook

(Feb 21 to Feb 25,2022)

Nifty-EOD Chart Analysis

(Averages)

Nifty-EOD Chart (18-Feb-2022):-

Technical Patterns and Formations in EOD charts

1- 5-Day SMA is today at 17219

2- 21-Day SMA is today at 17371

3- 55-Day SMA is today at 17442

4- 100-Day SMA is today at 17617

5- 200-Day SMA is today at 16851

Conclusions from EOD chart analysis

(Averages)

Averages are suggesting that deeper correction is on cards because all the Short Term Averages have moved below Intermediate Term Averages and Nifty closed little above 5-Day SMA(17219) at 17276.30 after intraday lowest(17219.20) formation exactly on it.

Although Long Term Average is still up but at stake because intraday lowest formation on 14-02-2022 was below it at 16809.70.

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (18-Feb-2022):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC' correction beginning.

2- Corrective Wave-A of "ABC" correction completion at 16410.20 on 20-12-2021

3- Wave-B completion at 18351.00 on 18-01-2022 and and Wave-C beginning

4- Wave-C continuation with recent bottom formation at 16809.7 on 14-02-2022

5- Last 20 Sessions sideways trading between 16810-17794

6- Stochastic- %K(5) line has intersected %D(3) line upward and its both lines are rising towards Over bought zone.

7- Stochastic:- %K(5)- 66.62 & %D(3)- 50.67.

8- In MACD- Both lines are kissing.

9- MACD(26,12)- -200.00 & EXP(9)- -238.89 & Divergence- 38.89

Conclusions from EOD chart analysis

(Stochastic & MACD)

Although in Stochastic both lines are rising towards Over bought zone after %K(5) line upward intersection of %D(3) line but such type of upward and downward intersection is being seen after little up and down moves for the last 20 sessions therefore Price action and trading range break out should be firstly watched in next week for next Short Term Trend formation confirmations.

As in MACD both lines are kissing in negative zone therefore not suggesting any side trend formations and let clear trend formation confirmation come from this indicator then will be decided accordingly.

Nifty

(Last 3 Sessions intraday charts analysis)

Nifty-Intra Day Chart (Feb 16 to Feb 18,2022):-

Technical Patterns formation in last 3 Sessions intraday charts

1- Whole day only intraday volatility on 16-02-2022

2- Selling between 17324-17417 on 17-02-2022

3- Selling between 17329-19380 17,380 on 17-02-2022

4- Getting suppports between 17235-17293 in last 3 sessions

5- Last 3 Sessions actual trading between 17220-17490

Conclusions from 3 Sessions intra day chart analysis

Although Nifty got supports at lower levels between 17335-17293 in last 3 sessions but higher levels good selling also in 2 previous sessions therefore expected that firstly down moves will be seen in the beginning of next week towards the lowest of last 3 sessions(17220) and once sustaining below it will mean sharp fall after breaking down confirmation of last 3 sessions trading range.

Conclusions

(After putting all studies together)

1- Short Term Trend is sideways.

2- Intermediate Term Trend is sideways.

3- Long Term Trend is up.

As corrective Wave-A of "ABC' correction started after Impulsive Wave-5 completion and new life time top formation at 18604.50 on 19-10-2021 therefore Nifty has to correct whole rally which strted begun from 7511.10 on 24-03-2020.

Now Wave-C of on going "ABC' correction continuation with recent bottom formation at 16809.7 on 14-02-2022 towards and below the bottom of of Wave-A(16410.20) after Wave-B completion at 18351.00 on 18-01-2022.

Last 20 Sessions sideways trading between 16810-17794 and finally sustaining beyond this range will form next trend therefore should be firstly watched in the coming week/weeks. Next supports and resistances within this range are as follows;-

1- Resistances in last 20 Sessions trading range are as follows:-

A- 17324-17417

B- 17580-17639

C- 17648-17684

D- 17699-17731

E- 17736-17761

2- Supports in last 20 Sessions trading range are as follows:-

A- 17235-17293

B- 17124-17213

C- 17044-17106

D- 17008-17110

E- 16872-16951

As good intraday selling in last 2 sessions of previous week therefore firstly down moves will be seen towards and below the lowest(17220) of last 3 sessions and once broken down confirmation of last 3 sessions trading range will mean steep fall possibility towards and below the lowest(16810) of last 20 sessions trading range because Short To Long Term averages are also suggesting inherent weakness.

200-Day SMA is today at 16851 and last Friday closing was above it therefore Long Term Trend is still up but at stake because it was tested on 14-02-2022 after intraday lowest formation below it was at 16809.70.

Wave-B begun after corrective Wave-A of "ABC" correction completion at 16410.20 on 20-12-2021 which is now below 200-Day SMA(16851). Now Wave-C continuation towards and below the bottom of Wave-B(16410.20) and once sustaining below 16851 will mean Long Term Trend turning down confirmation as well as sharp fall possibility towards below 16410.20.

Down moves towards next supports

Nifty-Intra Day Chart Analysis &

Market Outlook(18-02-2022)

Nifty-Intra Day Chart (17-Feb-2022):-

Technical Patterns formation in today intraday charts

1- Sharp fall after positive opening

2- Up moves

3- Selling between 17324-17417

4- Whole day actual trading between 17236-17442

Conclusions from intra day chart analysis

Although sharp fall after positive opening but up up move also seen after that. As good selling between 17224-17417 therefore down moves were seen in last hours which will remain continued towards next supports above 17100 in the coming session also.

Watch levels amid Russia–Ukraine

different types war news

Nifty-Intra Day Chart Analysis &

Market Outlook(17-02-2022)

Nifty-Intra Day Chart (16-Feb-2022):-

Technical Patterns formation in today intraday charts

1- Only intraday volatility

2- Whole day actual trading between 17258-17490

Conclusions from intra day chart analysis

As different types of Russia–Ukraine war reports therefore all the Global markets are reacting on it through huge volatility and Indian markets have also followed it accordingly in last 3 sessions.

Although last 40 sssions lowest was formed at 16809.70 on 14-02-2022 but jumped also next day after some positive signals from Russia–Ukraine border. As no one knows its fate and its impact on the world therefore if war begins then firstly sustaining beyond 16809.70 should be watched for deeper correction beginning confirmations but immediately sharp up moves will not be seen because following resistances are lying above today highest:-

1- 17580-17639

2- 17648-17684

3- 17699-17731

4- 17736-17761

As Nifty digested whole Russia–Ukraine news between 16810-17490 in the last 3 sessions through huge volatility therefore finally sustaining its beyond should be watched for next decisive moves beginning confirmations amid high possibility of finally sustaining below 16810.

Wave-C continuation towards 16410.20 & sustaining below it will confirm deeper correction

Technical Analysis,Research & Weekly Outlook

(Feb 14 to Feb 18,2022)

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (01-Feb-2022):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C completion and Impulsive Wave-1 beginning from 7511.10 on 24-03-2020

2- Impulsive Wave-1 completion at 11794.30 on 31-08-2020

3- Corrective Wave-2 completion at 10790.20 on 24-09-2020

4- Impulsive Wave-3 completion at 15431.8 on 16-02-2021

5- Corrective Wave-4 completion at 14151.4 on 22-04-2021

6- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC' correction beginning.

7- Corrective Wave-A of "ABC" correction completion at 16410.20 on 20-12-2021

8- Wave-B completion at 18351.00 on 18-01-2022 and and Wave-C beginning

9- Wave-C continuation with recent bottom formation at 16836.8 on 25-01-2022

10 Pre-Budget rally fused at 17794.60 on 01-02-2022

Conclusions from EOD chart analysis

(Waves structure)

Impulsive Wave-1 which started from 7511.10 on 24-03-2020 completed at 18604.50 on 19-10-2021 after its Impulsive Wave-5 completion and Corrective Wave-A of "ABC" correction begun.Corrective Wave-A completed at 16410.20 on 20-12-2021 and after that Wave-B also finished at 18351.00 on 18-01-2022. Now Wave-C of "ABC" correction continuation with its recent bottom formation at 16836.8 on 25-01-2022 and no indication of its completion yet.

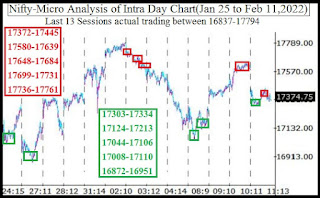

Nifty-Last 13 Sessions

intraday charts analysis

Nifty-Intra Day Chart (Jan 25 to Feb 11,2022):-

Technical Patterns formation in last 13 Sessions intraday charts

1- Selling(Resistances) in last 13 Sessions are as follows:-

A- 17372-17445

B- 17580-17639

C- 17648-17684

D- 17699-17731

E- 17736-17761

2- Consolidation(Supports) in last 13 Sessions are as follows:-

A- 17303-17334

B- 17124-17213

C- 17044-17106

D- 17008-17110

E- 16872-16951

3- Last 13 Sessions actual trading between 16837-17794

Conclusions from 13 Sessions

intra day chart analysis

Last 13 Sessions actual trading between 16837-17794 with above mentioned higher levels resistances and lower levels supports within it which are almost equally strong therefore expected that Nifty will firstly trade within last 13 Sessions trading range(16837-17794) and finally sustaining it beyond will confirm next big moves which will be seen in the coming week/weeks.

Nifty-Intra Day Chart Analysis

(11-Feb-2022)

Nifty-Intra Day Chart (11-Feb-2022):-

Technical Patterns formation in today intraday charts

1- 154 Points weaker opening

2- Selling between 17390-17436

3- Sharp fall

4- Support between 17303-17334

5- Up moves

6- Bearish Rising Wedge formations at higher levels

7- Sharp fall

8- Selling between 17372-17397

9- Whole day actual trading between 17303-17454

Conclusions from

intra day chart analysis

As fresh selling after 154 Points weaker opening therefore sharp fall after that but Nifty got lower levels supports hence up moves also developed in Mid-session.

Bearish Rising Wedge formations at higher levels and sharp fall after that as well as follow up selling therefore down moves in last half hour and closing was little above intraday lowest. As good intraday selling patterns formations last Friday therefore down moves will be seen below last Friday lowest(17303) in the beginning of next week.

Conclusions

(After putting all studies together)

1- Short Term Trend is sideways.

2- Intermediate Term Trend is sideways.

3- Long Term Trend is up.

Although Nifty will firstly trade within last 13 Sessions trading(16837-17794) but firstly down moves will be seen towards above mentioned supports in the beginning of next week because higher levels good intraday selling patterns formations last Friday.

Now Wave-C of "ABC" correction continuation with its recent bottom formation at 16836.8 on 25-01-2022 and no indication of its completion yet. As higher levels good selling in previous 2 weeks therefore corrective Wave-C will remain continued towards the bottom of Wave-A(16410.20). Fresh selling and once sustaining below it will confirm deeper correction beginning which should be watched in the coming week/weeks.

Sideways Market after down moves

Nifty-Intra Day Chart Analysis &

Market Outlook(11-02-2022)

Nifty-Intra Day Chart (10-Feb-2022):-

Technical Patterns formation in today intraday charts

1- Down moves in Bullish Falling Channel

2- Up moves

3- Selling between 17580-17639

4- Whole day actual trading between 17428-17639

Conclusions from intra day chart analysis

Following lines were told in "Rally continuation after fresh consolidation":-

1- rally continuation is expected in the coming sessions

2- fresh consolidation is also firstly required near about day's highest(17477)

Firstly Nifty slipped below yesterday highest(17477) after strong opening and after that rally continuation as well as Nifty closing 143 points up with 211 points recovery from lower levels.

Although lower levels good consolidation but higher levels good selling was also seen therefore down moves will be seen and Nifty will remain sideways between 17428-17639 tomorrow as well as prepare for next decisive moves.

Rally continuation after fresh consolidation

Nifty-Intra Day Chart Analysis &

Market Outlook(10-02-2022)

Nifty-Intra Day Chart (09-Feb-2022):-

Technical Patterns formation in today intraday charts

1- Consolidation between 17365-17436

2- Slow up moves

3- Whole day actual trading between 17339-17477

Conclusions from intra day chart analysis

As firstly consolidation between 17365-17436 after gap up opening therefore up moves were seen in last hours. Although rally continuation is expected in the coming sessions but fresh consolidation is also firstly required near about day's highest(17477) because last hours up movees were slow and some selling can not be ruled out on the back of these slow up moves.

Subscribe to:

Posts (Atom)